The number of pension plans accessed for the first time surged in the past year, as economic pressure continues to mount, FCA data has revealed.

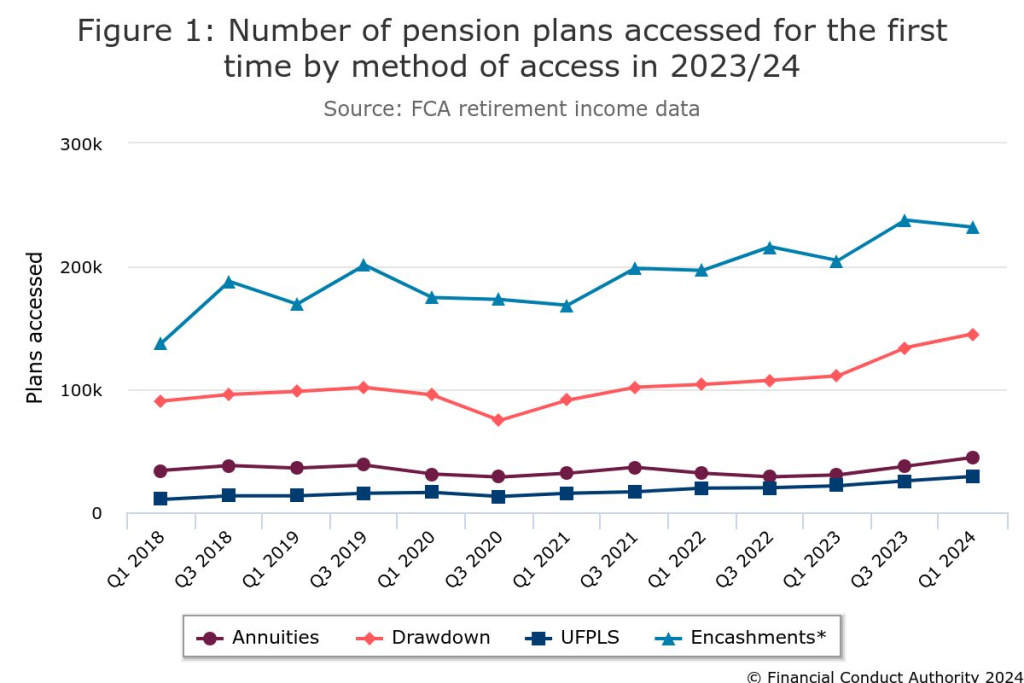

The regulator’s latest retirement income market statistics, published today (26 September) showed the total number of pension plans accessed for the first time increased by 19.7% to 885,455 in 2023/24 from 739,652 the previous year.

Around 30% of pension plans accessed for the first time in the past year were accessed by plan holders who took regulated advice.

This was down from 32.9 % the previous year.

Quilter head of retirement policy Jon Greer said this ongoing drop suggests that more people are navigating the complexities of pension withdrawals without professional help.

This, he said, raises concerns about the long-term sustainability of their retirement strategies.

Sales of annuities saw the biggest jump, from 59,163 in 2022/23 to 82,061 in 2023/24 (38.7%).

Sales of drawdown increased by 27.9%, from 218,183 in 2022/23 to 278,977 in 2023/24.

The overall value of money being withdrawn from pension pots rose to £52.1m in 2023/24, from £43.2m in 2022/23 – an increase of 20.6%.

Greer said the substantial increase indicates that more individuals are turning to their pensions to manage their financial needs.

This, he suggested, is likely influenced by the cost-of-living crisis “forcing people to dip into their pension pots” to supplement other forms of income.

The regulator and the government have made it clear that they intend to improve the UK pensions system.

The FCA published its thematic review of retirement income in March 2024.

It suggested that while there are no systemic issues in retirement income advice practices, there are pockets where they could be improved.

This includes approaches to determining income withdrawal and gathering information to demonstrate advice suitability.

The new Labour government yesterday (25 September) closed its call for evidence on the first phase of its landmark pensions investment review.

The review will aim to boost investment, increase pension pots and tackle waste in the pension system.

Greer said: “This review is expected to prioritise clearer guidance and support, helping individuals make informed decisions and avoid detrimental financial mistakes.”

The FCA should mandate (or make representations to whichever body makes such laws) that Income DrawDown inxs of a very modest percentage of the value of the fund may not be embarked upon without regulated advice. Perhaps it’ll get round to it in about a decade, after years years of meetings, consultations, reports and further meetings, by which time thousands of people who’ve chosen to abjure professional advice will have made unwise decisions and done irreparable damage to their retirement income.

Why do you assume that everyone that manages their own drawdown needs advice? Some people know exactly what they are doing and don’t need to pay some self-interested adviser a big fat fee to tell them what to do.

Agree with Julian about some sort of percentage over which advice should be sought, but there is at the same time a dearth of advice outside ‘buy an annuity’ when it comes to decumulation generally.

No one should be surprised at this. One look at the size of the fees charged explains the reasons perfectly. You will of course notice that most of this applies to drawdown and encashments, annuities seem to be in a somewhat different category.

As to Julian’s assertions – a prime example of the adviser self-interest that drawdown instils. As I never tire of pointing out drawdown is beloved by HMRC, fund managers, platforms and advisers all taking their pound of flesh for the longest time possible.

Well said Harry. There are millions of people out there with smallish pots, the size of which would not justify the level of fees (or, indeed the time taken for the Regulator’s required work to be done).

Perhaps the FCA could do something sensible and review the requirements for this situation.

Well said!

Clients of mine have accessed their pensions directly. If clients go through their advisor, the advisor has to follow the full regulatory advice process to confirm suitability which can be long-winded. Not all clients want to do that or pay for it!?

What we need is for HMRC to make clear, if you have taken all your money out of a “Pension”, from that date on, going forward your not entitled to any further State Benifits, like pension Cridit, I have seen several claimimg Pension Cridit who have done so. As cetrain people in the public today, state “Its in the Rules” Then we will see who knew what they were doing without advice.