I’ve been reflecting about the big issues discussed at the recent NextWealth Live event (19 March) and the promise of AI was top of the list.

In our Future of Financial Advice Report (published February 2024) we predicted that in 2028, AI in all its guises will be a given for 100% of clients, not as an optional curiosity.

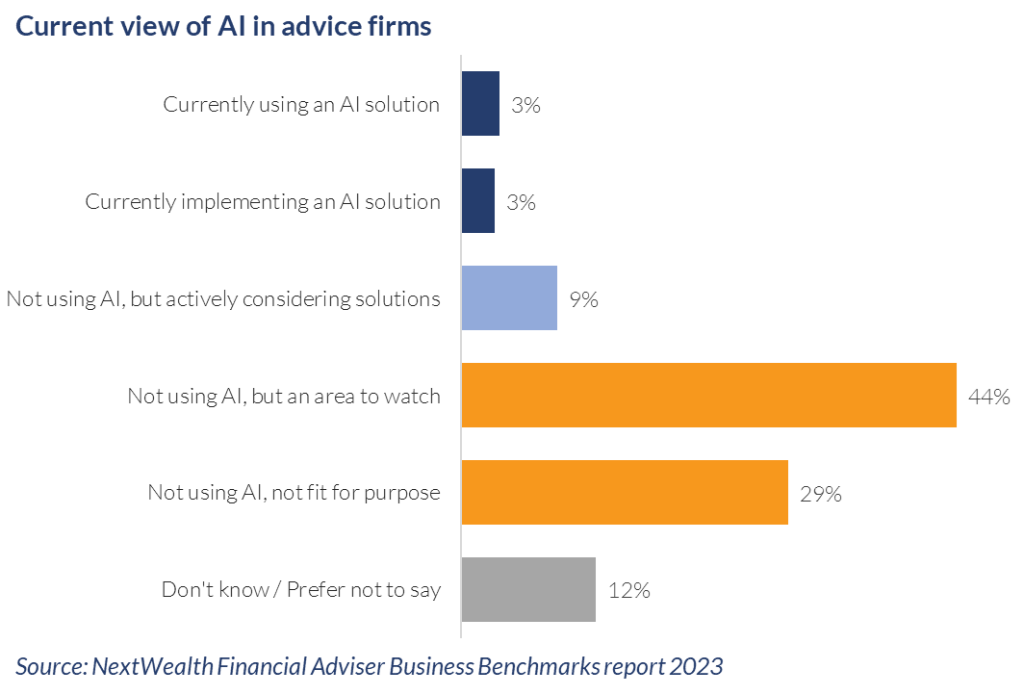

In other research, we reported that most financial advice professionals are open to using AI or are already using it.

Only a third (29%) dismiss it as ‘not fit for purpose’ – something that is likely to change as AI improves, which it certainly will…and fast.

At the conference, John O’Driscoll from SJP spoke about how they are successfully using AI in the business, saving over 3,000 hours since they implemented Adviser Assistant into their business.

This is just one example of how using clever tech can make a significant positive impact.

In an industry where the old adage ‘time is money’ is never truer, saving time means firms can focus on doing more – growing the business and delivering better outcomes for customers.

We reported that most financial advice professionals are open to using AI or are already using it.

Something else that came up multiple times during the conference was the ageing profile of the financial advice profession.

The average age quoted was 55 and, with no army of new recruits angling to take over the reins, it’s sobering to think that having a financial adviser could soon become even more of a luxury than it’s currently perceived to be.

Unless things change.

Clearly, recruiting and training an army of young advisers is an issue in itself. If it was easy, we wouldn’t be where we are today.

The answer lies in utilising technology that works alongside people but that can do the grunt work to free up advisers to focus on the things their clients value most.

Used correctly, AI could reduce the cost to serve clients and, ultimately, costs for clients, widening access to advice without the need to train and recruit that army of financial advisers.

Most people have tried ChatGPT. Firms are using it to draft letters, summarise meeting notes, cut down on jargon in client communication, etc.

The danger with embracing a tool such as this is assuming that the bot gets it right. These tools are great when 90% accuracy is okay.

Accuracy will get better but even at 90%, there are plenty of applications.

AI has the potential to allow us to personalise the client experience to a far greater extent. Of course, a meeting with a financial adviser is highly personal.

But the disclosure documents aren’t. The statements sent by platforms aren’t. The investment solution isn’t.

Making it personal was something that our guest speaker, Paddy Earnshaw from B&Q, honed in on.

He said 48% of consumers spend more time if their experience is personalised and 74% of consumers get frustrated when content has nothing to do with them.

So, installing a chatbot that isn’t equipped to personalise responses to individual client needs, or sending an unfiltered letter written by ChatGPT, is more likely to turn off business, not build it.

So, what’s the answer? I believe it’s about getting rid of barriers and working together to share and learn together how best to bring AI into financial advice.

We need to come together to find the best use of this new technology

This is why we’re establishing a membership group called NextWealth AI Lab. Through a mix of live events and content, we’ll help firms stay abreast of the latest applications of this new technology.

Members will share live use cases, learn from early adopters, overcome challenges and connect to find the best solutions for sharing.

We will also track adoption and readiness to adopt AI in financial advice businesses and the tech firms that support those businesses through an AI Index.

The Index will be updated regularly and made available to help firms benchmark their own adoption of and readiness to adopt AI.

We are holding a launch event in May, hosted by Aviva. You can find out more here.

The need to reach more customers has never been more urgent and to adapt, innovate and thrive as an industry we need to come together to find the best use of this new technology.

We can’t grow simply by hiring more financial advisers. We need to find new ways of doing business. AI holds that promise.

Heather Hopkins is managing director at NextWealth

The problem with AI is the experience that many have had with so called Chat Bots. To say that they are not only useless but hugely irritating is somewhat of an understatement. This has soured many peoples view of this type of technology. For it to be embraced it needs to show that can actually answer questions as well as an (Onshore) human operator and lead to a satisfactory desired outcome.