Good morning and welcome to your Morning Briefing for Monday 6 January 2025. To get this in your inbox every morning click here.

Divorces being deferred due to money worries, with small numbers consulting an adviser

Under a fifth (17%) of all divorces in the past five years were deferred due to money worries, with only 7% of people consulting a financial adviser as part of the process.

This is according to research from Legal & General (L&G) Retail, which also found that 41% of people felt that it was not an equal divorce financially.

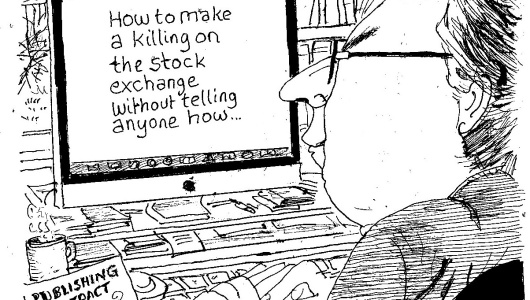

When was the last time you gave yourself a client review?

Why is it some doctors are unhealthy, despite their expertise in health, writes Universe Financial Advice director Taylor Beavis.

It’s a question I recently considered when visiting A&E with my son. I saw doctors eating meal deals on their breaks, drinking cans of fizzy drinks and smoking. It seems strange, doesn’t it? They are doing exactly the opposite of the advice they give us.

What about our profession? Do we always follow the advice we provide to clients?

Wren Sterling chair Darby stepped down at the end of 2024

Wren Sterling executive chairperson Ian Darby left the nationwide independent financial planner firm at the end of 2024.

Darby worked for Wren Sterling for just under a decade and led its buyout from the Towergate Group in 2015.

Wren Sterling said Darby had “helped steer the business to deliver strong performance and client outcomes”.

Quote Of The Day

Around a week into the New Year and already 7% of financial resolutions hang in tatters, after the optimism that carried us aloft into the New Year has been swiftly flattened by the relentless steamroller of reality

– Hargreaves Lansdown head of personal finance Sarah Coles on how short lived financial New Year resolutions can be

Stat Attack

Research from Oxford Risk highlights the disparities in pension income, savings and retirement strategies between men and women aged 55+.

36%

of women over 55 are unsure how much they might receive from their pension each year, compared to just 20% of men.

41%

of women are more likely to consider part-time work and property income (21%) to fund their retirement, compared to 30% and 18% respectively of men.

25%

of men are more likely to rely on self-invested personal pensions (compared to 16% of women) and investment portfolios (23% compared to 10%).

50%

of women and 53% of men rely on cash surpluses to fund their retirement.

Source: Oxford Risk

In Other News

SunLife has partnered with health support service RedArc, which allows access to free support to anyone who purchases a SunLife Guaranteed Over 50 Plan from 27 December 2024.

The service also covers policy holders’ partners and children living at the same address.

RedArc provides people with regular support from a registered nurse, to discuss health concerns, treatment and recovery. It describes itself as “providing the time that the medical profession is not always able to”, especially with the current pressures on the NHS.

RedArc revealed that across all individuals they support aged 50 and above, the most common health conditions supported are cancer (80% of those seeking support for cancer are aged over 50), mental health and orthopaedic issues.

Other reasons for requesting support include bereavement, cardiac and neurological issues, as well as stroke, Alzheimer’s and dementia. It is also common to receive requests for support from carers.

A RedArc nurse will be assigned to each individual, who will provide one-to-one support until the service user decides they no longer need the service.

From Elsewhere

China scrambles to shore up sliding yuan and stock markets (Reuters)

Seoul equities outperform despite political turmoil (Financial Times)

Canada’s PM Justin Trudeau ‘likely’ to announce resignation, reports say (Sky News)

Did You See?

Vitality has appointed Dr Arun Thiyagarajan as CEO of its health insurance business.

Thiyagarajan joins the insurer from Bupa, where he was the global healthcare transformation director.

He has also held other senior roles including general manager at Bupa Global and medical director at UK Health Clinics.

Prior to this, Thiyagarajan was a general practitioner and managing director at Hedena Health in Oxford.

Thiyagarajan succeeded Dr Keith Klintworth, who had been with the insurer for over 14 years. Klintworth will remain at Vitality in a consultant role.

Comments