I waste far too much time scrolling through videos on TikTok. Some are informative or educational, but the vast majority are about as intellectually stimulating as watching an episode of Love Island. However, occasionally I stumble upon one that gets my hackles up and triggers a sense of outrage.

There are some utter charlatans on social media when it comes to investing and finance topics. Content ranges from the mildly dangerous to the outright scam, with the fraudsters directing their unsuspecting viewer towards a brokerage account under their control or a Ponzi scheme.

It is difficult to combat this sort of thing. The international and largely unregulated nature of social media makes it virtually impossible for regulators to monitor and shut down dangerous content. The platforms themselves give it a good go but seem more concerned with other rule breaches.

Disappointing misinformation

So, I have become used to seeing utter nonsense about money matters on social media. It’s par for the course. But it was disappointing to see a respected journalist last month add misinformation to already inadequate levels of financial education.

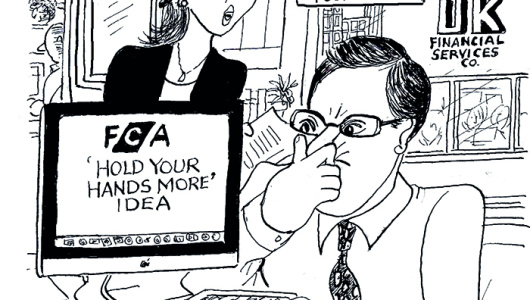

Leader – FCA fighting losing battle to warn young of investment risk

Sunday Times chief money reporter Ali Hussain is no stranger to controversy regarding his views about financial advice. But he perhaps took this anti-adviser bias a step too far with his tweets railing against the commission paid on life insurance, and then suggesting people would be better off investing their premiums, effectively self-insuring.

Without regurgitating too much of what happened at the heart of this Twitterstorm, the tweets followed the publication of a story about a retired financial adviser who was unhappy with the performance of his Phoenix whole-of-life assurance policy. Within a matter of hours, on a Sunday, many advisers leapt to the defence of protection policies and pointed out the problems with the article and subsequent tweets.

There are some utter charlatans on social media when it comes to investing and finance topics

What should we do as a profession when fundamentally essential products, such as life insurance, are misrepresented in the national press and by respected journalists no less?

It would be wrong to assume that stories or social media posts like these have no impact on people’s decisions about their money. We know from the latest Financial Conduct Authority Financial Lives survey that only around one in 10 adults met with a regulated adviser in the past year. On that basis, most of the population go it alone, relying on what they read in the papers or on the internet, or seeking advice from friends and family.

When that ‘advice’ turns out to be misguided or just plain wrong, there is no recourse to complain or obtain compensation. The money is gone.

The dangers of things going wrong when unqualified, unregulated individuals purport knowledge or an opinion about financial planning make it more important to push back as a profession.

We need to call out the misinformation. We should educate the wider population, beyond that somewhat exclusive subset we call our clients, about making better decisions with their money.

Moral obligation

Arguably, it’s not our problem if people choose to base their decisions on some nonsense they read on Twitter or watch on TikTok. Leave them to it. Let them get scammed or otherwise ripped off, or take steps that will financially ruin their families. After all, we run businesses and not charities. It should be the role of the government to improve levels of financial education.

But I would suggest we have a moral obligation to combat the fud we hear on social media, in the weekend papers or down the pub. Ultimately, it reflects poorly on our profession when things go wrong, even when professional advisers play no role in the process. And leaving an entire generation of investors to learn from their mistakes is incredibly unlikely to foster future clients.

Martin Bamford: It’s time advisers migrated off Twitter

We may not have the circulation of the Sunday Times, but that challenge is rapidly resolving. Anyone can be a publisher these days, using the same social media platforms that disseminate misinformation to share accurate, helpful content.

If, each time you saw a piece of nonsense online, you responded by creating something that would help people to make better financial decisions, in time the good would overwhelm the bad.

Let’s use the same social media platforms that disseminate misinformation to share accurate, helpful content

Relying on the regulator to start making scam-warning TikTok videos, or on journalists to pass financial planning exams before writing about complex money issues, will not produce results in the immediate future.

What can happen is for you to write a blog, film a video or post financial wisdom on social media.

Martin Bamford is chief executive at Bamford Media

This article featured in the August 2021 edition of MM.

If you would like to subscribe to the new monthly edition, please click here.

I agree strongly with Martin’s assertion to: ‘educate the wider population’, and feel financial literacy should be taught more assertively as a life skill starting in primary school.

There are a number of organisations pushing for this including the All Party Parliamentary Group (APPG) on Financial Education for Young People.

It is supposedly on the Curriculum, but with 4 in ten children saying they’ve received nothing, there seems a gentle tide continuing to push against this.

Well said, Martin. I was equally disappointed by the piece by Miles Brignall in last Saturday’s Guardian, regarding a very sad case of a man who unfortunately took his own life 8 days before the expiration of the standard 12-month ‘suicide clause’ under a term policy with AEGON. Whilst AEGON were allowed to explain, the fact of the matter is, the terms of the contract were upheld (I don’t think the 12 month exclusion for suicide is anything other than entirely reasonable and have had personal experience of the devastation such a sad event can cause), which I think fair enough.

I have always found AEGON very fair with their life assurance proposition and have had two substantial claims expertly handled in the last decade, the most recent a CI claim that was promptly paid even though the pandemic had just hit last year, which was impressive.

People have to remember that life assurance policies, like annuities, are contracts and, assuming that the proposer can get underwritten (don’t get me started on the problems with GPR’s and surgeries demanding multiples of the BMA agreed rates prior to completing the darned things), they are exchanging premiums for a certain, guaranteed, payout should disaster strike.

There is good reason that the FCA allowed commission to continue post-2012 in that most people who really need personal insurances are less likely to be in a position to pay fees.

Whilst it remains unregulated, social media will continue to be the “go to” platform of choice for organised criminals, racists, sexists, extremists and any other “ist” you care to think of.

According to Nick Gibb MP, Financial Literacy was made a statutory part of the National Curriculum for the first time in 2014. Also according to Nick Gibb MP:

“Schools are also free to include the teaching of financial education in their personal, social, health and economic (PSHE) provision if they wish, drawing on the PSHE Association’s non-statutory programme of study.”

So, as I see it, the problem becomes magnified by virtue of the fact that social media users have little or no financial education and the social media platforms are free to promote anything without fear of penalty.

How many times have we heard an executive from Facebook, Instagram or Twitter dole out the same old line: “We strongly condemn the (insert offending action) and will act swiftly and decisively in removing any content which…..blah, blah?

Nothing will change until we see significant penalties imposed on platforms which continually demonstrate their indifference to allowing criminals to defraud their subscribers.

These are huge global corporations which will only change if their business models stop being financially viable.

The Dunning Kruger effect springs to mind. We have flip flopped from not needing experts to demanding experts in the pandemic. TCF was an wide awakening for our profession and rightly so. Naturally Lord Taylor did not understand the unintended consequences of the the FCA actions. The CII /PFS pushes on with help for vulnerable people and education of the young, sadly the Covid restrictions have reduced our activities. We can only help those who wanting be helped and remember the man down the pub who shouts loudest tends to get listened too.