Those of you who know me will be aware of my love of horror.

Ever since the Covid-19 pandemic struck, I have been fascinated by a subset of the genre called ‘virus horror’.

Analysing my psyche, this was probably an attempt to comfort myself with the fact that the pandemic could have been so much worse. In many ways, we were lucky.

For me, the best plots in these types of horror stories are the ones where a virus has been lurking somewhere, for example in the Arctic ice, for thousands of years. It is then released, wreaking havoc on the global population. Naturally, my favourite is when people are turned into mindless flesh-eating monsters.

The likes of Alphabet and Amazon will come in and challenge traditional financial advice. That is going to happen

This ‘looming threat’ element is the same reason I like more traditional horror films. A werewolf in the woods, picking people off one by one. A murderous alter ego hiding in someone’s mind. A demonic being possessing an old house.

The thought that everything is not as it seems can cause human beings to crumble. Or it can give us a chance to make sure we live the best life possible.

Something sinister

Within financial services, there is something sinister lurking in the shadows. It has been mostly dormant for decades, but every so often it rears its head and looks around. If and when it actually strikes, the impact is likely to be devastating for a sector unprepared.

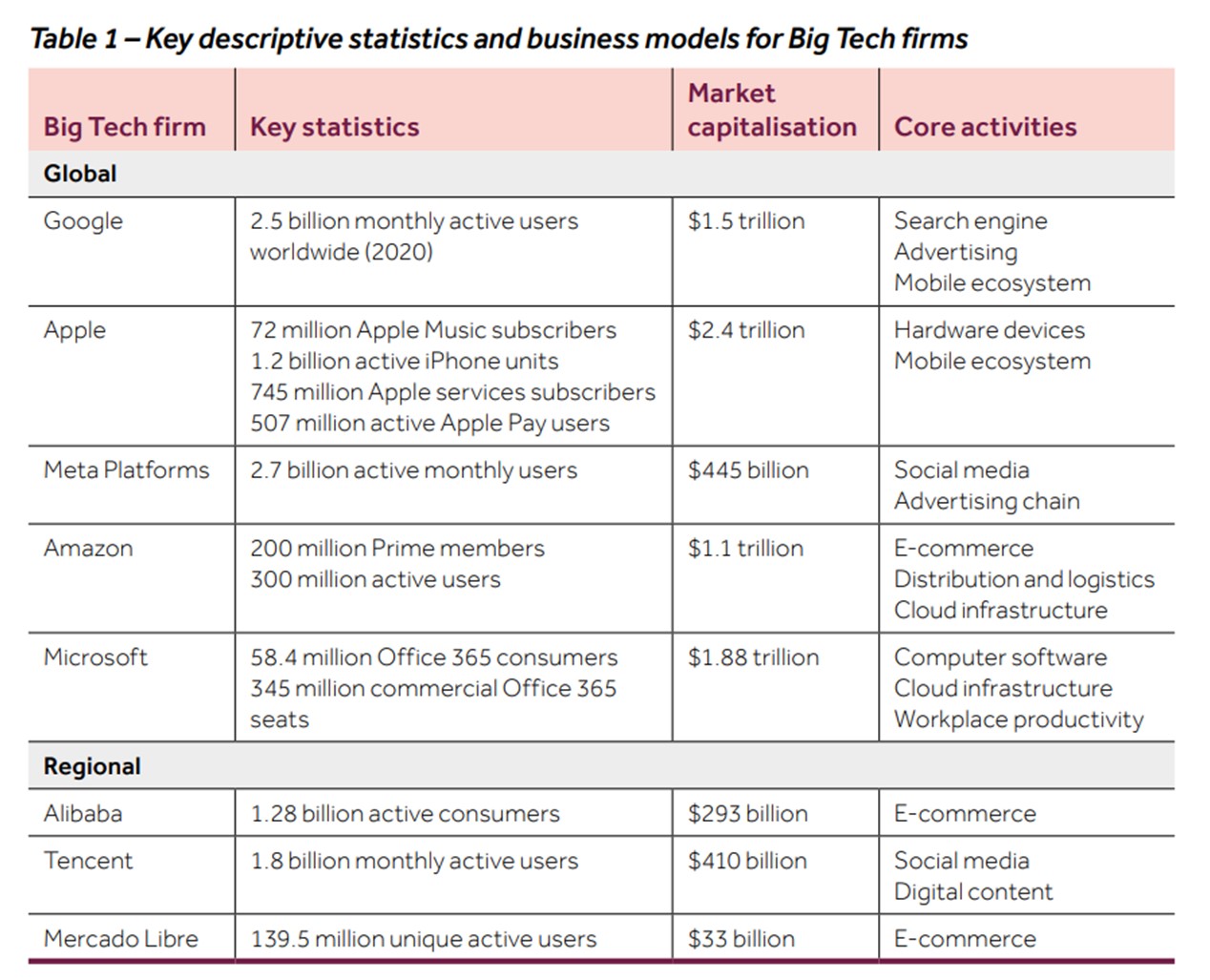

For once, I am not talking about climate change. This time, I refer to the Big Tech companies, commonly accepted as Apple, Facebook (Meta), Google (Alphabet) and Microsoft.

When I used to write for a grocery publication, I noticed that the big supermarket chains all feared Amazon. Would the online giant decide to enter their space?

Amazon Fresh opened its first till-less grocery store in the UK in March 2021. The idea is that customers scan their Amazon app as they walk in, do their shopping and walk out without having to interact with a cashier. This has been widely billed as ‘the future of grocery’.

Digitisation is an opportunity, not a threat. We should not resist the change, but adapt

Reports suggest Amazon does not generate much revenue from its physical stores. Its rapid expansion in this space has been possible because it has a seemingly endless supply of cash. Its net worth currently stands at a staggering $992bn (£801bn).

Some commentators question whether a Big Tech company like Amazon would bother with the UK’s financial services. After all, its market cap alone is nearly a third of UK GDP.

But the tech giant has already started to encroach on the sector. Towards the end of last year it announced it had launched a home insurance comparison service in Britain.

At that point, it had already signed up three large insurers to its portal: Ageas UK, Co-op and LV= General Insurance, part of Allianz.

This new offering brings it uncomfortably close to the life and savings market, and experts have warned it should be a ‘wake-up call’ to insurers.

Big Tech firms make it so easy to do business with them

This is not the first time Amazon has shown interest in financial services. It has had a limited insurance operation in the UK for several years. And it dipped its toe further in 2020 when it announced its intention to offer car and motorbike insurance in India.

In August 2021 it invested in Indian fintech start-up Smallcase, laying the foundations for an incursion into the wealth management space.

The business has also got Amazon Pay, it offers loans to SMEs, and it has a joint venture with JP Morgan around credit cards. A few years ago, there was also talk of a joint venture with JP Morgan Chase or Capital One to launch a checking account in the US, which would be huge.

Long history

There is a long history of tech firms eyeing up financial services.

“It’s a pretty tried-and-trodden route for many retailers, not just Big Tech,” says Dynamic Planner chief executive Ben Goss. “John Lewis and others have moved into savings, credit, loans or even mortgages.

“Those simpler products can be margin rich, which is why companies like Virgin ventured into that part of the market.”

Alphabet is probably a more important partner than someone like Abrdn for advisers in the long term

Other Big Techs, too, are starting to make inroads into the industry.

Google’s first foray into insurance was the launch of its own comparison website, Google Compare, in 2012, to compete with the four main price comparison websites in the UK. This was live for four years before Google closed it in 2016, stating that it “hadn’t driven the success we hoped for”.

Beyond this direct move into insurance, Google has since taken the path of investing in InsurTechs; notably, Applied Systems, Collective Health, Gusto, Lemonade and Oscar.

While Amazon and Google tinker at the edges and invest, Tesla (as per founder Elon Musk’s modus operandi) wants to be more groundbreaking by becoming a full-stack insurer to compete head on with motor insurers, offering a radically different product from traditional policies.

Robos have not taken off, and we all know why. It’s because of the lack of a human in that process

Apple is already in payments with Apple Pay, which is almost ubiquitous. It has a joint venture with Goldman Sachs to offer a credit card and now it’s launching a buy now, pay later service as well.

Just last month (April), Apple also announced the launch of a savings account for US customers, in partnership with Goldman Sachs. This offers a high-yield annual percentage yield of 4.15%, which, Apple says, is more than 10 times the US national average.

Abrdn head of digital solutions Paul Titterton says: “These Big Tech companies are already in financial services, but the models always seem to take a slice that requires the least regulation. They build a proposition, then they own that proposition.”

Regulatory interest

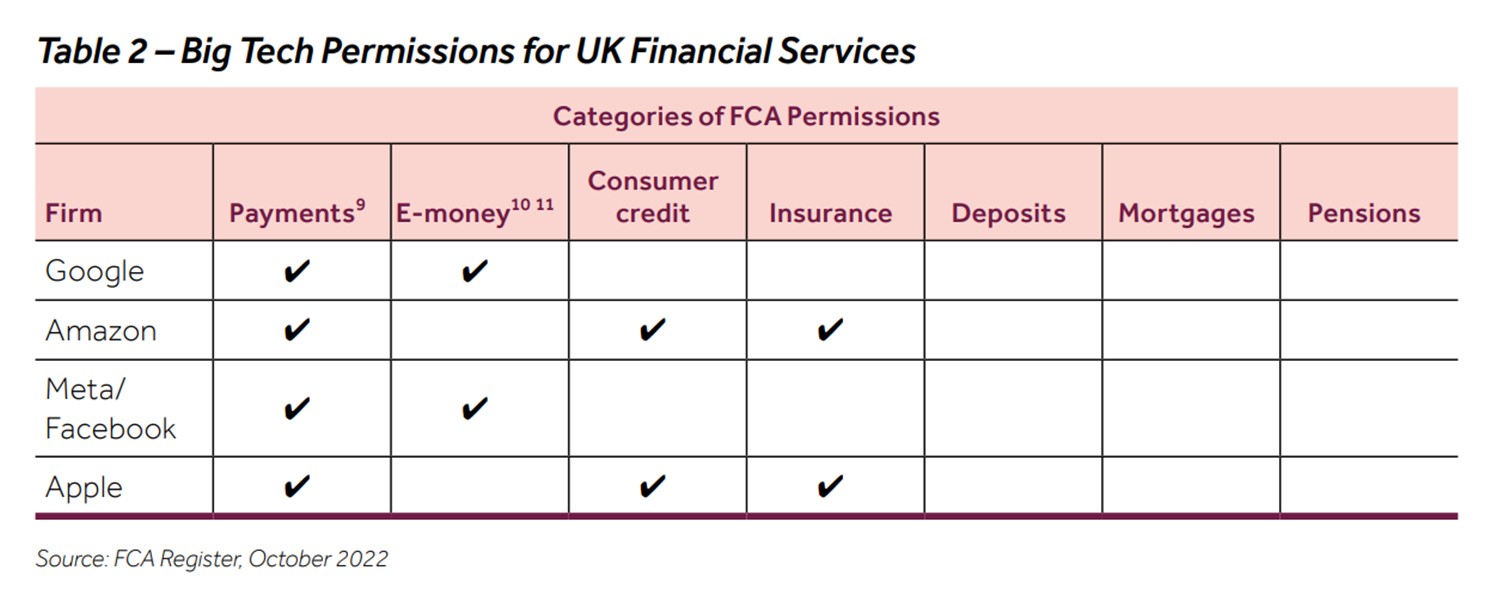

The potential for Big Tech to enter financial services in a big way is so great that the Financial Conduct Authority has started to look at it.

In financial advice and wealth management, we can learn about making it easier for our clients to do business with us

FCA chief data, information and intelligence officer Jessica Rusu says Big Tech’s entry into financial services, in the UK and elsewhere, has proved its “potential to disrupt established markets, drive innovation and cut costs for consumers”.

She adds: “Across the globe, we have seen the capability of Big Tech to offer new products in areas such as payments, insurance, deposits and consumer credit.”

[Source: FCA]

The regulator believes a partnership-based model is likely, at first, to continue to be the dominant entry strategy for Big Tech firms. But in the longer term they may seek to rely less on partnerships and compete more directly with existing firms.

“Big Tech firms may look to bring more activities in house and expand their service provision along the value chain through mergers and acquisitions, organic growth or a combination to compete more directly with existing providers,” it said in a discussion paper published in October last year.

Big Tech generally, and AI particularly, is going to transform this industry. I’m seeing far more recognition of this among advisers

The FCA believes Big Tech firms could bring benefits to consumers of retail financial services by “effectively and fairly competing with incumbent providers and other new entrants, including fintech firms”. One thing these firms are very good at is providing innovative, efficient products and services.

On the flip side, based on evidence from Big Tech firms’ core markets and their expanding ecosystems, competition risks could arise in the future. If Big Tech companies manage to get a stranglehold on the financial services market in the same way they have in other sectors, they could rapidly gain market share. This market power would be harmful to competition and consumer outcomes if exploited.

Although it’ll be interesting to see how things change over the months and years, I don’t think there is a particular threat or worry for financial advice

Abrdn’s Titterton points out that the Big Tech firms have enormous customer bases and huge amounts of data. They also have the ability to analyse, interpret and understand this data, and grasp customer needs as a consequence.

But, he warns, what may initially look like a great innovation offering customer choice and more competition in the market could ultimately lead to less choice.

“There could be a concentration effect, given their scale and their power. Ultimately, we may end up with less choice,” says Titterton.

Wider focus?

So far, Big Tech’s focus has been on small sections of financial services. But how far might they go? Will they look at the wealth market?

Financial advice is a different kettle of fish from simpler products like insurance and savings.

Technology is a tool that enables human beings to be much more productive

“The risk to the company and the nature of regulation are a much more complex affair, not least because they are principles based,” says Goss.

“The risks associated with getting it wrong at scale versus the margins available, which are lower than they are in other parts of financial services, have always proved a greater hurdle for large tech companies here and, to my knowledge, in the US and around the world.”

Moneyinfo managing director Tessa Lee agrees that there are too many barriers to entry for Big Tech in the advice space.

“Robos have not taken off, and we all know why,” she says.

If you can meet the regulatory standard in the UK, you can probably meet it anywhere in the world

“It’s because of the lack of a human in that process. One thing we know is you can’t phone up Amazon and speak to someone; it just doesn’t happen. It’s not where they sit. Nor Google, Meta or any of the Big Tech providers.

“There may be a worry for some of the smaller fintechs, in terms of what they might be doing in the D2C space.

“Although I think it’ll be interesting to see how things change over the coming months and years, I don’t think there is a particular threat or worry for financial advice.”

But Financial Technology Research Centre director Ian McKenna believes Big Tech will go all the way.

“Absolutely we will see the likes of Alphabet and Amazon come in and challenge traditional financial advice. That is going to happen.”

These Big Tech companies are already in financial services, but the models always seem to take a slice that requires the least regulation

McKenna says the UK is a really good environment for Big Tech to test new services.

“We have a regulator that absolutely believes technology will provide it with the solution to the advice gap.

“It’s recognised now that the UK has probably the toughest financial advice regulatory regime. But we also have a regulator that is very open to innovation, which actually makes it a great place to try new things. If you can meet the regulatory standard in the UK, you can probably meet it anywhere in the world.”

AI adoption

As the role of artificial intelligence (AI) technology continues to advance — fuelled by a rise in both interest and investment — Big Tech firms are making sure they are at the forefront of the revolution.

AI tech ChatGPT — owned by Open AI, which receives hefty investment from Microsoft — rose to fame at the end of 2022 and has graced the headlines ever since. Hot on its heels, Google released its own AI chatbot, called Bard.

Advisers who use AI will replace advisers who don’t, such is the advantage to be gained from effective use of technology

One thing the FCA looks at in its discussion paper is the adoption of AI by a growing number of financial services firms.

A recent survey by the regulator on machine learning found 72% of firms were either using or developing machine-learning applications across an increasing range of business areas. These included enhanced data analysis and improved detection of fraud and money laundering.

“We are working with Big Tech firms and financial services providers to explore how technological innovation is changing markets,” says Rusu.

“For example, through the Artificial Intelligence Public-Private Forum we, alongside the Bank of England, engaged with a number of Big Tech firms on how AI was being used in financial services, and the risks and benefits of its adoption.”

Changed but not replaced

Ultimately, digitisation changes the role of a financial adviser but it does not remove it.

“It removes the mundane and the repetitive, and allows technology to do that,” says Titterton.

One thing we know is you can’t phone up Amazon and speak to someone; it just doesn’t happen. It’s not where they sit

“This releases people to be able to focus on the things that machines will never be able to do, like building relationships, providing customers with confidence, and ensuring they’ve got a plan that’s right for them. A machine is never going to be able to deliver empathy and understanding in that way.

“I see digitisation as an opportunity, not a threat,” he adds. “We should not resist the change but adapt. And actually, the role should become more interesting and more valuable, not less interesting.”

For the advice profession, 40% of the work that is carried out by an adviser and their support staff could be replaced using AI. But McKenna does not think advice firms should deem this a threat.

“As a society, we’ve got an enormous opportunity there. If we got that productivity gain, I’d much rather move to a world where we could keep the same number of jobs but work 40% fewer hours,” he says.

“Candidly, most advisers find they’ve got more potential clients than they have time to look after. They could take the lead on giving staff a better quality of life [by freeing them up to focus on what they really want to be doing — talking to clients].

There could be a concentration effect, given Big Tech’s scale and power. Ultimately, we may end up with less choice

“There is absolutely no doubt that Big Tech generally, and AI particularly, is going to transform this industry,” adds McKenna. “I’m seeing far more recognition among advisers that this is going to happen.”

Goss agrees that the role of technology, which is often AI driven, will only increase.

“Technology is a tool that enables human beings to be much more productive,” he argues.

“It means that financial advice firms, small or large, will be able to be more productive and reach as many clients as they want.

“Some may decide to spend more time on the clients they see already, and some may decide they want to serve more clients, but ultimately it means that more clients will be able to get more access to advisers.”

There is also an opportunity to learn from the Big Tech firms about building a brand.

“Google is a verb now, it’s not just a brand,” says Lee. “We talk about ‘Googling’ everything now. It is so good at making itself ubiquitous in our lives.

Big Tech could bring benefits to consumers by effectively and fairly competing with incumbent providers and other new entrants, including fintech firms

“And Big Techs make it so easy to do business with them. The brilliant thing about Amazon is how easy it is to do business with.

“That’s where, in financial advice and wealth management, we can learn about making it easier for our clients to do business with us.”

Pivoting advisers

The looming spectre of Big Tech should not cause financial services firms to cower in the corner as if hiding from a werewolf. Quite the opposite.

“One thing financial advisers have been incredibly adept at is adaptation,” says McKenna. “There have been so many predictions over the years of the demise of financial advice, and that big firms will come in and eat them all up. And guess what? It never happens. Why? Because these advisers are great at pivoting.”

But, he warns, advisers of the future will have to partner with tech companies if they are to have any chance of surviving.

“Alphabet is probably a more important partner than someone like Abrdn for advisers in the long term.”

John Lewis and others have moved into savings, credit, loans or even mortgages

He continues: “There’s a famous and often misquoted statement, which is that, ‘Advisers who use technology will replace advisers who don’t.’ That was originally said many years ago by Trisha Rothschild, who used to be the chief product officer at Morningstar.

“Let me give you my own variation: advisers who use AI will replace advisers who don’t, such is the advantage to be gained from effective use of technology, but particularly AI.”

The ‘threat’ of the Big Tech monster should be viewed instead as an opportunity for financial advice firms, to make sure they operate in the best possible way for their clients and customers. Only then will they stand a chance.

Scam protection

“Tech companies have a vital role to play in protecting consumers from scams and we have pressed for continued progress here,” says FCA chief data, information and intelligence officer Jessica Rusu.

“We have worked closely with both Google and Meta to change their advertising policies to ensure they only allow financial promotions that are made by, or with the approval of, firms authorised by the FCA.

“But we believe there is much more that needs to be done by tech companies to protect consumers from illegal and harmful adverts.

Tech companies have a vital role to play in protecting consumers from scams

“We have also called on the government to ensure financial content is included within the Online Safety Bill.

“The FCA is committed to fostering innovation, and through our Innovation Hub — which provides services such as the Digital Sandbox and Innovation Pathways, and the Regulatory Sandbox — we are providing the tools and support to help firms test new ideas.”

The voice of ChatGPT

We asked ChatGPT if Big Tech firms would disrupt the UK financial advice profession. It replied thus:

“Big tech companies like Amazon and Google have already disrupted many industries, and it is certainly possible that they could disrupt the UK financial advice profession as well. However, the degree to which they will do so remains to be seen.

“Many fintech companies have already entered the financial advice space, offering automated investment advice and financial planning tools. These companies have gained popularity among younger investors who are comfortable with technology and prefer a more self-directed approach to managing their finances. Amazon and Google could potentially enter this space as well, leveraging their vast resources and customer base to offer similar services.

“However, financial advice is a highly regulated industry, and there are many rules and requirements that companies must comply with to provide advice to clients. Additionally, many investors still prefer to work with human advisors who can provide personalized advice and guidance based on their individual circumstances and goals. While technology can certainly enhance the efficiency and effectiveness of financial advice, it may not be able to fully replace the value that human advisors can provide.

“In summary, while big tech companies like Amazon and Google could disrupt the UK financial advice profession to some extent, the extent of this disruption remains to be seen. It is likely that there will continue to be a place for human advisors in the industry, particularly for those who value personalized advice and guidance.”

This article featured in the May 2023 edition of MM.

If you would like to subscribe to the monthly magazine, please click here.

Can you really see anyone with serious money going this route? OK I guess for the youngsters who have peanuts to invest. Any decent adviser has nothing to fear.

Little did L Frank Baum, know all those years ago that his little story would play out so many times.

Now we have technology in the leading roll as the scarecrow “if I only had a brain”

Let us not confuse ourselves that intelligence beyond, our wildest dreams and one that holds no bounds is 80% of the solution.

Tech is what it is …driven by greed, marketed as a need, reality its a weed that will never have a brain.

We already know technology is making us regress mentally and our brains in reverse.

Simple maths replaced by the calculator

Hand writing replaced by the key board.

Problems solved by the algorithm.

The brain …use it or loose it !!