When I was in Year Eight at school, my English class was full of (for want of a better word) hallions. I loved English and genuinely wanted to learn stuff — I got called ‘boffin’ for it — but some of my classmates made it almost impossible to do so.

Three boys, in particular, used to run around the classroom during lessons, breaking off chair legs and using them as crowbars to smash things up. They were completely out of control. I felt sorry for our English teacher. She was a small, shy lady and, try as she might, she had absolutely no chance of regaining that control.

One day the head of our year, who was the opposite of our English teacher — a scary, tall man with a booming voice and a short temper — intervened. He came into the classroom mid-lesson; the hallions stopped in their tracks, crowbars in mid-air, and looked the closest I had seen them come to being scared.

An AR is exempt from the regulatory regime — the burden of compliance falls upon the AR’s principal

I was relieved. Finally, these boys would be removed from our class and we could go back to analysing the nuances of To Kill a Mockingbird in peace. I was wrong, though, because what actually happened was the entire class was put into detention for a week.

I was far too timid to argue against the head of year’s decision, but in my head I was livid. Why should the majority be punished for the sins of the minority?

I imagine this is what advice firms feel when they have to pay the Financial Services Compensation Scheme (FSCS) levy to foot the bill for a few rogue firms that have acted badly.

Editor’s View: Networks can’t claim the dog ate their AR homework

The British Steel Pension Scheme (BSPS) saga is one example of a scandal that damaged the reputation of the entire profession. The majority — decent advisers — and the minority — dodgy advisers — were tarred with the same brush.

In June 2017, trade unions wrote to their members about the risks of transferring out of the BSPS, highlighting the issue of some financial advisers having “questionable motives”, and stressing caution before taking a decision to transfer out.

Where harm occurs, it is often because principals do not undertake adequate due diligence

As the story had unfolded over the preceding years, advice firms that had offered clients questionable advice about transferring out of the BSPS began to go out of business. More than five years on, many badly advised clients are yet to receive compensation.

To be fair, the regulator has said it is working to reach final decisions on appropriate sanctions where it has found misconduct.

Unhappy advisers

Advisers often bemoan the fact the FSCS levy is so high. And with good reason. Like some of us in my English class, they feel it is unfair they should pay for the discrepancies of others. The FSCS indicated late last year the levy for 2023/24 would be £478m — a figure based on expected compensation payments totalling £592m.

The Financial Conduct Authority estimates that principals and appointed representatives (ARs) make up more than 60% of the total value of recent claims to the FSCS. They also generate up to 400% more supervisory cases and complaints than other directly authorised (DA) firms.

We’re very careful about who we bring on board. We have this trust with our advisers

In December 2021, the regulator put out a consultation paper — CP21/34 — proposing changes to its AR regime to “reduce potential harm to consumers and markets”.

The AR regime is set in primary legislation and allows self-employed representatives to engage in regulated activities without having to be authorised.

“While the regime has benefits, we have seen a wide range of harm across all the sectors where firms have ARs,” the FCA wrote in its consultation paper.

“Where harm occurs, it is often because principals do not undertake adequate due diligence before appointing an AR, and from poor ongoing control and oversight. We consider there is now significant evidence of harm requiring regulatory intervention.”

Final rules

In August last year, after receiving responses to the consultation, the FCA published its final rules for principals of ARs, in a policy document called PS22/11.

It is possible, in the coming months, many ARs will leave or be forced to leave the market

The rules apply to all firms that currently have ARs or intend to have ARs in future. They also affect ARs themselves. The FCA estimates there are presently around 3,400 principals with around 37,000 ARs across advice, trading, banking and financial exchanges. This number also includes introducer ARs (IARs).

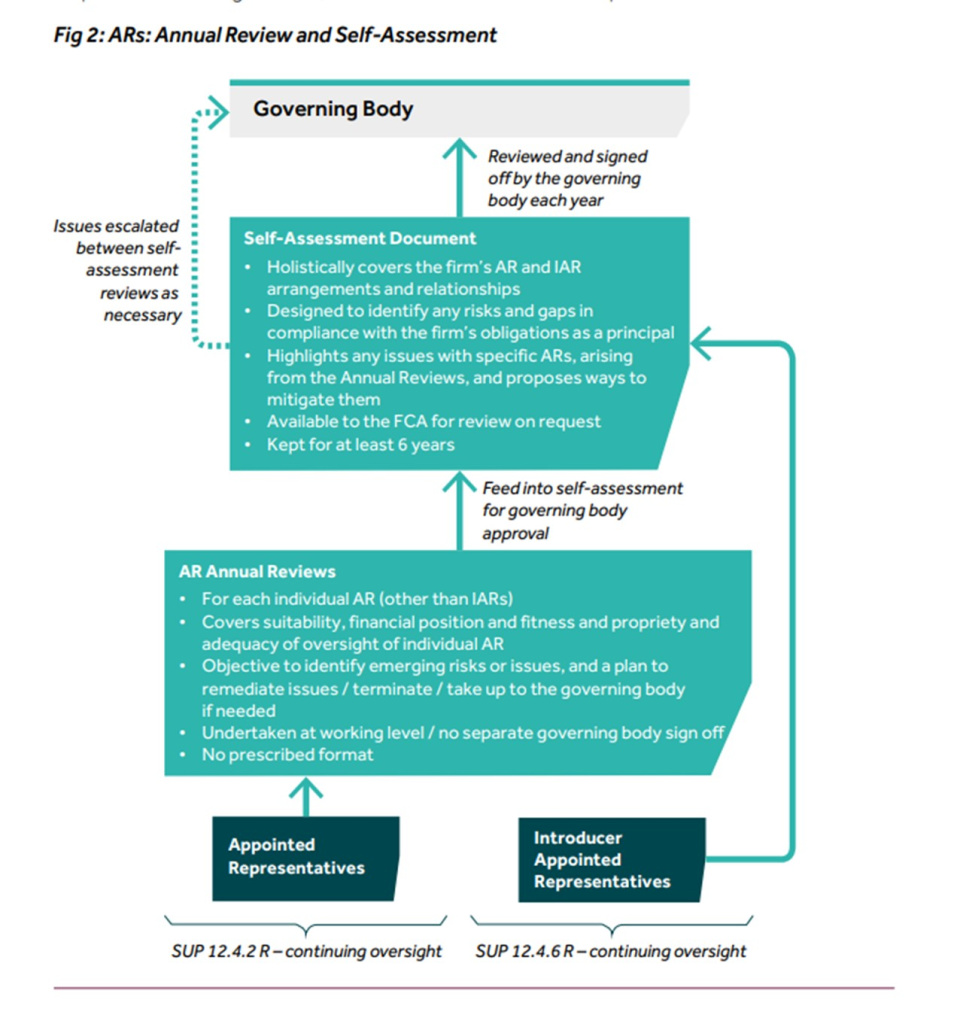

Under the new rules, principal firms will have to keep a closer eye on ARs. This includes ensuring they have adequate systems, controls and resources. Firms will also need to assess and monitor the risk their ARs pose to consumers, providing oversight similar to that used for their own business.

Plus, networks will need to review information on their ARs’ activities, business and senior management annually, and be clear on the circumstances when they should terminate an AR relationship.

While the changes may appear to have had the desired effect, the impact on the wider AR model seems to be negative

They must notify the FCA of a future AR appointment 30 calendar days before it takes effect. The regulator originally suggested 60 days but reduced this to 30 following feedback to its consultation.

Finally, networks must supply complaints and revenue information for each AR to the FCA on an annual basis.

The new rules came into force in December 2022 and the first reviews are due to be submitted in December this year.

The regulator is also working with the Treasury to explore if further amendments to the AR regime are needed, which would require future legislative change.

A spokesperson for the FCA says ongoing reporting by principal firms on their ARs will provide the regulator with better information to “assertively supervise and target” its interventions on highest-risk principal firms.

It is unclear whether the FCA’s assessment that not more than 10% of ARs will leave the market is correct

“Firms should be clear on the type and format of the information they are required to provide, and should be continually assessing their processes and systems to satisfy themselves they can collect and report the data on their appointed representatives in line with our requirements,” the spokesperson adds.

Inevitable changes

Changes to the regime were inevitable. Excello Law partner Brendan O’Brien says the need for change was “obvious”, with AR firms generating a “disproportionate number” of supervisory cases and complaints. This was due, in part, to compliance failures in the appointment, and ongoing management, of ARs.

“Many AR networks and regulated businesses running an AR model do so in a properly balanced medium,” says O’Brien. “For them, the changes are seen as an increase in the amount of reporting they must produce, but which they are able to do from existing data used in their auditing processes.”

The FCA has rightly tightened up significantly on the use of the AR regime, which was open to significant abuse

So, what prompted the regulator to act?

Bellevue Law solicitor and regulation expert Chris Croft points out the review of the AR regime was triggered, in part, by the collapse of Greensill Capital, a financial services company based in the UK and Australia. Its primary role had been to provide “supply chain financing and related services”.

It filed for insolvency protection on 8 March 2021 after a multitude of issues I won’t go into here.

“Under financial services legislation, an AR is exempt from the regulatory regime — the burden of compliance falls upon the AR’s principal,” says Croft.

“That enabled companies like Greensill to avoid the capital and other regulatory burdens that would have been imposed if they had been a bank.”

There’s a lot more focus on evidencing what we’ve done. And we’re pre-empting questions we know are now coming from the FCA

Research suggested complaints against firms that used ARs were “very significantly higher” than for firms that operated only in their own right, adds Croft, which was also a factor in the FCA’s decision to review its regime.

The new rules are designed to help ensure principals “manage their ARs better”; and to avoid scandals such as Greensill from happening in the future.

Supportive networks

Many advice networks have welcomed the changes. Benchmark Capital has a network that looks after around 119 ARs. It is listed as Best Practice IFA Group on the Financial Services Register (FS Register).

The firm’s managing director for wealth, Ed Dymott, who will step up to chief executive early next year, says the network has not had to change much in light of the new rules.

Some of it is about asking: ‘How do you know this adviser or director has not been involved in any unsuitable advice in the past?’

“What was pleasing, when we saw what we were being asked to do, was that it met most of the things we’re already doing today. Generally, it hasn’t caused much of a concern,” he says.

“Our interpretation of what the AR regime was trying to do was to make sure businesses were not using that structure to not provide the appropriate compliance oversight, or using that as a lighter-touch way of firms almost avoiding some of the regulatory scrutiny they would normally get.

“That’s never been how we’ve operated. We absolutely ensure we maintain the highest standards and supervisory practices across all the firms we regulate. They’re fair and balanced, but they are robust as well.

“We’ve always had a very close working relationship with all the firms we regulate, and therefore a lot of the things the AR regime was trying to achieve we were already doing.”

Dymott suggests some businesses may have found it challenging to keep on top of the breadth and scope of all the activities their advice firms carry out.

Our role as a network is to ensure new regulation is not burdensome for firms

“The totality of anything the advice business is doing — whether it’s regulated or unregulated — if it’s under the oversight of the principal firm, that has been one of the areas all businesses have had to be satisfied with.

“One of the things we’ve had to recheck is that anything an advice business is doing under our regulatory permissions, we are comfortable it is competent and qualified, and it’s got the right controls in place.”

Quilter’s network is responsible for 674 ARs, according to the FS Register. Quilter Financial Planning managing director Stephen Fryett says the firm has been supportive of the FCA’s aim to strengthen the AR regime.

“We fundamentally believe networks play an important role in the advice sector to oversee quality of process and, where necessary, step in when things go wrong,” he says. “As is always the case when there is regulatory change, we work with our ARs to implement and embed any required changes to ensure compliance with the regulation.

“Our role as a network is to ensure new regulation is not burdensome for firms, so we provide support in areas like the requirement for an annual audit, removing the heavy lifting to ensure the effectiveness and robustness of an AR’s internal systems, controls, procedures and reporting.”

What was pleasing, when we saw what we were being asked to do, was that it met most of the things we were already doing

Fryett adds the network was “pleased” the FCA responded — during the consultation last year — to recommendations to cut the AR notification time from 60 to 30 days.

“A 60-day application window would have been a considerable period during which the proposed AR may not be able to serve customers, which may prevent them from trading. The change to 30 days was good news and helped avoid disruption for businesses and customers alike.”

Unhappy networks

Other networks believe the rule changes place an undue burden on principal firms.

ValidPath is a network of about 98 ARs, according to the FS Register. Advice and compliance director Nicola Butterworth says it has had to bring in extra resources as a result of the changes.

She feels there is a “presumption of guilt” as soon as anybody wants to become an AR.

“The FCA is very suspicious of anybody who would want to be an AR because it immediately thinks the firm must have something to hide,” she says.

The need for change was obvious, with AR firms generating a disproportionate number of supervisory cases and complaints

“[The regulator is suspicious] of anybody who wants to move away from being DA, or to change network, in fact. It seems to question any kind of movement in the industry as: ‘Why do they want to do that? Why do they want to go to that principal? Do they think they can just hide in the background?’

“There’s this weird mentality we get just from questions [the FCA is] raising.”

Butterworth says a lot of the focus has been around onboarding.

“[The FCA has] changed the onboarding process. It’s very clear it is focusing maybe less on the advisers themselves and more on the AR business as a whole.

“[The regulator wants to know] who’s running it, how it is being managed, what controls are in place, and the whole background of directors and significant shareholders. We’ve increased our resources in our onboarding to cope with the increased due-diligence checks.”

We’ve had to recheck that, with anything an advice business is doing under our regulatory permissions, we are comfortable it is competent and qualified

She continues: “We’ve always been very careful about the sorts of firm that join ValidPath. But [in light of the new rules] there’s a lot more focus on evidencing what we’ve done. And we’re pre-empting questions we know are now coming from the FCA.

“Some of it, especially to do with defined benefit transfers, is about asking: ‘How do you know this adviser or director has not been involved in any unsuitable advice in the past?’

“Whereas we might have previously gone, ‘OK, well, they’ve grown quite nicely, we’ll keep an eye on them,’ we’ve now got to make sure we know what they’re doing and have all the evidence of that.”

To do this on an annual basis is a “huge burden” and a “huge drain on resources”, claims Butterworth. “It becomes very tickbox-y.”

“We’re very careful about who we bring on board,” she adds.

“We have this trust with our advisers because we’ve already checked they have the right attitude in terms of ethics and trying to do the right thing by the clients. They’re not trying to find shortcuts around the regulation.

We’ve always had a very close working relationship with all the firms we regulate

“We get to know them very well during the onboarding due-diligence process, and if we had any concerns we wouldn’t allow them into the network anyway.”

No change yet

While networks have been working away to implement the new rules, ARs themselves are yet to feel the effects.

Ian Richards, founder of Work to Live Financial Planning — which is part of ValidPath’s network — says he has been notified by the network about the changes that will be introduced over the next few weeks.

“We know we will need to provide annual information,” he says.

So far, though, the changes have not been felt by Work to Live.

Many AR networks and regulated businesses running an AR model do so in a properly balanced medium

The same goes for Finura, which is part of Benchmark Capital’s network. Compliance manager Emma Hunt says the firm is yet to see any change to processes following the regime.

The regulator is clearly serious about its rules. It announced in June it had put restrictions on 10 firms for failure to monitor ARs properly. It also wrote to more than 3,000 principals about their obligations to properly oversee the behaviour and conduct of their ARs.

“There is no question it has rightly tightened up significantly on the use of the AR regime, which was open to significant abuse,” says Croft. “Under the new regime, principals that fail to monitor their ARs properly will be held accountable by the regulator.”

Well-run networks and IFA groups already have compliance and supervisory controls in place, Croft continues, and it is unlikely the impact of the changes will be much greater than the “inevitably increased compliance burden” from adherence to the Consumer Duty principles.

Firms should be clear on the type and format of the information they are required to provide

The full impact of the changes introduced in December 2022 will not be known until at least a year has passed since the commencement of PS22/11, and the regulator has seen the first annual reports from principals. But some effects are being felt already.

O’Brien points out part of the FCA’s drive for change was an attempt to tackle the regulatory hosts’ ‘revenue versus risk management’ conflict of interest.

“The challenge has been to demonstrate there are systems and controls in place to manage risk in more diverse and particularly larger regulatory hosts, where the resources to manage the broad cross-section of business cannot exist,” he says.

“Anecdotally, this has had an impact on the ability to generate revenue at previous levels. It is unclear whether the FCA’s assessment that not more than 10% of ARs will leave the market is correct.”

The challenge in respect of the AR model was to attempt to de-risk the process for those businesses, without affecting what was a workable model in most cases.

“While the changes may appear to have had the desired effect, the impact on the wider AR model seems to be negative,” O’Brien adds.

While the regime has benefits, we have seen a wide range of harm across all the sectors where firms have ARs

“It is possible, in the coming months, many ARs will leave or be forced to leave the market, and the implications for access to services, competition and pricing are going to be felt by the consumer. This must run counter to the objectives of the changes made by the FCA.”

Sometime in the future we may reach a utopia in which no advice firm acts to the detriment of clients.

Until that day comes (if it comes), the regulator will, like an austere headteacher, continue to observe all ARs and principal firms with a vigilant eye.

And some may feel pushed out of the profession as a result.

What the FCA expects principal firms to report

• AR complaints and revenue: Firms must report this data once a year in the FCA’s RegData system using the REP025 form. This return will appear on a network’s RegData reporting schedule by the 1 December 2023 in line with their accounting reference date (ARD). The data must be submitted within 60 business days of the ARD.

• Firm details attestation: Networks must check, amend and confirm their details annually using the FCA’s Connect system. From December 2023, they will also be required to confirm details for their ARs and introducer ARs within 60 business days of their ARD.

• New ARs: Companies must tell the FCA if they recruit a new AR, at least 30 calendar days before the appointment starts. They must also tell the regulator if their AR’s activities change at least 10 days before these changes take effect.

This article featured in the September 2023 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

About time these rules were tightened. Those firms who recon they do this already, shouldn’t complain – they need to prove it. Being an AR up to now has almost been a ‘get out of jail free’ card as fines and sanctions generally fall on the network and more often than not the miscreant can continue as before. I wonder how SJP fares in this? Will they deny that their ‘partners’ are ARs?

An excellent overview!

LoL… I handed my IFA licence back in 2002… ARs were the biggest risk then…as now it would seem!

Many industries and the firms within them rely upon ARs to deliver quality service to customers, err, sorry, clients here, within strict and prescriptive rules and regulations, E.g. Food, pharma, blood…

In the end, the networks earn their money by ‘warehousing’ the ARs, thus, without any they are not worth very much. The diligence has to be with the service provider to allow maximum client time for the AR, this client time needs to be within the rules, to avoid fines and loss of reputation, through training, support, and routing out bad apples.

This was (is?) something the Banks & B. Soc. were incredibly bad at, perhaps the rapid growth of the fund manager led charge into advice will be better?

A quick note on Greensill – see LV’s excellent article above –

Chris C. is off beam here – Greensill had a perfectly good model – using the interbank method of netting off funds. The concept of exploiting the demand and treatment differences between different markets – Banks vs Insurance – is quite valid.

Greensill failed becaused they ignored the risk concentration ratios with both the business type they presented to insurers, and the concentration of risk to a single insurer too. I doubt they had a (competent) risk manager… otherwise, and surely, a Captive (self insurance) model would have meant access to much greater capacity and cheaper rates.

Ha! Analyse that any Psychiatrists available…? 🙂