If 2023 taught us anything, it’s that we live in uncertain times. Shifts of all kinds constantly threaten to overturn past orthodoxies, and the sheer pace of change can be either thrilling or terrifying (or often both).

When it comes to the financial advice sector, these changes pose a unique challenge. How can advisers properly advise when the future is so hard to predict? And how can clients plan with any kind of confidence when the world around us so often undermines that confidence?

Unanswerable questions, you may say. Well, yes and no. While peering into a crystal ball invariably makes you look foolish, it’s still useful to step outside the daily news cycle and look more closely at the factors that will drive the news cycles of tomorrow.

How will advice firms react to the growing burden of costs in economically uncertain times?

With that in mind, Money Marketing wanted to answer a simple question: what are the key trends that will shape the future of financial advice?

To answer it, we looked at five areas: global politics, technology, demographics, regulation and costs. Each of these areas, in turn, raises its own set of questions.

How will global financial markets react to increasing levels of instability, from Gaza and Ukraine to Yemen and China?

How will the rise of adviser tech and artificial intelligence (AI) change how firms operate, and indeed the adviser-client relationship?

How will advisers communicate with the next generation of clients, and where are the advisers of the future coming from?

How can advisers properly advise when the future is so hard to predict?

How will a growing tranche of Financial Conduct Authority regulations, including but not confined to the Consumer Duty, affect the advice landscape?

Finally, how will advice firms react to the growing burden of costs in economically uncertain times?

The answers to these questions and others will define the nature of financial advice for years to come. They will also give an indication of what firms and individual advisers should be keeping an eye on if they want to survive the coming storms.

So, while we can’t provide advisers with a crystal ball, we hope this set of features contains plenty of practical wisdom. You can’t say you weren’t warned….

Global politics

Tom Browne

It’s a cliché that, when the US sneezes, the world catches a cold — and, frankly, it’s due an update.

After all, in an interconnected world, snuffles big and small across multiple regions are liable to have an impact, and predicting where these may occur is increasingly difficult.

After a turbulent couple of years — when the effects of Brexit, Covid-19, the war in Ukraine and domestic upheaval dragged the UK to the brink of a recession — the hope across the advice sector is for a period of calm. Instead, the word on everyone’s lips is ‘uncertainty’.

Politicians, investors and voters will likely be watching and waiting on events before making any major decisions

At a recent appearance at the Treasury select committee, the Bank of England’s Carolyn Wilkins said: “There are a lot of risks… coming from the global economy [that] could create an uptick in inflation and therefore the need for higher interest rates, but also a slowdown in economic activity.

“I think that combination, given the vulnerabilities… would be stressful from a financial stability point of view.”

From that perspective the US still looms large, not least because of the November 2024 presidential election. The reaction of the markets to another Donald Trump term is hard to gauge, but his crushing win in last month’s Iowa caucus has certainly increased its likelihood.

The question, then, is: what might the impact of this be on the Ukraine conflict? Russia’s invasion in 2022 has already sent food and energy prices soaring and exacerbated tensions with the EU, the UN and Nato. With no end in sight, the possibility that an incoming Republican administration might withdraw support for Ukraine is a major worry for Europe in particular.

The UK economy avoided a recession in 2023, but the threat hasn’t gone away

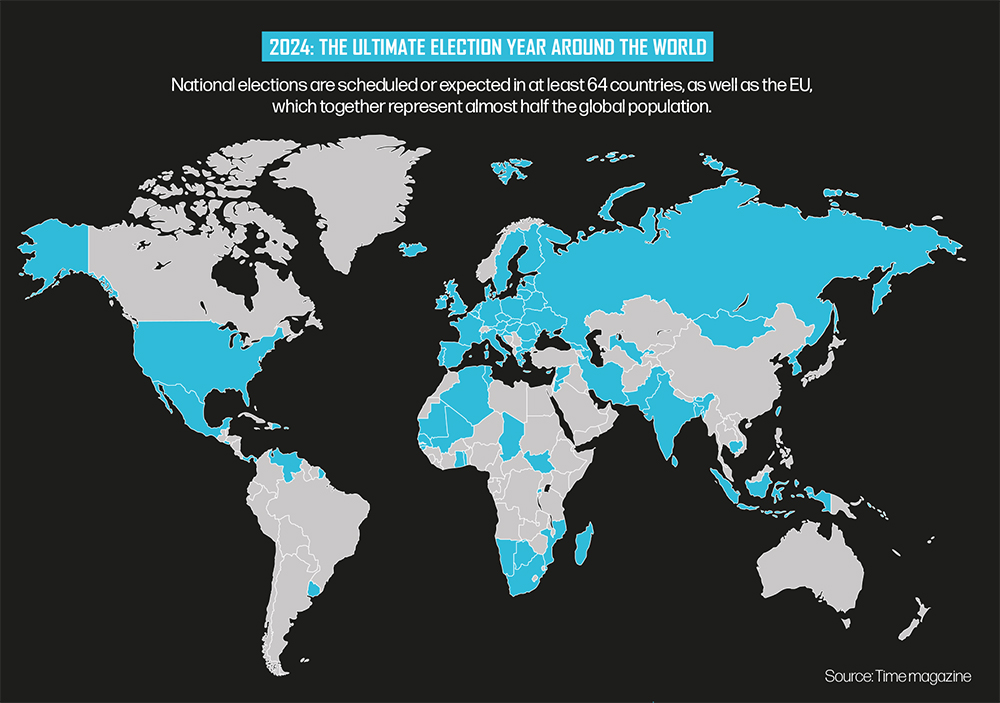

Of course, the US election is only one of at least 64 worldwide in 2024, many with potential for upheaval. The recent election of William Lai in Taiwan, for example, has done little to calm tensions with China, renewing concerns that it could try to annex the territory — the source of 92% of the world’s semiconductors.

And, in places where fighting has already broken out, the picture is even more worrying.

At the start of 2023, few observers would have predicted the explosion of violence in Israel and Gaza. Should this spark a wider conflict within the oil-rich region, the economic fallout could be devastating. Already, attacks by Iranian-backed Houthi rebels on Red Sea shipping have disrupted vital global trade routes, adding to inflationary pressures and provoking counter-strikes by the US and the UK.

The UK economy, for its part, avoided a recession in 2023, but the threat hasn’t gone away. A general election now looks likely in October or November, with the Conservative government hoping that an economic recovery will give it some kind of election platform.

In an interconnected world, snuffles big and small across multiple regions are liable to have an impact

Attention thus shifts to the Spring Budget on 6 March and the dogs that failed to bark in last November’s Autumn Statement, such as changes to inheritance tax and income-tax thresholds.

Whatever happens, a Labour victory in the election now looks inevitable.

But, while the markets are unlikely to be spooked by a centrist Labour government, the party will still inherit a country with sluggish growth, high interest rates, inflation well above the Bank of England’s target and an ongoing cost-of-living crisis.

Given such an environment, politicians, investors and voters will likely be watching and waiting on events before making any major decisions.

It could be a long time before uncertainty turns to decisiveness.

Technology

Momodou Musa Touray

If you speak to veterans of the advice sector, they will tell you how “primitive” the system was during the glory days in the 1980s. All they had then were paper spreadsheets and telephones.

Then the sector pivoted away from analogue to digital.

The early stages of adviser tech were rudimentary. Online access for clients was narrow and limited. This affected overall client engagement and outcomes.

Thankfully, the sector moved on. Technology is now an integral part of the advice process. Every facet of the value chain — from client onboarding to cashflow planning — has been streamlined, which has improved the adviser-client relationship.

Firms are now engaging with and managing the huge amount of data involved in the financial-planning process

But, as we all know, change is constant. AI, automation and blockchain are all set to transform the advice landscape.

And yet, the sector is playing catch-up. Legacy tech persists in some areas, which is preventing advice firms from growing their business.

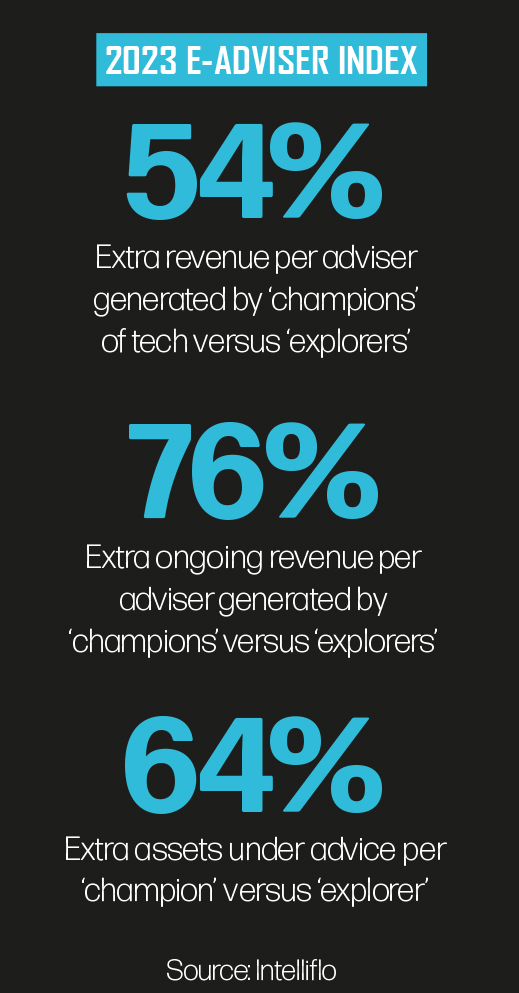

The rate of tech adoption differs among advice firms. Software provider Intelliflo says tech adoption is the “make-or-break factor” for future success. Its 2023 eAdviser Index shows that advice firms that had adopted tech outperformed their peers.

The index, which analyses nearly four billion interactions within Intelliflo Office over the past year, breaks down advice firms into four cohorts based on their level of tech adoption. These cohorts are ‘explorers’, ‘adopters’, ‘embracers’ and ‘champions’.

The explorers are the lowest adopters of tech while the champions are the highest.

One in five UK financial advisers believes AI will replace the work they do

The champions were shown to have generated 54% more revenue per adviser than their explorer counterparts had.

They also generated 76% more ongoing revenue per adviser. The difference in assets under advice per adviser was 64%.

The benefits of embracing new technology are therefore clear. It’s profitable for tech-savvy firms and beneficial to their clients. It’s a win-win situation.

AI, which has shown great potential, is regarded by many as a threat. The latest research from CoreData shows that one in five UK financial advisers believes AI will replace the work they do.

But the same study finds that 45% of advisers think AI will help them to serve clients more efficiently, while almost a third (31%) think it will reduce advice fees.

“AI offers many opportunities for advice firms, including automating tasks, managing data, assessing risk and complying with regulations,” says CoreData managing director UK and US Rory Wilson.

Legacy tech persists in some areas, which is preventing advice firms from growing their business

“This could allow advisers to spend more time with clients and put into use those essential soft skills, including empathy and reassurance, which cannot be replicated by technology.”

Some firms are already incorporating AI. Calton Wealth Management has teamed up with advice tech firm Ningi to launch AI Copilot, which will automate part of the planning process and enable advisers to focus on human interactions.

Some firms are already incorporating AI. Calton Wealth Management has teamed up with advice tech firm Ningi to launch AI Copilot, which will automate part of the planning process and enable advisers to focus on human interactions.

“A human generating and sending out a client agreement does not add any value; a human transcribing notes onto a back-office system does not add any value; a human typing out a letter of authority doesn’t add value,” Calton founder and chief executive Tom Ham told Money Marketing recently.

Finally, there’s data integration. Data makes up a large part of the Consumer Duty, which came into force last July.

Firms are now engaging with and managing the huge amount of data involved in the financial-planning process.

However, the lack of a sector-wide central hub, with data flowing seamlessly in and out, remains a big challenge.

Demographics

Lois Vallely

Generation Alpha is getting older. The more steps this cohort takes towards adulthood, the closer its members get to becoming potential advice clients.

The oldest are still only tweens, but advisers hoping to be around in 10 years’ time would do well to consider how they will serve the next generation of clients.

The oldest in the generation before Alpha — known as Gen Z — are in their mid-20s, which means many of them are beginning to plan for their financial future.

To reach younger clients, advisers should be willing to have a social-media presence

Just as with Millennials 10 years ago, Gen Z is a fountain of opportunity for advisers. But, for this generation of digital natives who have never known a world without the internet, advisers must be prepared to work in a different way. To reach a younger audience, they should be willing to embrace tech and have a social-media presence.

Some potential Gen Z clients may not feel they need full-fat advice just yet and will opt for guidance instead. The deadline for feedback on the FCA’s advice-guidance boundary review is at the end of this month.

Younger clients are also more likely to care about sustainability issues and where their money is being invested. As such, it has never been more important for advisers to gain an understanding of what their clients want from their investments.

Financial wellbeing, too, is creeping up the agenda. As taboos associated with talking about one’s feelings fade, people are becoming more attuned to their mental health. Since financial wellbeing has a big impact here, advisers can aim to understand more about their clients’ financial desires and where they come from.

There has been a lot of dealmaking and aggregation of firms by several big spenders

Of course, the next generation also brings in new financial advisers (FAs), albeit we need more people training as FAs to combat the predicted adviser gap, which will otherwise widen as three-quarters of advisers reach retirement age in five to 10 years.

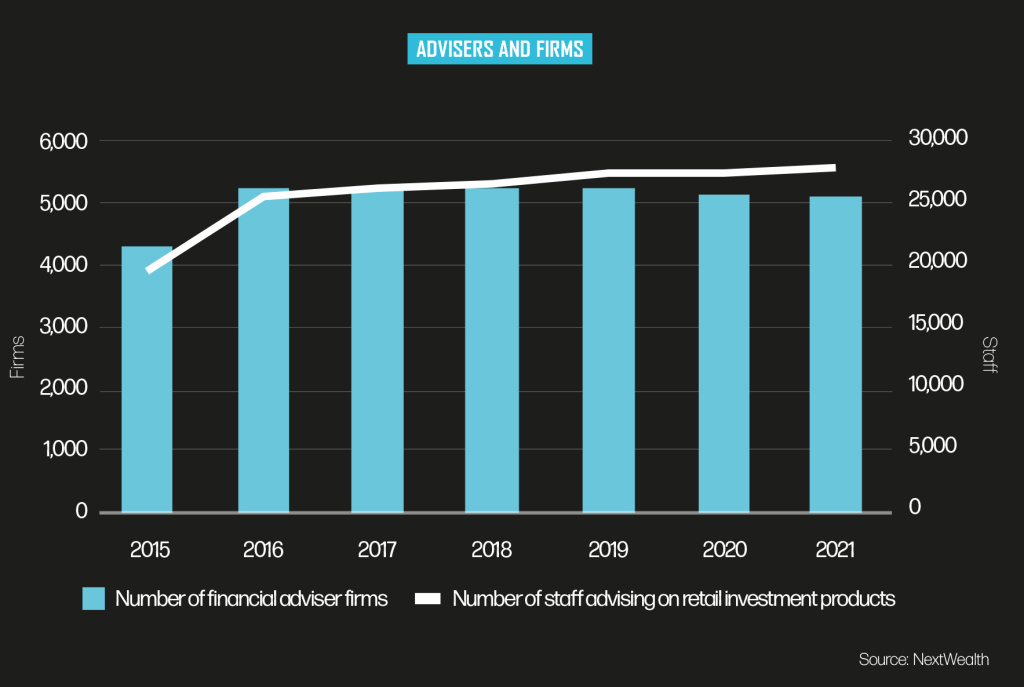

Until now, adviser numbers have been on the rise, according to the latest NextWealth figures. However, at the Chartered Institute for Securities & Investment’s annual conference last year, Financial Planner Life founder Sam Oakes warned that 20,250 advisers were expected to retire by 2033.

Meanwhile, the consolidation train continues to chug along, with a huge number of deals announced in 2023 and many more in the pipeline.

A big theme developing in the M&A advice market is the difference between genuine consolidation and aggregation.

There has been a lot of dealmaking and aggregation of firms by several big spenders. Platform One chief executive Alex Cowan-Sanluis predicts a “real divide” between those combining businesses efficiently using technology and those running a disparate group of companies.

The more steps Generation Alpha takes towards adulthood, the closer its members get to becoming potential advice clients

“They are not actually consolidating by utilising technology or providing a central investment proposition, making real efficiencies and driving down costs,” he says.

“They’re just aggregating advice businesses and building pure scale in terms of client numbers and assets. That’s an expensive exercise in this period of high interest rates.”

He warns that many private-equity backed consolidators have not budgeted for tech costs, an oversight that could “come back to bite”. On top of this, as more advice firms get swallowed up, the pool of choice for clients shrinks.

Encouragingly, another trend that looks set to continue in 2024 is the launch of start-up advice firms. These should bring much-needed innovation into the space and help close the advice gap — if business owners are realistic and sensible.

Regulation

Dan Cooper

Just over a decade ago, the introduction of the Retail Distribution Review (RDR) transformed the way financial advice was regulated. Last summer, the introduction of the Consumer Duty redefined the boundaries again.

Fast forward to 2024 and the pressure on advice firms to comply with regulatory changes has never been greater. A flurry of activity from the FCA in the last quarter of 2023 saw a raft of new proposals.

Everything from ESG (environmental, social and governance), digital assets, the use of AI and financial crime to operational resilience will be under the spotlight.

Personal investment firms will have to set aside capital to cover costs of compensation

This is also the year that the blurred boundaries between advice and guidance should come sharply into focus. The FCA has come up with proposals to try and close the advice gap and further clarify the difference between targeted support and simplified advice.

The regulator is still trying to work out what should and should not be in the scope of simplified advice, and how firms can charge for it.

Then there’s targeted support. The FCA anticipates this will appeal to life insurers and platforms, as they can use customer data and product knowledge to provide greater support to consumers than is currently possible under guidance.

However, targeted support is different from advice. As the FCA says, “It is not clear such a service could be provided by a financial advice firm.”

All this is new territory and leaves a lot of questions still unanswered.

There are fears that this perfect storm could put additional pressure on smaller advice firms

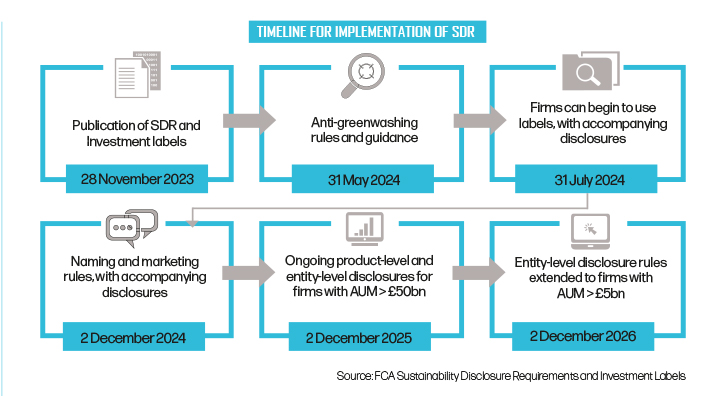

The regulator also plans to introduce measures to improve the trust in, and transparency of, sustainable investment products, and to minimise greenwashing. This is designed to make sure sustainability-related claims are fair, while product labels help investors understand what their money is being used for.

There are also naming and marketing requirements, so products cannot be described as sustainable when they are not.

In addition, we should find out more about how: 1) the FCA intends to regulate critical third parties, including AI services, for the UK financial sector, and 2) it will crack down on firms that keep some of the interest on customers’ cash balances for themselves while also charging a fee to hold the cash.

The watchdog is concerned that this latter practice, known as ‘double dipping’, may not provide fair value.

Then there are the results of the regulator’s thematic review of retirement income advice, which was undertaken to explore how advice firms were delivering retirement income advice and to assess the quality of outcomes consumers were getting.

The pressure on advice firms to comply with regulatory changes has never been greater

Finally, there’s the outcome of the FCA’s ‘polluter pays’ consultation. Under the proposals, personal investment firms will be required to set aside capital so they can cover compensation costs. The regulator says this will ensure “the polluter pays” when consumers are harmed.

Keeping on top of these regulations would be a challenge in normal circumstances. With geopolitical tensions and economic turmoil added to the mix, it poses an even greater obstacle. There are fears that this perfect storm could put additional pressure on smaller advice firms already struggling with the cost of implementing Consumer Duty regulations.

Whether this leads to the ‘little fish’ jumping out of the pond and exiting the market, or to the consolidation trend continuing as the big fish snap them up, only time will tell.

Costs

Darius McQuaid

Last year was tough on advice firms and they can expect little respite in 2024 as regulation and interest rates continue to put pressure on costs.

The Consumer Prices Index inflation rate of 4% is still well above the Bank of England’s 2% target, following a surprise rise of 0.1 percentage points in December. Bringing this down comes at a cost. High inflation last year forced the Bank to hike the base rate 14 times in a row, taking it to 5.25% from 0.1% in December 2021.

The Consumer Duty has put downward pressure on fees

This is something that impacts every consumer and business, and IFAs are no exception. But, despite rising interest rates creating a tougher environment for advisers, most commentators insist they have kept the burden off clients.

Succession Wealth corporate director Paul Morrish says that, when cost pressures build up in IFA firms, the client is the last person to pay for an increase without an improvement in the proposition.

But it is not just inflation and interest rates creating challenges. The rollout of the Consumer Duty last July has put downward pressure on the fees that firms can charge from clients.

This had a clear influence on the decision by St James’s Place to scrap its controversial exit fees in October. And a similar impact can be seen across the sector.

According to a report by NextWealth last year, the total client cost fell to 1.75% in 2023, having remained at about 2% for several years. The report also pointed to a series of regulatory interventions that had put a focus on fee disclosure — in particular the RDR and Mifid II.

However, the FCA is not yet content with the behaviour of many wealth managers.

In a damning ‘Dear CEO’ letter published in October last year, the regulator scolded them for failing to meet their obligation to deliver good consumer outcomes.

Despite rising interest rates creating a tougher environment for advisers, most commentators insist they have kept the burden off clients

One pertinent point was about price and value. The letter said the regulator continued to see firms “charging for services which are not delivered” — such as ongoing advice — overtrading on portfolios to generate high transaction fees, and providing a product or service that did not align with consumer needs.

In addition, the FCA expressed concern that firms were “not consistently providing clear disclosures on their fees or charging structures”.

Another trend that looks set to continue is the pace of consolidation, with numerous smaller consolidators — backed by private-equity firms — having entered the market.

Dyer Baade co-founder Stuart Dyer says these smaller consolidators are more willing to buy smaller IFA firms, while Gunner & Co managing director Louise Jeffreys believes that even bigger consolidators will now consider purchasing smaller firms they had previously “turned their backs on”.

Advice firms can expect little respite in 2024 as regulation and interest rates continue to put pressure on costs

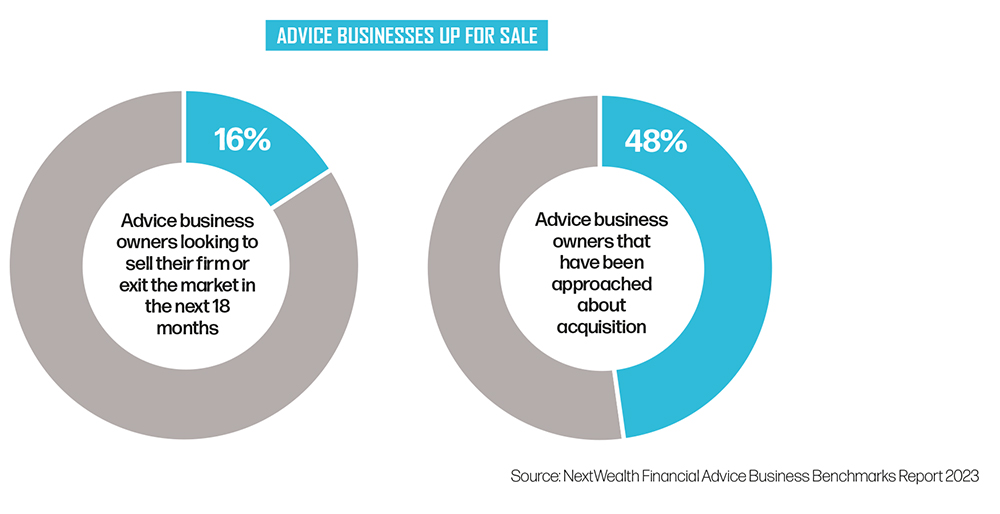

NextWealth’s report found that 16% of advice business owners were looking to sell their firm or exit the market in the next 18 months; this was up 5 percentage points year on year. It also revealed that 48% had been approached about an acquisition.

Indeed, 2024 was only just under way when consolidators such as Perspective, Söderberg and Succession made their first acquisitions, and Morrish believes the abundance of private equity will lower the price of IFA firms looking to sell.

However, he does have concerns that these businesses may consider going restricted or semi-restricted under the pressure of rising costs.

While it’s clear that IFAs are still vital for clients, it’s debatable how many will be able to hold on to their independence.

This article featured in the February 2024 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

Comments