The platform sector is a diverse and fragmented industry in need of unification and greater collaboration.

In the past, many attempts have been made — unsuccessfully — to bring providers together under an umbrella group. The setbacks have always been attributed to the competing interests of platforms and, until now, there has been no formal trade group to represent the community.

The sector’s views have instead been represented by various organisations, including the Association of British Insurers (ABI), the UK Platform Group (UKPG) and The Investing and Saving Alliance (TISA).

However, all that is about to change with the formation of the Platforms Association.

People have been asking, ‘Why wasn’t this done five years ago?’

The association, which was launched in late September on the eve of the Schroders UK Platform Awards, wants to be the representative voice of the multibillion-pound platform sector.

It claims the industry has “lacked specific sectoral representation and co-ordination” and “needs to take greater control over influencing regulatory issues and shaping growth”.

The trade body will act as a conduit for the sector to engage with regulators and policymakers, as well as co-ordinate and promote industry interests. Several leading platforms, including Abrdn, Aegon, Fidelity, Quilter, Seccl and SS&C, have already signed up.

The Platforms Association will be chaired by David Moffat, a senior director at SS&C who has decades of platform experience, and headed by industry veteran Keith Phillips, a former executive director at TheCityUK, the British Bankers’ Association and the Investment Association.

The pair will be supported by a board made up of leading industry experts.

Organisational structure

Membership of the association is open to UK- and Europe-regulated platforms whose primary activities are the settlement, custody and safekeeping of retail investor assets, as well as sub-custodian firms and white-label technology providers.

There are also affiliate members drawn from platform consultancies, legal firms and software providers. In addition, related financial and professional services firms, including Alpha FMC, have been appointed as independent strategic partners.

The platforms obviously felt they didn’t have a trade body that properly represented their interests and needs

“Given a background of increased economic uncertainty and regulatory scrutiny, the UK platform industry now needs its own dedicated forum and representative voice,” says Moffat.

“The Platforms Association will look to co-ordinate collective action and agree best practice to the benefit of platform operators, financial advisers and underlying investors.”

Phillips agrees.

“The investment and fund industry has been transformed and democratised over the past decade, with millions of customers now interacting directly with their financial futures through a platform.”

As a result, he adds, “sector-wide co-ordination should now be fully realised for the benefit of all”.

The association has already developed a roadmap of priority issues to be tackled, including platform requirements, regulatory expectations, and operational efficiencies and improvements.

Having a body specifically for platforms will encourage a better understanding of the issues

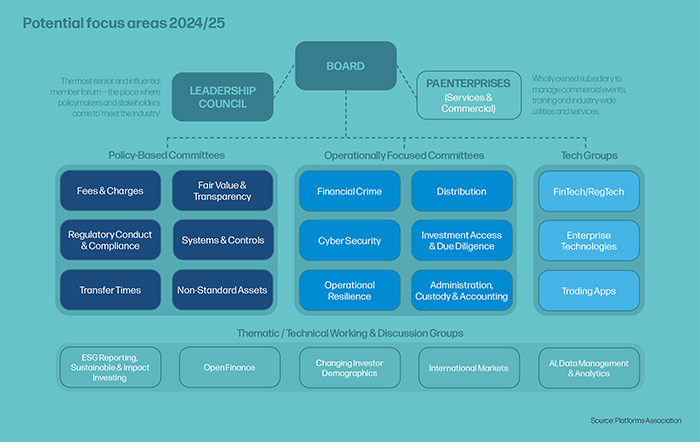

These three broad areas will be overseen by a leadership council comprising representatives from across the industry. This will meet quarterly and set the strategic agenda for the association.

Membership of the council, chaired by platform veteran Peter Mann, will be by invitation only.

‘Hard prioritisation’

Moffat says the association has already managed to collate a long list of 30 platform issues that the council needs to deliberate on.

The list was collated following consultations with the Financial Conduct Authority, the Investment Association, the Personal Investment Management and Financial Advice Association (Pimfa), TISA and other stakeholders.

“We have probably a capacity to cope with half a dozen [issues] at most and there’s some hard prioritisation going on,” says Moffat. “We need the leadership council to give us the steer as to what areas to focus on.

I’m not sure how dividing representation into two groups is helpful

“There’s a whole slew of other areas that potentially would justify, warrant and command our attention. But we’re going to have to cut our cloth accordingly,” he adds.

The association will also have standing committees to cover legal, regulatory, operations and technology issues.

Moffat states that the association, which is a not-for-profit, is working closely with some of the leading financial services trade bodies, such as the ABI, Pimfa and TISA.

“We have talked a little about ‘Trade Body 2.0’ as a kind of model, rather than simply emulating some of the existing major players.”

He says the association is different from others because all its members, regardless of size and assets, will participate and contribute “on an equal footing”. The cost of membership is £10,000.

Moffat continues: “I think that’s important, not so much for the amount but at the level that everybody is there equally.

“Part of the problem you tend to see with the pricing models that some of the other trade bodies adopt is that the biggest players contribute by far the largest amount of the money.

We hope this new forum can find common ground that enables progress

“The problem, of course, is that those very big players dominate and almost dictate the agenda that the trade body follows. And that’s what we’ve been keen to avoid.

“We want everybody sat around the table to contribute, and their value lies in the quality of their arguments and their analysis, rather than the amount of money they paid to be sat at that table.”

Warm welcome

The sector has largely welcomed the newly formed platform trade body and the response from across the industry has been “genuinely quite flattering”, says Moffat.

“The one question that people have been asking is, ‘Why wasn’t this done five years ago?’

“There is no good answer to that right now other than the fact that it wasn’t. Let’s do it now, then, and get it right.”

Platforum head Jeremy Fawcett thinks investment platforms should argue their corner with the regulator, the government and other parts of the industry.

In five years’ time, I’d like to see a platform community that is competitive and providing innovation and change at the individual platform level

It’s “surprising that it has taken so long to get here”, he says of the new trade body.

Fawcett adds: “Transact has been around for 25 years and collectively platforms hold a serious amount of the population’s wealth — about £800bn, according to our data.

“As a large and distinct part of the personal investing landscape, they find themselves in the regulator’s crosshairs and often need to respond in a co-ordinated way.

“Asset managers and wealth managers have their own well-established associations to represent them and don’t just rely on the broader industry groups. Investment platforms are sensible to do the same.

“The platforms obviously felt that they didn’t have a trade body that properly represented their interests and needs, and spoke with a single, clear voice to the government, the regulator and the rest of the industry.

“TISA was never likely to do the job, given the wide range of members — from asset managers to large intermediaries — and the potential for conflict between them, although it remains a very useful forum.”

The challenge in platform trade bodies has been the fact there are some business models that significantly compete with each other

Söderberg & Partners Wealth Management UK CEO Nick Raine adds: “While not a silver bullet, we think having a trade body specifically for platforms will encourage a better understanding of the issues platforms face.

“This will be a step forward from simply addressing the symptoms, which has often been the problem in the past.

“Platforms can improve transparency for end-clients and help advice firms fulfil their Consumer Duty obligations. With the additional support and advocacy of a trade body, we predict a bright future for platforms.”

Benchmark Capital chief executive Ed Dymott says: “We are always interested by improving industry collaboration, driving best practice and ensuring regulatory policy is appropriate.

“There is a lot of focus on platform business models, and we see benefits if there is more consensus in how the industry addresses key challenges.”

Divided loyalties

However, not everyone agrees with the formation of a new platform industry body.

Parmenion chief executive Martin Jennings believes the UKPG represents the platform sector. He wants to see the group strengthen itself rather than have to compete with a rival trade body.

We’ve seen trade bodies that have tried to become quasi regulators; that doesn’t work out well for anybody

“We have currently decided not to join the Platforms Association and to continue to strengthen our representation through the UKPG,” he says.

“I’d welcome anyone who wants to represent the industry or represent the interests of the industry and the clients within it. However, I’m not sure how dividing representation into two groups is helpful.

“I’ve a concern that we’ll end up diluting the voice because the UK platform people will represent themselves either through the Platforms Association or through the UKPG. And, when I look at

that, one group is surely better than two.”

Jennings hastens to add that his platform firm is not ruling out joining the Platforms Association in the future “if its voice becomes much stronger than the UKPG’s over time”.

The UKPG was set up in 2014 to represent retail platform operators. However, the group is limited to a small number of members in the UK. It does not have a formal legal structure or secretariat.

They’re just drowning in stuff, trying to make some kind of coherence out of the whole thing

A UKPG spokesperson says the group remains active and continues “to deliver in line with the principles that govern it”, dismissing any suggestion of rivalry between the two trade bodies.

“The UK Platform Group is aware of the Platforms Association,” adds the spokesperson. “The UKPG, with Pimfa as secretariat, will continue to represent the views of its members and looks forward to working alongside the Platforms Association to improve the understanding of the industry and advocate for positive change.”

Definition debate

“‘Platform’ is a label in search of a definition,” the late Ian Taylor, a former CEO at Transact, once said. Decades after Taylor’s assertion, the platform sector still can’t agree on one definition.

I put the question to the UKPG.

It replied: “It is not the role of the UKPG to define what is and what is not a platform. The UKPG has clear criteria for membership in its terms of reference, which are available on request to prospective firms who may wish to join.”

Meanwhile, the Platforms Association’s founders say they too struggled to come up with a definition.

“What is and what isn’t a platform has been a bedevilment all through the period. In the mid-2000s, this was a recurring theme on all the conference circuits,” says Moffat. “What we always agreed whenever we got bored was, ‘If it walks, swims and quacks like a duck, it’s probably a duck.’”

We have currently decided not to join the Platforms Association and to continue to strengthen our representation through the UKPG

However, the association has opted for a broad definition of ‘platform’, he adds.

“The answer is: anybody who’s got a name above the door operating a kind of investment online solution. Most people know what a platform is when they look at it.”

The sector is beset with challenges, from regulation to tech integration. The association will face its stiffest task in getting a consensus on key industry issues.

Dymott says: “The challenge in platform trade bodies has been the fact there are some business models that significantly compete with each other.

“This has always been a limiting factor for the sector in making progress. We hope this new forum can find common ground that enables progress to be made.”

Moffat agrees with Dymott’s assessment, adding that the new association is aware of the challenges ahead because of the “very disparate business models and players sat around the table”.

He continues: “You can’t really do anything in this space without potentially treading on toes.

This will be a step forward from simply addressing the symptoms, which has often been the problem in the past

“I would argue that a trade body, particularly one that’s trying to establish industry best practice and to provide thought leadership, should be treading on a few toes. Otherwise you’re probably not doing your job.

“Ideally you want to do it in a way that doesn’t offend people. We’ve seen trade bodies that have tried to become quasi regulators; that doesn’t work out well for anybody.”

Regulatory scrutiny

Platforms have experienced a sharp rise in regulatory scrutiny since the introduction of the FCA’s Consumer Duty.

The duty, which came into force in July 2023, seeks to set higher standards for consumer protection across the financial services sector.

In September the same year, the regulator sent a Dear CEO letter to platform bosses in which it outlined concerns that fees and charges might not represent fair value.

It said platform fees were “not properly disclosed” and consumers did not have a “clear understanding of what they are being charged”.

A similar letter was also sent last November on the practice of ‘double dipping’ by platforms. This led to issuance of several Section 166 reviews against platforms.

Moffat says: “Part of the challenge for the sector is a regulator that is not entirely comfortable with the behaviour of some of the platform operators. And that was evidenced.”

TISA was never likely to do the job, given the wide range of members

He stresses that the Platforms Association is keen to engage with the FCA in addressing issues that affect the sector, saying that in the past the industry has struggled to get its message across.

“There is no steering group they can talk to,” says Moffat. “The challenge is, they’re having to have a multitude of bilateral discussions and they keep getting told different things and different approaches. And they’re just drowning in stuff, trying to make some kind of coherence out of the whole thing.

“While we probably wouldn’t have [the FCA] at the leadership council every time, there’s a standing invitation if they want to come along and discuss any of their concerns. They will get a very attentive audience.”

Moffat says the Platforms Association will focus on a comprehensive programme of activity to address high-priority industry issues.

“In five years’ time, I’d like to see a platform community that is competitive and providing innovation and change at the individual platform level; which benefits from a coherent world view of what we’re doing and why we’re doing it; and which benefits from a number of common initiatives that strip away either costs or possible errors, or uncertainty as a whole.

Given a background of increased economic uncertainty and regulatory scrutiny, the UK platform industry now needs its own dedicated forum and representative voice

“I’d like us to be far more transparent with management information, and we’d like to have clearer best-practice guidance around what transfers look like.”

Watch this space

When it was launched in September, the Platforms Association was roundly welcomed by a sector yearning for representation.

Those in favour say it was long overdue, while others prefer to wait and see.

Will it succeed where previous initiatives have failed?

This article featured in the November 2024 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

Comments