Good morning and welcome to your Morning Briefing for Tuesday 7 November 2023. To get this in your inbox every morning click here.

Advice does not lead to more confidence

Receiving financial advice does not necessarily lead to more confidence in people who are approaching or in retirement, a new report from Nucleus has revealed.

The company’s technical services director Andrew Tully said it shows “we should all perhaps be looking at the advice gap from a different angle”.

Getting away with poor service

Fiona Tait asks: “How is it fair that just the possibility of oversights costs advice firms a fortune in compensation, and every expression of dissatisfaction is treated as a full-blown complaint?”

She says there are two reasons for this. “First, the impact of our mistakes can last for years. The airport queue was frustrating but mostly forgotten once we had reached our lovely gite, and a lack of clean underpants can be dealt with by a trip to the nearest superstore.”

Quote Of The Day

Despite recent property data indicating a small correction in UK house pricing is underway the sector continues to demonstrate its resilience and popularity in the face of high inflation and higher borrowing rates.

– Tom Brown, managing director of real estate at Ingenious, comments on the unexpected rise in Halifax house price index data

Stat Attack

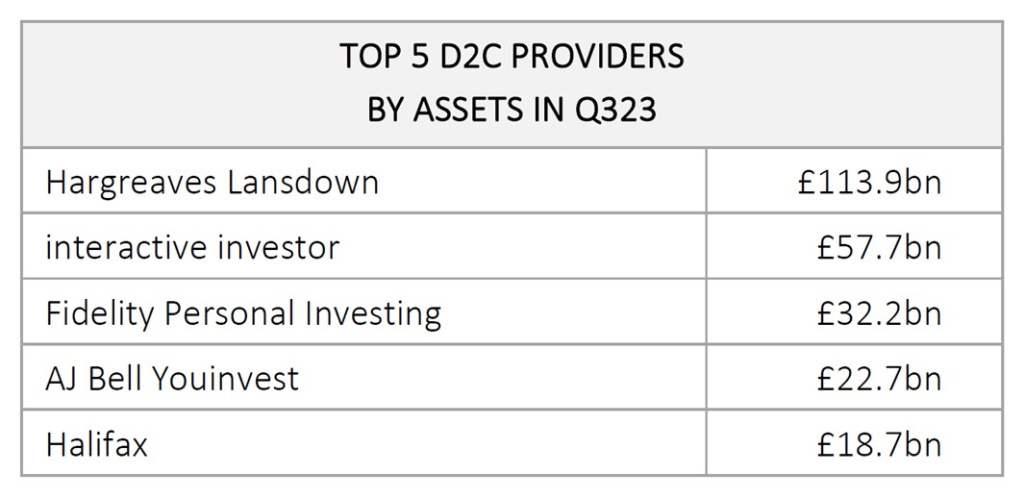

Research by Fundscape found that Hargreaves and Interactive Investor (now part of Abrdn) remain the largest platforms by assets. Meanwhile, the fastest growing platforms in the UK are Interactive Investor and Moneyfarm. The acquisition of Profile Pensions boosted Moneyfarm’s assets while Interactive Investor’s multi-media advertising campaign continues to turn heads and attract investors.

Source: Fundscape

In Other News

Goldman Sachs Asset Management has promoted 53 investment professionals to Managing Director.

The promotions are split across public and private markets investors, representing the breadth and depth of talent in the firm’s investment platform.

The promotions include individuals located in New York, Dallas, London, The Hague, Mumbai, Hong Kong, Tokyo and Sydney.

Goldman Sachs Asset Management has around 1,000 investment professionals globally.

With offices in all major financial centres, its teams draw on the broader resources of Goldman Sachs to deliver investment performance on behalf of clients.

Marc Nachmann, global head of asset and wealth management at Goldman Sachs, said: “The group represents the breadth and depth of talent across our global investment platform.

“We are proud to celebrate this milestone in their careers as they continue to focus on delivering outstanding investment performance on behalf of our clients.”

Fundhouse has hired business development manager Georgia-Rae Fry.

She has spent seven years in the industry, of which six have been dedicated to supporting financial advisers with everything from investment solutions to platform services.

She also co-founded the 150+ strong NXGEN Investment Club for young investment professionals.

Fry will be hired as business development manager at Fundhouse, a role created for her.

She will be responsible for the growth of the model portfolio business and starts on 1 November 2023.

She previously worked at Redwheel and 7IM.

From Elsewhere

US interest rates add to ‘silent debt crisis’ in developing countries (Financial Times)

Metro Bank says deposit outflows return to ‘more normal ranges’ (Reuters)

House prices rise for first time in six months, says Halifax (BBC News)

Did You See?

Controversial tech entrepreneur Elon Musk predicted that one day artificial intelligence (AI) will “replace all jobs” when he shared the stage with Prime Minister Rishi Sunak at Lancaster House last Thursday.

The billionaire owner of X (the site formerly known as Twitter) described AI as “the most destructive force in history” following the AI Safety Summit at Bletchley Park in Buckinghamshire.

News editor Dan Cooper asks advisers what they think.

Comments