Good morning and welcome to your Morning Briefing for Wednesday 6 December 2023. To get this in your inbox every morning click here.

HFMC buys London-based IFA

HFMC Wealth has acquired Harford Financial to bolster its London office and existing mortgage team.

The transaction, which is HFMC’s fourth purchase of 2023, completed on 30 November.

As part of the deal, all Harford Financial client-facing staff will be retained.

The story that won’t go away

December’s cover feature revisits the much-publicised row between the Chartered Insurance Institute (CII) and the Personal Finance Society (PFS) from last year.

This falling-out culminated in the so-called Christmas Coup, in which the CII announced a majority takeover of the PFS board following a failed mediation process.

Unleashing value in exploring protection services

Tune in to the fifth episode of our Pensions & Protection Podcast series in association with Royal London, presented by Kimberley Dondo and featuring guests Andy Walton, Protection Proposition Director at Mortgage Advice Bureau, and Tony Ormond, Strategic Partnerships Manager at Royal London.

Quote Of The Day

An independent review and inquiry would probably be the only trust mending action but [the CII] refuses to do it. And then we’re told to keep calm and carry on.

– Clémence Chatelin, integration manager at CCLA, comments on the CII/PFS debacle which appears to still be ongoing

Stat Attack

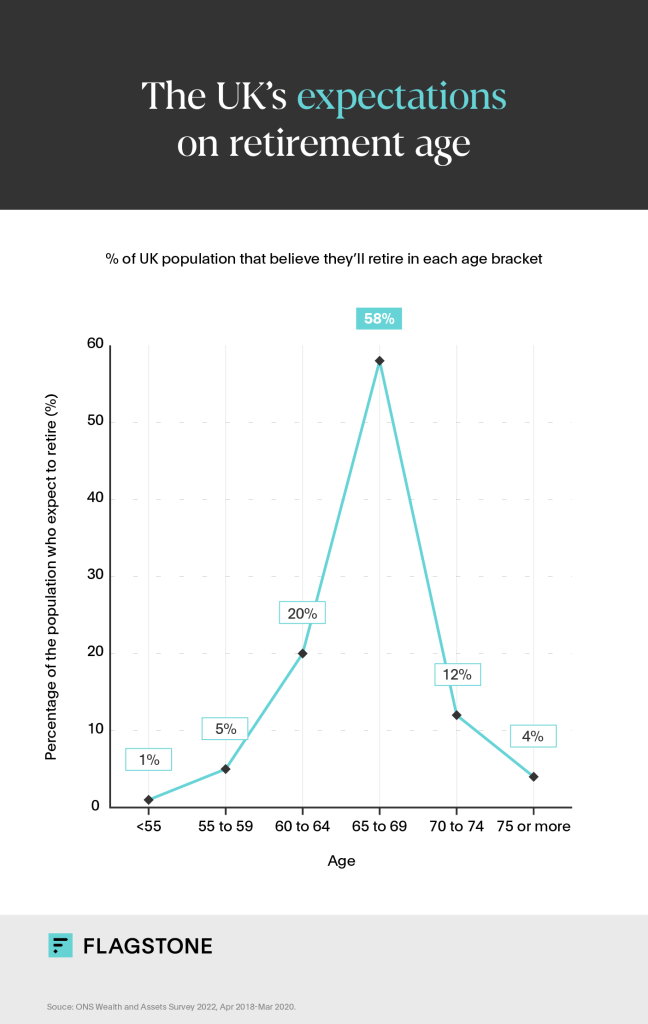

Cash deposit platform Flagstone has compiled a study into modern-day early retirement. It looked at what age people expect to retire.

Source: Flagstone

In Other News

Octopus Group has acquired a majority stake in Amicable, to help accelerate its growth and transform the way couples across the UK end relationships.

Amicable will work with sister brands Octopus Money and Guardian Angel to help customers navigate the financial, legal and administrative headaches that difficult life events can involve.

Amicable was founded in 2015 by Kate Daly and Pip Wilson, following Kate’s lengthy and expensive divorce.

Since then, it has grown into a trusted brand that helps couples avoid the emotional and financial turmoil of divorce through a kinder, more collaborative and tech-enabled process than the traditional lawyer-led model.

The acquisition will power Amicable’s growth, and enable more separating couples to build positive futures apart.

EPIC Investment Partners has announced that the EPIC MPS AIM IHT Portfolio is now available to the IFA market through EPIC’s model portfolio service (MPS).

The portfolio is constructed to harness the potential for long-term capital growth and mitigate inheritance tax by investing in a concentrated selection of 20-30 Business Relief qualifying companies.

Following their success in managing the portfolio for two and a half years, managers Malcolm Schembri and Tim Hall have decided to make it available to the IFA market via a number of investment platforms.

The team will conduct in-depth analysis to understand performance drivers and systematic risk within the portfolio, which will have substantial diversification.

The team maintains strict value disciplines to avoid speculation and premium pricing.

The Chartered Institute for Securities & Investment (CISI) has appointed Glenn Murphy as the new head of its wealth management forum committee.

He takes over from Hamish Warnock, who has chaired the committee since 2020.

The committee comprises a group of senior practitioners who discuss market activity and organise events to share insights about sector developments.

Murphy, a c-suite consultant to the wealth management community, has over 20 years of experience in wealth and investment management.

He was formerly chief operating officer at Stonehage Fleming and Multrees and has held leadership roles at Schroders and Rathbones. He is also a member of the CISI fintech forum committee.

Since joining the Institute in 2018, Murphy has actively hosted webinars and spoken at wealth management sessions.

He is keen to grow the professional forum membership to drive more robust engagement in the CISI through regular activities and thought leadership events.

From Elsewhere

Economists see Fed keeping rates at 22-year high until at least July (Financial Times)

UK investors pull money from property funds in November (Reuters)

UK landlords battered by higher rates are selling their rentals (Bloomberg)

Did You See?

Recent research by Royal London and the Lang Cat found that the majority of advisers feel the Consumer Duty has been a “worthwhile” exercise.

When advisers were asked if conducting Consumer Duty fair value assessments had been helpful, 68% described it as a useful exercise.

Of these 68%, 36% said it was somewhat useful, 23% said very useful and 9% said it was extremely useful.

In general, the report found that advisers felt Consumer Duty – which came into effect on 31 July this year – has been a “positive” change.

What do you think?

Comments