The legacy definition of white labelling has created an increasingly polarised debate around adviser-as-platform versus white label models.

The legacy definition of white labelling has created an increasingly polarised debate around adviser-as-platform versus white label models.

A pure white label approach, strictly speaking, involves little more than branding and distributing an existing platform. This is as opposed to the adviser-as-platform model, which grants full control over the technology and customer journey.

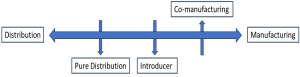

An entire spectrum now exists between full platform ownership and the traditional white label model, offering advice firms a range of options – with varying degrees of risk, responsibility, revenue and cost, as well as control over the client experience.

An overwhelming majority of advisers were as interested in white labelling (81%) as they were in launching their own platform (87%)

A recent Embark survey found an overwhelming majority of advisers were as interested in white labelling (81%) as they were in launching their own platform (87%), with nearly half of both groups harbouring some concerns over the pros and cons of each model (44% and 48% respectively).

The fact advice firms are looking for more control of the client experience is unequivocally a good thing. It demonstrates a commitment to providing a consistent client journey and good outcomes under the Consumer Duty.

Understanding exactly what a firm is looking to get out of platform ownership, however, is an important first step.

A totally bespoke platform carries not only higher risks that come with ownership but higher costs of delivery and increased complexity

The option to white label can fit anywhere between manufacturing and distribution, but firms must be clear on where they wish to sit and the impact that has on their obligations.

The white label spectrum

Consumer Duty accountabilities shift depending on the role taken, with greater cash being needed the closer you move towards the manufacturing end to cover regulatory changes, risk management and change management.

The more responsibility a firm takes on and the closer the move towards manufacturing, the greater the potential revenue in the form of full platform fees. But the attendant costs and funding needs also grow higher as firms move to the right.

A totally bespoke platform carries not only higher risks that come with ownership but higher costs of delivery and increased complexity. We know platform profit margins are skinny, under constant pressure and platforms require continual levels of investment.

These stages along the spectrum occupy an attractive middle ground for many firms

With the wide range of bespoke solutions now available, white labelling can be a smart option for many advice firms, as it gives them greater control over the client experience and access to robust technology and propositions at a fraction of the time, cost and risk that would be incurred were they to develop their own platform from the ground up.

A white label solution may start with the provision of the core technology, then evolve to include the hosting of platform products and services, and then progress even further to a full ‘white label-plus’ package that includes greater levels of support and management. These stages along the spectrum occupy an attractive middle ground for many firms.

The perils of full platform ownership

Full platform ownership may still be the right choice for some, however, the associated risks cannot be overstated. There are some potentially serious cost considerations beyond the basics that advice firms may not have fully considered.

If something goes wrong, you need to ensure you have the appropriate oversight and controls in place to quickly identify and resolve issues

Take administration errors, for example, for which they are now liable. If a client instructs a trade and it fails to happen on time, yet the markets move and the client loses out, then, under best execution rules, the platform needs to make good that shortfall.

There are other complex issues to consider. A platform is invariably a connected system of underlying solutions, so if something goes wrong, you need to ensure you have the appropriate oversight and controls in place to quickly identify and resolve issues. If technology issues result in losses, can you seek the appropriate redress from your system providers?

There are a variety of white label models available to support firms’ growth ambitions, while not burdening them with the risks of full ownership. However much control a firm wishes to take, it is likely a more efficient and cost-effective decision for them to find a place on the white label spectrum and not fall into the trap of believing platform ownership is an all-or-nothing choice.

Ranila Ravi-Burslem is intermediary distribution director at Scottish Widows and Embark Group

Gotta love out of context statistics.

A recent Embark survey found an overwhelming majority of advisers were as interested in white labelling (81%) as they were in launching their own platform (87%)