I have never considered taking financial advice — perhaps because I don’t think I have enough money to be able to afford it. I also don’t feel I need it, but maybe I’m wrong.

Before I joined Money Marketing in June 2021, I had always assumed a financial adviser was just for the super-wealthy.

To be honest, this opinion hasn’t changed much in the three and a half years since. I still think so-called ‘full fat’ advice is only for rich people.

There are plenty of conversations going on at the moment about whom financial advice should be aimed at. Many, especially younger planners, argue that it should be accessible to all. Others believe that regulated financial advice should be reserved for people with assets over a certain amount — and advisers’ views on how much that should be vary widely.

If implemented effectively, targeted advice could empower millions

It’s a Catch-22 situation because often those who most need advice are the ones who can’t afford to pay for it.

The Financial Conduct Authority’s Consumer Duty firm survey, published in February, shows that 40% of firms have set minimum pot sizes for new clients. And even those that don’t have an official limit tend primarily to take on clients with bigger pockets.

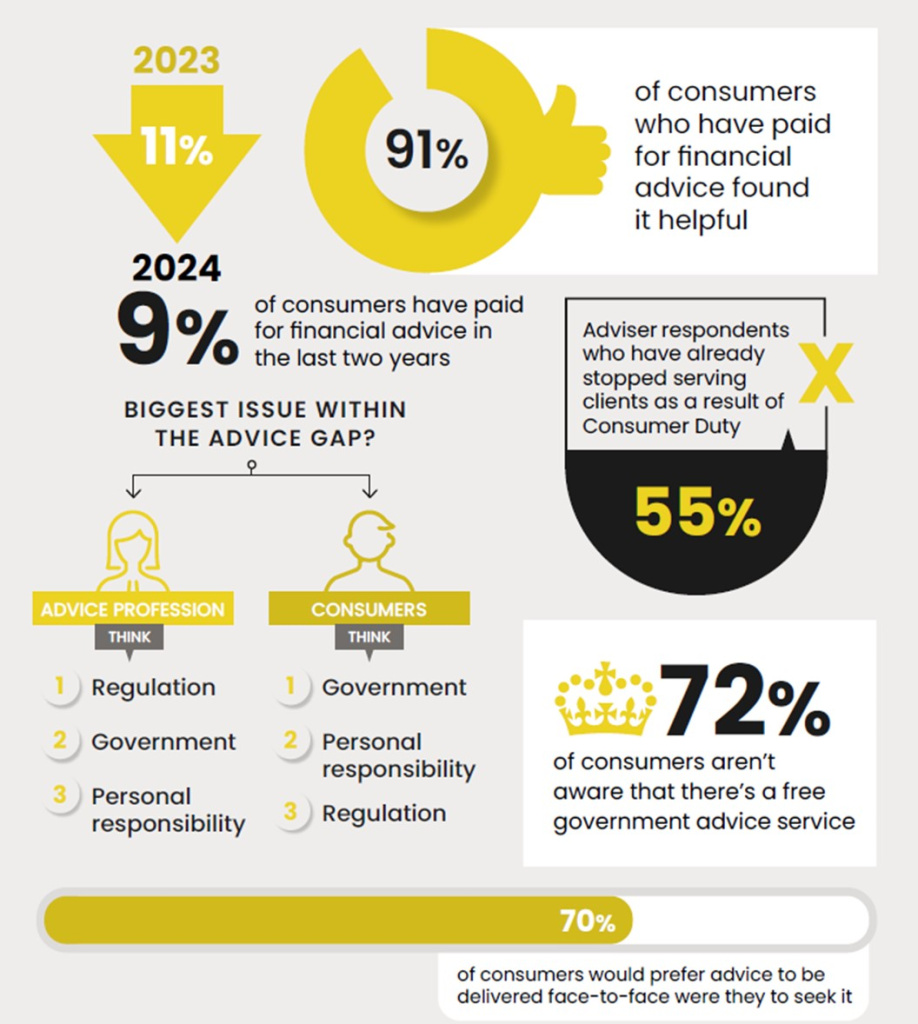

So, in conclusion, people with a smaller amount of money often struggle to obtain financial advice. And the FCA’s Consumer Duty requirements, introduced in July last year, don’t seem to be helping.

A recent report by The Lang Cat has found that the new rules have limited the access to advice for many. The research found that 80% of advisers believed the Consumer Duty had made it harder for them to service clients.

In particular, this is impacting those with low investible assets. Alarmingly, over half (55%) of advisers have stopped serving people who fall into this category.

Heavily regulated

It is understandable how we’ve got to this point. After all, financial planning businesses need to be profitable and can’t offer their services for free. However, in such a heavily regulated profession, this does limit what they can offer to people with less money but who still need help.

Let’s keep the bar high. Personal and holistic advice for everyone is possible

An obvious way to help plug the gap is to allow large providers and banks to offer their version of ‘advice’ to customers. But the line between regulated financial advice and simple guidance is often blurred.

The regulator has acknowledged that the current advice landscape is failing those who need it most. Firms are limited to either providing holistic advice, a regulated activity, or offering general information and guidance, which falls short of making personalised recommendations.

However, many firms interested in offering more affordable support to consumers are deterred by concern about inadvertently crossing the boundary into advice.

The question, then, is how do we solve this conundrum?

Official action

In 2022, the former Conservative government announced plans to “fundamentally review” how the boundary between advice and guidance on investments was operating. And, in December 2023, the FCA published a discussion paper exploring the regulatory distinction between financial advice and guidance.

This is a radical departure from previous attempts to solve the advice gap

The government describes the Advice Guidance Boundary Review — which outlines the following preliminary proposals aimed at addressing the advice gap — as a “significant opportunity” to reshape how financial advice is delivered to consumers.

First, it will consider targeted support. This would be a new form of support allowing authorised firms to provide suggestions that are appropriate to consumers with the same high-level characteristics.

Second, simplified advice — a new form of advice that makes it easier for firms to provide affordable personal recommendations to consumers with more straightforward needs and smaller sums to invest.

And, finally, further clarifying the boundary. The FCA says it wants to provide “greater certainty” for authorised firms in scenarios where they can provide support that does not constitute regulated advice.

FCA update

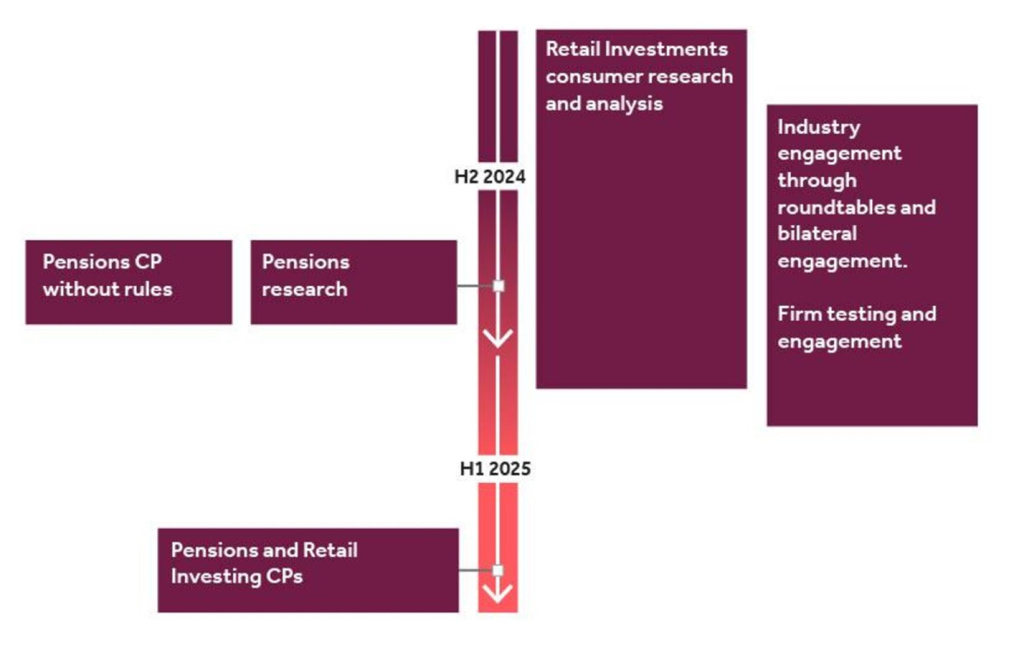

Last month, the FCA published an update saying it would look at targeted support for pension savers during the first phase of its review, with a consultation on the plans set to open this month (December).

We must strive to get targeted support into the hands of consumers in 2025

During the first half of 2025, it will then consult on rules for better support for consumers in retail investments and pensions.

Explaining its reasons for going down the pensions path first, the FCA says many people struggle to make important decisions about their retirement finances.

It warns that consumers do not understand or are disengaged from their pensions, making them “unprepared for retirement”.

In the 12 months to 2022, according to the regulator, only 57% of defined contribution (DC) pension holders attempted to read at least some of an annual pension statement, with just over a quarter (26%) saying they understood the statement ‘well’.

This means many consumers may feel unprepared when making a complex decumulation decision; or they have not built up a pension pot that will provide an adequate income in retirement.

“Some keep too much of their savings in cash,” says the FCA, “losing out on potential returns. Others do not regularly review their investments, or they invest in products that don’t meet their risk appetite.

It starts with raising our expectations for what positive change in the mass market looks like

“People are not getting the advice and support they need,” the regulator warns.

Data from its Financial Lives survey found only 8% of UK adults reported having taken financial advice over the previous year — just 4.4 million consumers in 2022.

The Lang Cat consulting director Mike Barrett believes that targeting pensions first is a sensible move by the FCA.

“That’s a nettle that needs to be grasped,” he says.

“Pension decisions are complex, often irreversible, and can have significant financial implications.

“Many consumers make costly mistakes, like withdrawing their entire pot and paying unnecessary taxes. The regulatory environment doesn’t allow those providers to say, ‘Whoa! You’re taking 100%. Do you realise you’re going to pay more tax?’”

‘Pivotal role’

Targeted support could play a “pivotal role” in addressing the advice gap, says Altus Consulting head of research and regulation Robert Holford, particularly for millions of pension savers in auto-enrolment whose financial decisions currently lack adequate guidance.

This could provide the missing bridge between current guidance and more holistic financial advice

In a recent survey, 65% of the financial service providers the consultancy spoke with said they would consider offering targeted support.

This, says Holford, highlights its potential to address the mass market’s need for more financial help, while also helping firms meet their Consumer Duty obligations to prevent foreseeable harm.

“However,” he warns, “especially at retirement, success hinges on pairing targeted support with mechanisms to build trust and deliver more personalised outcomes than a pure ‘People like you’ approach can achieve alone.

“While targeted support won’t close the advice gap entirely, it is a crucial step towards improving financial decision making for the underserved mass market.”

The demand for targeted support among pension savers is high. A recent report by Aegon, ‘The Second 50: Navigating a Multi-Stage Life’, revealed that 64% of those approaching retirement (aged 50–59) found targeted-support strategies ‘appealing’. And 71% of those aged under 50 backed the idea.

It’s not necessarily sensitivity to fees preventing people from seeking advice

Pensions and Lifetime Savings Association director of policy and advocacy Zoe Alexander says targeted support offers an opportunity to deliver personalised financial guidance, helping those unable or unwilling to seek regulated advice.

“By aiding individuals with key financial decisions, it could significantly reduce the advice gap,” she suggests.

But, she warns, clear regulatory boundaries, a robust framework and consumer trust will be “vital”.

“If implemented effectively, it could empower millions while maintaining safeguards,” she adds.

‘Perception issue’

It’s not just those who may lack enough money to seek traditional financial advice who fall into the advice gap, as Barrett points out.

“It’s not necessarily sensitivity to fees preventing people from seeking advice,” he says.

“The biggest barrier is trust. People often can’t see the professionalism the advice sector displays. They still think it’s financial services, it’s bankers, and often bankers aren’t trusted. So there’s a perception issue that needs to be addressed.”

Anyone looking at this as an opportunity to simply sell products has completely missed the point

He believes this perception of advice held by many consumers can be addressed by championing its value.

Believing they don’t need a financial adviser because they can ‘do it themselves’ is another thing preventing many people from taking advice, he adds.

“The visibility of advisers is really important to help address this,” says Barrett. “The most common method that a consumer will have to find an adviser is via a referral from a friend, family member or colleague. If someone’s friends, family and colleague network don’t know a good adviser, it becomes quite hard.”

The FCA’s evaluation of the impact of the Retail Distribution Review (RDR) and its Financial Advice Market Review found most people were comfortable making less-complex financial decisions themselves, such as taking out a cash Isa, without getting advice or more specific support.

However, for decisions that consumers regard as more complex, such as deciding to invest in a stocks-and-shares Isa, most would value some help.

Despite best intentions, the ideas gaining traction in our industry ignore everything we know about how to engage customers and what great advice looks like

Unsurprisingly, the FCA’s evaluation found that, as the level of complexity of the financial decision increased, the perceived need for support among consumers also rose.

Only when you go through all of those barriers do you get to pure cost, Barrett suggests.

“There is a small segment of the population for which advice is too expensive,” he says.

“But you could double the number of people who would pay for advice if you addressed the greater issues around trust, availability and visibility.”

Targeted support is considered by many commentators across the financial services sector to be a great next step for the profession.

According to Nucleus technical services director Andrew Tully, advice works.

Targeted support could lead to better outcomes for consumers and improve trust in financial services

“We need to find ways to encourage more people to access it. However, we also need to accept the advised cohort will only ever be a minority of people,” he insists.

“Many others need help and education, ideally personalised to their situation to some degree.

“Hopefully, targeted support can be one way of delivering this to the millions of people saving through auto-enrolment.”

Improving confidence

Nucleus’s latest Retirement Confidence Index, published last month, highlighted the importance of planning.

It’s vital that we get new tools into the hands of customers as soon as possible

“Given the low confidence of people in their ability to manage their finances, and the potential changes to the regulatory landscape, now is a good time for the industry to be considering all routes to helping their clients with advice and guidance, whatever form that might take,” the report said.

Tully says: “Our research demonstrated we need to focus on engaging people with the planning process, and by doing that we can create greater confidence and provide a pathway towards advice.”

Moneybox head of personal finance Brian Byrnes agrees. He says targeted support could significantly improve people’s retirement outcomes with personalised contribution amounts and investment options.

“One of the challenges with how consumers’ needs are supported today is that financial providers are required to couch any guidance shared in risk warnings and to present all the options that their customers ‘could’ choose,” he says.

We need to accept the advised cohort will only ever be a minority of people

Recent Moneybox research has found that a quarter of people say they often lack confidence to make financial decisions.

“One of the outcomes from targeted support surely must be to better guide customers to make a decision based on what their financial providers know about their financial history,” Byrnes adds.

“It’s vital that we get new tools into the hands of customers as soon as possible. The advice gap has been ever growing since the RDR, and the recent cost-of-living-crisis has accentuated the need for financial support from firms.

“We must strive to get targeted support into the hands of consumers in 2025.”

Barrett says targeted support will enable organisations to help people understand sensible approaches and introduce “guardrails”.

“For example, if someone is making a poor or harmful decision with their investments — such as withdrawing 10% from their pension when most people typically take only 4% — providers could intervene and advise against it.

You could double the number of people who would pay for advice if you addressed the greater issues around trust, availability and visibility

“Currently, the advice-guidance boundary prevents firms from doing this, leaving them to simply watch as consumers make damaging choices, which is far from ideal.

“Targeted support could lead to better outcomes for consumers and improve trust in financial services. Many people view financial services as inherently working against them. Shifting the balance slightly in favour of consumers over time would be a positive step.”

Simplified advice

Further down the line, the FCA says, it will probably look at simplified advice, as well as targeted support.

“[Simplified advice] will go ahead, but it will likely be adopted by a minority of niche, small operators or large, vertically integrated firms,” suggests Barrett.

He says the challenge for traditional advice firms — 90% of which have fewer than five advisers and half of which are one-person operations — is that they often lack the resources, time or desire to engage in this space.

“Many are run by individuals, typically men in their fifties, and their core services are already in higher demand than they can meet,” says Barrett.

“If these firms had more time or capital, they would likely continue focusing on their wealthier clients rather than expand into less profitable areas.

If implemented effectively, this could empower millions while maintaining safeguards

“This isn’t something that regulation is likely to change, as it wouldn’t make commercial sense for advisers to prioritise clients paying smaller fees over those paying larger ones.

“That said, regulation could be improved and streamlined for firms willing to specialise in this niche.

“Larger firms with vertical integration can leverage cross-subsidies from other parts of their business to make it viable. In these cases, the advice is often linked to in-house funds, generating additional revenue from both asset management and the advice itself.”

This is not the first attempt to solve the advice gap. But many commentators are hopeful that the FCA’s proposals will go at least some way towards bridging it.

Royal London director of policy Jamie Jenkins says the recently announced plans of the FCA are a “radical departure” from previous attempts.

“The targeted-support proposals could help address the gap for people who don’t need financial advice just yet but who could do with some help on how to engage with their savings,” he says.

While targeted support won’t close the advice gap entirely, it is a crucial step towards improving financial decision making for the underserved mass market

“This could provide the missing bridge between current guidance and more holistic financial advice, warming people to the benefits of paying for the services of an adviser when the need arises.

“This is a radical departure from previous attempts to solve the advice gap, shifting from a culture of warning people about the risks of poor decisions to one of trying to help people make good ones.

“However, anyone looking at it as an opportunity to simply sell products has completely missed the point.”

Narrow focus

Octopus Money chief executive Ruth Handcock believes previous attempts have failed because their focus has been too narrow.

Robo-advice was once heralded as the answer to the advice gap — and an earlier incarnation of the ‘simplified advice’ proposals we see today.

“More than 10 years on, it’s used by only 1.5% of adults and has largely failed to deliver on its initial promise to create a nation of more confident investors. Why? Because robos serve too narrow a need: they give customers only a few jigsaw pieces in a 1,000-piece conundrum,” says Handcock.

It’s a nettle that needs to be grasped. Pension decisions are complex, often irreversible, and can have significant financial implications

“They recommend investment funds to customers who have already decided they want to invest a certain amount of money. But most customers have much broader financial uncertainty.

“They want help working out how much to spend, how much to repay on mortgages, how much to save, how much to invest and how much to put into a pension, as part of one holistic plan. They need the whole picture.”

She believes the Advice Guidance Boundary Review is helpful in putting a spotlight on that issue and how to solve it. However, “despite best intentions, the ideas gaining traction in our industry ignore everything we know about how to engage customers and what great advice looks like”.

Handcock continues: “As we work towards closing the advice gap, we must take the right lessons from advisers and the service they already deliver to millions.

“For any adviser, the formula is obvious: it’s personal and it covers your whole life. And yet, these two critical ingredients are entirely missing from targeted support and simplified advice.”

Some people keep too much of their savings in cash, losing out on potential returns

Handcock argues that the best thing the FCA can do is clarify the advice boundary in a way that gives the industry the “inspiration and confidence” to pursue new models that combine regulated advisers, non-regulated coaches and technology. She is optimistic that there’s a better way.

“I’ve seen it first hand,” she says. “But it starts with raising our expectations for what positive change in the mass market looks like.

“A new methodology helps everyone — it can enable financial advice firms, wealth managers and even retail banks and building societies to serve a wider range of customers more affordably.

“Let’s keep the bar high. Personal and holistic advice for everyone is possible.”

Next steps for the Advice Guidance Boundary Review

Feedback on the FCA’s discussion paper

The FCA said most respondents had agreed that its proposals were a ‘positive step’ towards improving consumer outcomes, and they had agreed with the proposals outlined in the paper.

The Financial Services Consumer Panel challenged the regulator to realise the full ambition of this review, and encouraged it to “keep an open mind” on what might be needed to achieve the strategic aims — which are to help consumers access the support they need to make informed decisions.

Some respondents said they would welcome more examples of support they could give without undertaking financial advice

There was concern too about the risks of developing new forms of regulated help, including the need to ensure people fully understood the support they were being offered and what protections would be provided.

Targeted support

A majority of respondents indicated that targeted support offered the best way of helping consumers at scale.

Stakeholders pointed out that targeted support would be successful only if consumers had confidence in it, and if they understood what it was and what protections it provided.

There would be risks not only to consumers if this service was not delivered well but also to the success or viability of targeted support as a new regulatory offering.

The FCA received feedback focused on the scope of the regime, and on the importance of delivering good outcomes for all savers and investors, including those with characteristics of vulnerability.

A majority of respondents indicated that targeted support offered the best way of helping consumers at scale

Some respondents emphasised the need for a joined-up approach with the wider regulatory family, and the importance of the Consumer Duty to support implementation of any proposals, with a debate on the merits of detailed rules or an outcome-based regime.

Others discussed the role of technology, including Open Banking, to support the proposals.

Simplified advice

Respondents also saw a role for simplified advice but recognised that it might not meet the demands of the mass market.

Some suggested that simplified advice was needed in conjunction with targeted support for those who could not afford, or did not want, holistic advice but needed additional help.

The Financial Services Consumer Panel challenged the regulator to realise the full ambition of this review

The FCA has also heard feedback that targeted support could help with directing consumers to further sources of support, including holistic advice.

Further clarifying the boundary

There was interest shown towards the proposal for the FCA to further clarify the boundary between regulated financial advice and unregulated guidance, but also recognition that on its own it was unlikely to resolve the support gap.

But some respondents said they would welcome more examples of support they could give without undertaking financial advice.

This article featured in the December 2024/January 2025 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

Really, a very good report and well set out,,, But surly this should have been done Pre RDR rather than Post RDR!!!!. I think the RDR was very good in removing the Volume Selling of investment products by way of enhanced “Commisions”, mostly the Banks and tied agents!! ( L&G paying 9.25% Upfront in a Life Bond to one bank!) o yes and a ten year exit penality. But surly, in 2024, some 44 years after the Financail Sevices Act of 1988, it must be down to indivigual Education, unforunatly there is a lot of “”Cannotbebothered!!! by those who need it most..