Better late than never, so the saying goes. The FCA has certainly been tardy when it comes to the defined benefit transfer market. It pushed through rules to clean up the mess only after the sector’s reputation was tarnished by the British Steel scandal.

Better late than never, so the saying goes. The FCA has certainly been tardy when it comes to the defined benefit transfer market. It pushed through rules to clean up the mess only after the sector’s reputation was tarnished by the British Steel scandal.

Better late than never has been tested again with its unveiling of an assessment tool advisers can use to check their recommendations.

It has been published to help firms and pension transfer specialists understand the watchdog’s file review methodology. The use of the tool is limited though. It does not incorporate the new contingent charging rules implemented from 1 October 2020, for example. The FCA says an updated version of the tool for advice given after that date will be published shortly.

The release of the tool was uncharacteristically low-key compared with the rest of the FCA’s musings on DB transfers. Its release should also be seen in the context of a longer announcement about the watchdog’s latest figures on DB transfers. These were published the weekend after the tool, and provide insight on how the watchdog’s new rules are shaping the market.

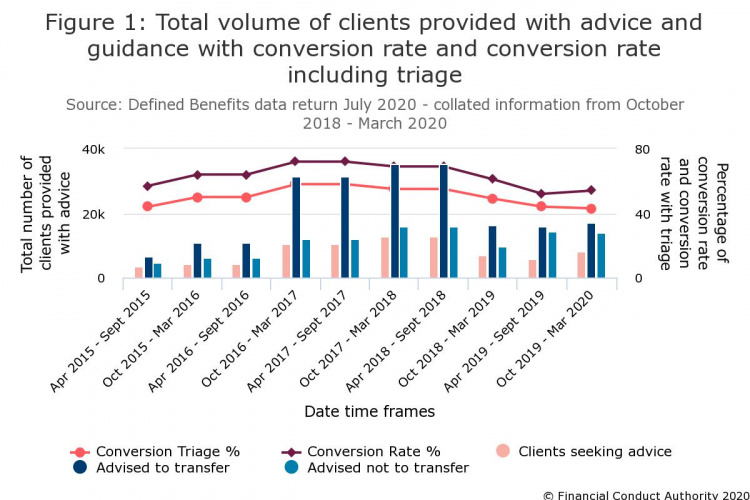

Advisers have known for several years the watchdog’s view: the conversion rate for transfers is too high. If you combine figures from the watchdog’s two rounds of data collection then active DB advice firms fell from 2,426 to 1,310 between April 2015 and March 2020.

It is hardly a coincidence that the FCA has published a tool to help advisers grasp how the watchdog reviews case files just as the latest data shows a fall in transfer volumes.

The proportion of pension scheme members recommended to transfer following advice fell from an average of 69 per cent in October 2018 to 57 per cent in March 2020.

The FCA notes the data shows “some signs of improvement” and a “significant fall in conversion rates”.

It has also wanted to push down the percentage of savers who transfer on an insistent client basis.

A cynic might argue the timing of the tool’s release might allow the FCA to justify what it always wanted: a subdued transfer market. But is that really the case? Will the tool change anything in how advice is given?

Money Marketing spoke to advisers, networks and compliance experts to understand how the tool has been received. The reactions are mixed. While some are very welcoming, others are more reserved about the tool.

Bolting the gate

Many advisers applaud the watchdog’s efforts and the materials it has provided to help advisers get accustomed to the tool. There are nine videos lasting only a couple of minutes that give brief instructions, but there is also 104-page instruction document that accompanies the videos which explores the application of the tool in more detail.

Plutus Wealth Management chartered financial planner Ruban Sanmuganathan finds the supportive material helpful.

He says: “The text in the videos is useful support to just a pure spreadsheet and it could be used by firms to present key considerations to their advisers when they give DB advice.

“The spreadsheet questions could be put into a separate paper checklist for each adviser to go through to ensure they cover off every possible point in a consistent way.

“When doing this kind of advice, it is hard to cover off all possible things to consider without having such a template to work off. We have such a checklist at our firm, but it was created before this tool so there may be things we can add to our existing checklist.”

Sanmuganathan is encouraged by the overall thought put into the tool, adding: “I like the fact it was created by the FCA and gives some clear guidance on exactly what it does and does not look for.

“This is good as it helps keep us on the same page as the regulator and ensures we can constantly meet its requirements rather than self-guide ourselves through the process.

“I also like the fact the FCA has made it clear the investment advice is separate but equally important as the transfer itself. Both are important and must be looked at by any adviser.

“Overall, this initiative really helps advisers look at DB transfers in a more objective way and covers the obvious things to consider in both quantitative and qualitative terms.”

Some of the biggest networks have welcomed the FCA’s tool and will incorporate it into their own systems. Quilter Financial Planning and St James’s Place both went on the record to Money Marketing about their views on the device.

Quilter Financial Planning appears to be the first major network to publicly declare it will use the tool. Managing director Gemma Harle says: “Quilter values this input from FCA on the highly complex area of advice. We are looking closely at the tool to support our own supervision process. Our initial review of the tool shows that is heavily aligns to our own supervision guidelines.

“The tool and the accompanying completion guidance notes will help ensure consistency throughout the industry and is a welcome addition to the FCA’s ongoing work on DB transfers.”

An SJP spokesman says: “The tool is a helpful guide to see the principles by which the FCA assesses suitability on DB transfers. Having reviewed the tool, the principles are well aligned to our own approach. All recommendations and advice in this area are reviewed by a central team of specialists within SJP to ensure it is in the client’s best interests. We look forward to seeing an updated FCA tool to reflect the new rules which recently came into effect.”

Expert view: The FCA finally got something right with its new DB tool

If you haven’t yet looked at the DB advice assessment tool I strongly recommend you do. It is the tool that the regulator uses to assess whether the advice that you and I give is suitable or not.

Spreadsheet based, the concept is that an assessor goes through the file and completes a great deal of data about the client and their DB benefits to determine if enough suitable information has been gathered.

If I had any criticism of the tool it would be two-fold. First, the regulator might have issued this some time ago and having it might have helped to improve the percentage of DB transfers considered suitable. Second, it does seem to miss some of the nuances we have to account for when advising on the most complex of advisory services.

We all know that the starting point for advice in respect of DB pension schemes is to assume that retaining the benefits is probably the best course of action. But unlike the regulator, most financial planners tend not to deal with huge swathes of clients. Instead, we concentrate on suitability of advice for each individual client.

While there might be some common ground for each client we advise, they will have their own unique views that sit alongside their identified needs and wants. It is best to approach each client’s situation with an open mind.

The tool delivers a binary outcome. Either the advice to transfer and the investment recommendations are “suitable” or “unsuitable”. Disclosure of adviser charges and product costs are also considered in terms of whether it has been done properly or not.

You can download the tool directly from the FCA website. I recommend downloading the instructions for its use as well – over 100 pages of detail that will give you a great insight into the regulatory mind-set for this subject. I can see financial planners using it each time they formulate advice for a client with a DB pension that needs to be considered.

In terms of the data entry, it didn’t seem any more onerous than the level of data you might have to input to produce an Appropriate Pension Transfer Analysis report. In many respects it is probably more useful in reassuring both the client and the financial planner that the advice they are providing is suitable.

Let’s hope that the FCA has told the Financial Ombudsman Service about this tool because that might help them to approach the subject with a bit more consistency. So well done the FCA, more of this please.

Nick Bamford is chairman at Informed Choice

Prelude to a pensions review?

Regardless of the positive feedback, there are those who are less enthused by the tool and levy several criticisms against. There are lawyers who are concerned it might be used by the FCA in any future review of the DB market.

This worry is underpinned by the belief the regulator has not managed transfers well, and might be over-correcting for past failures. Likewise, there were questions about what view the watchdog might take of firms that do not use its tool.

The FCA has allayed fears by clarifying the assessment tool is not mandatory and firms can use their own to assess suitability. It recognises other “adequate methodologies” to assess suitability and any “supervisory judgement” of a firm will not be affected by using alternative methods.

DWF associate Aaron Osborn says: “It is important firms understand how the FCA is reviewing files as part of its review to allow firms to challenge the basis on which they are told by the FCA that their advice was unsuitable.

“It must be right that this is not mandated, and is positioned as a ‘suggested approach’ – suitability is not binary; within limits it is subjective. This will give firms hope of defending their positions in individual cases, particularly if their professional indemnity insurers will only cover a ‘legal liability’.

“That being said, firms will need to be ready to defend their methodologies from FCA suspicion as there is a risk that firms will be judged by these standards in hindsight, whether by the FCA or FOS.”

FOS tells Money Marketing it will not be using the tool when assessing complaints on DB transfers, but regularly speaks with the FCA about the sector.

But FOS also notes the tool is based on FCA rules and guidance which are taken into account when it adjudicates on cases.

These clarifications since the tool’s release are little comfort to advisers who have decided to leave the market completely though.

Thameside Financial Planning director Tom Kean says: “The tool would have been helpful right at the start, but now it is like shutting the stable door after the horse has bolted.

“The FCA clearly does not differentiate between clients who should not transfer and clients who should. I have had to stop as I cannot bear the pressure this puts me under as a business owner. I also cannot bear the potential liability this puts on me as an individual.

“The number of long-standing clients I cannot help has now turned from one to two. There is no way to refer them to firms that can help, and I will lose these two clients if I do. No one will take the referral and hand the clients back.

“It has all been handled really badly and we are all being tarnished like the original pensions review from 1988 to 1994. This is a disaster, and I am not surprised people exit the profession because of it.”

Nonetheless Kean does strike a more cheerful note on the tool’s benefits to young advisers who are just entering the sector .

He adds: “If you come in fresh faced the tool enhances your protection as it is FCA created and that can only be a good thing. But I would strongly advise new entrants to consider carefully whether they want to work on transfers. It generates such a long liability and I do not blame the PI insurers here.”

Falling into the wrong hands

That the tool was introduced too late or could be used to unfairly hammer the profession are not the end of the concerns that some have raised.

When Pension Advice Specialists pension transfer advice head Craig Stokes became aware of the tool he wasted no time in getting the firm’s compliance team to review the impact it’s likely to have on the pension transfer market.

He welcomes the FCA’s transparent approach and says the size and nature of the tool emphasises just how complex this area of advice is.

Although, he suggests some firms may be put off by the dauntingly large instruction manual which accompanies it.

While he deems the tool useful, he highlights its limitations for existing and future cases, which the FCA plans to work on.

The firm won’t be replacing its current processes but plans to use the tool alongside them and has already assessed its in-house reviews on historic cases.

The biggest danger Stokes sees with the tool is the chance it is used by those who don’t understand the market and is manipulated for misguided ends.

He says: “We do have concerns over the potential risk and harm the tool could have, if it falls into the wrong hands. For example, it could be used by unqualified and inexperienced individuals, such as those at claims management companies looking to promote and develop complaints.

“If not used correctly, it could easily encourage an image of poor advice and increase the ‘complaint culture’ even when suitable advice has been given.

“There is a licencing agreement that has been published in accordance with the tool intended to prevent the tool being exploited for commercial gain, but we are not sure how this can be enforced.”

Only time will tell if these dangers materialise given the recent introduction of the tool and the fact many are still learning about it.

Glass half full

Supporters of the tool think advisers should try and look to the future and not the past when reviewing the issues it poses.

It does show that the FCA has attempted to be transparent with IFAs about the way it assesses files for business reviews.

The tool should also give advisers an insight into how the FCA might assess them if a sweeping pensions review does happen.

Stokes says: “It gives those firms working in this market a clear picture of what the FCA expects. The tool provides a consistent and relatively in-depth option for reviewing files, taking account of the regulator’s standards.

“It provides transparency on how the regulator assesses files and can give firms confidence they are adhering to the requirements in this area of advice.

“It can be used to identify weaknesses or risks within a firm and also has a valuable ‘check the assessor’ function, which ensures there is no bias forming in the checking process.

“We work on a two-adviser model and are pleased to see several references to this model within the instruction document, giving further guidance on how cases are assessed on that basis. This is a welcome development, as outsourcing DB advice becomes increasingly popular as a solution.”

The only caveat here is the significant limitations of the tool for existing and future cases until it is updated.

Stokes adds: “The size and nature of the tool clearly emphasises the complexity in this advice area and the robust regulatory requirements, which can only be a positive. As a review tool for past-business and complaints it can certainly add value.

“We don’t feel it is a tool that should replace existing file or advice checking processes, as it does lack the ability to capture soft facts, but we do see the value that it can add to the market as a whole.

“We deem it to be a valuable addition to any compliance department’s toolbox. For those firms that don’t already have a robust advice or checking process in place, the tool’s introduction could help tighten this up, and ultimately get everyone providing DB advice to the same required standard.”

Threesixty managing director Russell Facer is overwhelmingly upbeat about the prospects for the tool and rebuffs criticism of the FCA.

He says: “It is a positive step and although it only goes up to 1 October there is a lot of guidance and plenty of opportunity to check your processes. The FCA must be praised as it has taken big steps to put the tool out there.

“It could be misused accidently, and you might have problems if you have not read the guidance that goes with it properly. Someone could take one or two questions and use it as the basis for starting a complaint. But you could say that about anything.

“The quality of advice post 1 October should be made better and the tool can help. Many firms have stopped doing transfers due to PI insurance. The tool might actually help insurers get more confident in terms of assessing firms DB books. They might even write more generous terms accordingly.”

Adviser view

Kate Shaw

Director, Financial Life Planning IFA

I am aware of the tool and the videos are helpful for those who will be using it. We’re aware they’ll need to be updated to incorporate the new parts of the post 1 October process. I imagine those who want to assess historic advice will find the tool helpful as it is.

I’ll be using it as a sense check against my processes, just to make sure I haven’t missed anything. I don’t compliance check my own files – they go to my compliance service provider to avoid any conflict of interest as I’m a single adviser firm.

The strong points are it does clearly give some examples of unsuitable advice, loads of information requirements and does acknowledge DB transfers to impaired life annuities happen.

I have done a few of these recently and they’re often ignored in documents like this.

The weak points are it is very tick box based, I realise this is difficult to avoid really. But my main gripe is the instruction document that comes with it is 104 pages long with no executive summary.

Good article but confused by a couple of people criticising the tool for generating a binary suitable/unsuitable result. It can only be this as there is only suitable or unsuitable in the Handbook (and hence in law). What do they want – a sort of suitable category?

Of course, suitability is subjective and hence there is a judgement to be made but this tool allows this, for example by allowing the assessor to over-ride the automatic answers

An adviser won’t refer a client as he will not have the client referred back? This is why it’s still an industry and not a profession. Effectively he is saying I would rather give bad advice than make a referral.

Rory

I referred to it as a “binary decision” but it wasn’t a criticism.

I entirely agree with you that “suitability is subjective”

Too many commentators think their subjectivity trumps other people’s subjectivity!

This is a very valuable tool and again (and I so rarely say this) well done FCA!!

Whilst this is welcomed and will help advisers understand and insure the FCA is happy with their process and files, it does nothing to provide any certainty of a defence against future claims.

The fact the FOS has already stated effectively they will look at it, but not use it, says it all.

Until there are agreed rules and processes agreed by the FCA, FOS and FSCS, all this has achieved is a system to insure advisers meet FCA requirements.

The PI Insurers and advisers still cannot asses any future liabilities with any certainty. Without this I cannot see why any adviser would wish to place themselves in harms way. It will not claim and encourage PI insurers to return to the market or drive down costs.

The best way to interpret DBAAT is in the context in which it was produced. This requires a level of transparency the FCA may not be willing to embrace.

Common sense suggests the context is Past Business Reviews (PBRs) These are conducted at the FCA’s bequest by firms or a third party appointed by the firm. Not sure whether this is entirely within the firm’s discretion. This required a degree of consistency of approach to ensure consistency of outcome, both over time (applying only rules at time) and between individual assessors. Anything else would be rough justice compared with the FOS process that it replaces (EG 11.2) -although consistency is inherently difficult for an ombudsman as long as a case is nuanced or balanced (involving trade-offs eg).

The FCA starting point is a template. This does not allow for interpretative judgement by an assessor. That ensures consistency but not justice.

It’s the 104 page instruction manual that provides scope for justice but at the expense (perhaps) of consistency. That gets sacrificed where the trade-offs are subject to personal bias. In a transfer, most are. Indeed that’s exactly where the FCA’s guidance and consultation on rules has in the past made errors.

The question is, was the instruction manual only prepared by the FCA in response to third-party complaints that the template was not fit for purpose? My suspicion is, it was. Again, just common sense: the template is clearly binary and not nuanced.

If so, how have internal FCA assessors applied the template when doing selective file reviews (on which the call for Past Business Reviews were based), lacking an instruction manual? Or did they have this or something like it at some point since internal reviews started? If they did, how do they vary and why?

Understanding the evolution of this process would provide insights into the FCA’s ‘journey’ of discovery that transfers are not as unsuitable as it has made out, even if egregious cases remain just that.

We are also waiting for final guidance on the advice process following a consultation ending last September, due this quarter. This will need to be cross checked against the instruction manual for PBRs to see if the FCA’s move to a more nuanced position is clearly enough stated in both.

Finally, we need more transparency around the PBR process itself, including the enforcement actions that follow its results, to ensure firms do not risk being made to pay redress on a flawed basis that would not be a just replacement for a FOS process. Common sense also suggests legal challenges to come.