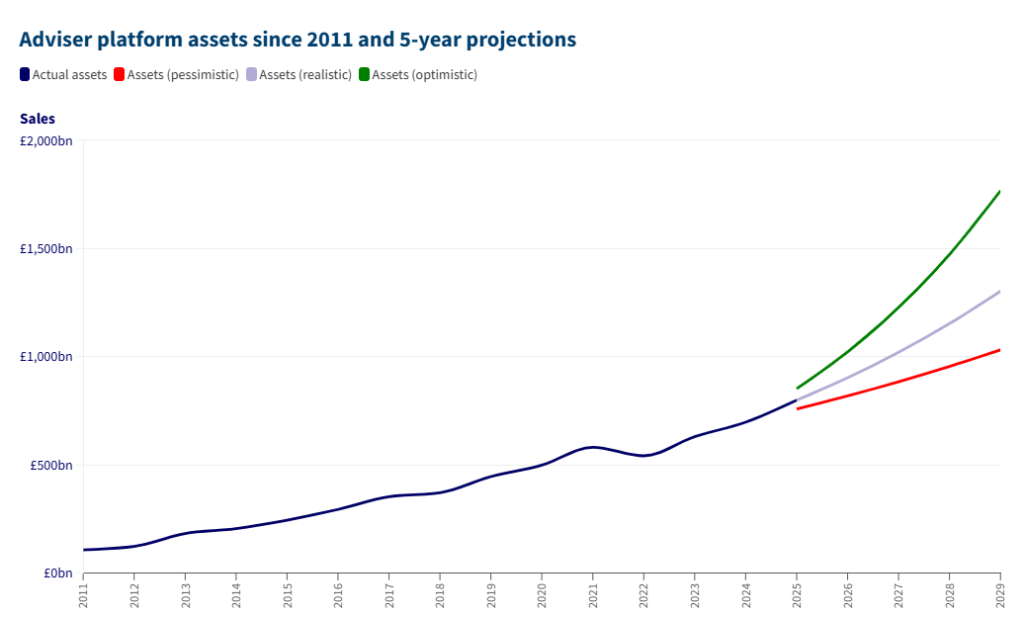

Adviser platform assets will likely reach more than £1trn by 2029, while all-platform assets will hit £2trn, Fundscape has predicted.

The research consultancy has published figures showing that assets on adviser platforms grew to £697bn in 2024.

Meanwhile, all-platform assets set a new high of £1.1trn.

Fundscape chief executive Bella Caridade-Ferreira said that, in the firm’s “realistic scenario”, which has a compound annual growth rate of 13%, it expects all-platform assets to rise to £2.1trn by 2029 and the adviser platform component to £1.3trn.

It said that, overall, 2024 was a “mixed year” for the industry.

Normal service was resumed in the final quarter of 2024, after the “doom-laden media frenzy” of the previous quarter.

During Q4, gross flows jumped 14% to £44bn – the second highest on record – while net flows stayed steady at £5.4bn.

However, a lack of confidence in the Budget has meant that outflows continue to be elevated and directed into cash and annuities.

Claire Trott: What the Budget means for pensions

Gross flows rebounded and are close to 2021’s high of £164bn, but net flows were dragged down to £26bn, with outflows of £136bn.

Isas and GIAs have borne the brunt – Isas experienced net outflows of £577m and GIAs were just positive at £40m.

Caridade-Ferreira said: “The second half of 2024 would have been more buoyant were it not for the Budget – investor confidence was on the rise and platforms were upbeat about the outlook.

“However, the Budget triggered a new wave of uncertainty that will inevitably affect the short-term outlook. The Isa season will be the bellwether for 2025.

“The 2025 outlook may be more uncertain, but the underlying fundamentals and long-term outlook remain strong.

“Consumers need to save for retirement and the changes in the Budget will see demand for advice surge.”

Comments