I have some friends who live in northern California — in a town called Glen Ellen, about an hour outside San Francisco. In 2013 I went to visit them.

It’s a beautiful place near some of California’s best national parks and I have fond memories of riding my friend’s trail horses. We’d go out for five or six hours at a time and explore all the remote trails in the mountains among the coyotes and mountain lions.

Greenwashing is a term that is thrown around a lot and is not well defined

My friend trains her horses to compete in an event called the Tevis Cup — a 100-mile, 24-hour race through the Californian mountains. One of my ambitions is to compete in it some day.

In the autumn of 2017, my then-boyfriend and I spent six weeks travelling across the US from coast to coast, ending in northern California. The idea was to revisit the friends I hadn’t seen for four years.

Alas, it wasn’t to be. Starting in New York, we travelled down the East Coast towards Miami and, as we approached, Hurricane Irma hit Florida. We managed to avoid the brunt of the storm but, as we neared Charleston, we got caught in the tail end.

Downpour

I had never seen rain like it. We couldn’t see more than a foot in front of the car and had to drive at about 20mph along the highway, which had a speed limit of 75mph.

Police closed almost every junction along the route, making it impossible for us to pull over, so we had no choice but to carry on.

It’s not been easy for expert ratings agencies to dissect all the information and agree on measurements and appropriate yardsticks

To this day I admire my travelling companion. Had I been driving,

I probably would have stopped in the middle of the road and experienced a panic attack.

Eventually we reached Charleston safely — just. That was towards the beginning of our trip.

Wildfires

When we ended up in northern California five weeks later — still with the intention of visiting my friends — unfortunately some particularly aggressive wildfires struck.

California is well accustomed to a lack of rainfall and, that summer, a particularly bad drought had caused the land to dry out so much that fires had started almost out of nowhere.

The IFA market is not suitably educated in ESG to accurately assess the validity of the products

My friends’ house and outbuildings burned to the ground and their land was devastated.

Later, they sent me photos of their old Jeep, the beautiful house I’d stayed in and the barn where they’d kept the horses. All had been reduced to ash.

Luckily, no one was hurt — horses included. I’m not an emotional person but I cried when I saw the photos.

I had only a small taste of some of the extreme weather that, more and more, is ruining, and sometimes taking, the lives of increasing numbers of people.

My friends were lucky, in some respects. They weren’t short of money and had nice people in the neighbouring town who put them up for as long as they needed. And they were able to rebuild their house and barn.

Not everyone is so fortunate.

Climate refugees

The number of climate refugees is on the rise as people are forced to flee their homes because of extreme weather events and natural disasters brought about by climate change.

A lot of clients have a foot in both camps. That, to me, feels like a sensible way of approaching this subject

In fact, United Nations secretary-general António Guterres said at the Cop27 summit in November 2022 that, by 2050, one billion people might be refugees because of the climate crisis.

That is an eighth of the world’s population.

Since 2017, weather patterns in the UK have changed dramatically too. In the summer just gone, temperatures in parts of the country reached 40°C — the highest ever recorded. Winters are becoming milder also.

The FCA has done something no other regulator has done, and I think it is incredibly bold and also incredibly useful for retail investors

This is all indicative that the climate is changing. And many believe it to be the biggest threat to our civilisation.

We are fast approaching a point of no return, and talks are moving towards adaptation as well as mitigation.

Arguably, the most significant outcome of Cop27 was the agreement in principle to establish a ‘loss and damage’ fund to support the poorer nations most vulnerable to the physical impacts of climate change.

Front of mind

As climate change develops into more of a threat, it is fast becoming front of mind for much of the public.

As I wrote in a Behind the Headlines piece in October last year, there has been a multitude of research suggesting people now care more about climate and social issues than they did in the past, and this is being reflected in their investment choices.

As a fund buyer, I would rather still have the ability to make my own interpretation than follow a strict guidebook

The Financial Conduct Authority’s Financial Lives data shows that 81% of adults surveyed would like the way their money is invested to ‘do some good’ while providing a financial return.

But there is also much research that suggests people do not fully understand what ESG — environmental, social and governance — actually is.

Furthermore, as interest in sustainability increases, so too do people’s concerns about greenwashing.

The majority of people, it seems, focus on the ‘E’ in ESG — environmental. I have even done this myself, in the introduction to this feature.

When it comes to the ‘S’ and the ‘G’, people are generally less clear. Terms such as ‘climate’, ‘environment’, ‘sustainable’ and ‘ESG’ are often used loosely across the financial sector, sometimes interchangeably. And this makes greenwashing easier.

Perhaps one of the best ways to communicate that a product meets a certain standard is to have a labelling mechanism approved by an authoritative body

Even the term ‘greenwashing’ itself can be used to mean different things.

“It is a term that is thrown around a lot and is not well defined,” argues Chris Fidler, a senior director in the global industry standards team at CFA Institute.

He believes it is important we start being more precise about what we mean by the term.

“There are different types of greenwashing.

“For example, sometimes when people make false or misleading statements in their disclosures or their marketing materials, people might characterise that as greenwashing.

“Another instance would be if the manager has a policy to do something like screen out certain types of company, or has committed to certain principles. If they don’t follow through on that, that can be characterised as greenwashing.

This FCA programme is a little bit different

“Sometimes people will say that a manager is greenwashing even if they’re doing exactly what they said they were doing but it doesn’t meet that person’s own personal standards. That should not be characterised as greenwashing.”

Regulatory measures

The FCA is concerned that there has been growth in the number of investment products marketed as ‘green’ or making wider sustainability claims that are not always backed up.

In a consultation paper published on 25 October 2022, the regulator warned that exaggerated, misleading or unsubstantiated claims about ESG credentials “damage confidence” in these products. As such, it has vowed to crack down on greenwashing with a new set of measures to “help consumers and firms build trust in the sector”.

FCA director of environment, social and governance Sacha Sadan says: “We are aiming to stamp out greenwashing in investment products — so that advisers and consumers can trust that products which claim to be sustainable actually are.

“Without this trust, ESG products won’t meet their potential to provide solutions to some of the world’s biggest ESG challenges.”

This is an iterative process. So the regs as drafted aren’t the finished article

The new measures will provide a framework for funds that wish to use common terms such as ‘sustainable’, ‘green’ and ‘ESG’, and will provide retail investors with informative disclosure on how funds deliver on their claims.

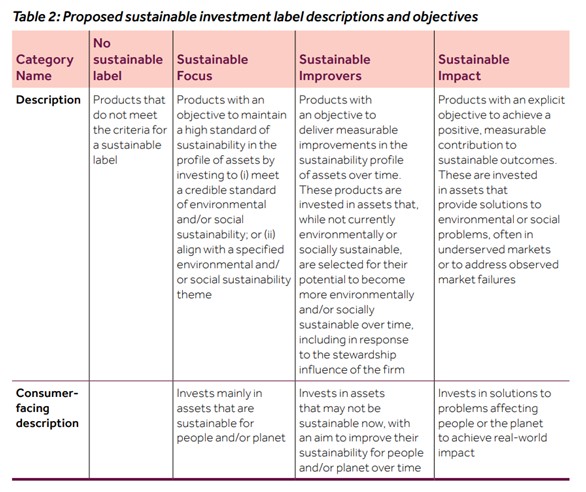

Based on feedback to its July 2022 discussion paper about sustainability disclosure requirements, the regulator has proposed three labels: Sustainable Focus, Sustainable Impact and Sustainable Improvers.

“I look at the evolution of how regulators have been tackling the issue of greenwashing, and how to best communicate to retail investors about the sustainability of products. The FCA has done something no other regulator has done, and I think it is incredibly bold and also incredibly useful for retail investors,” says Fidler.

“If you accept the argument that most retail investors aren’t very financially literate, and they don’t have a lot of time or willingness or ability to read detailed disclosures, then perhaps one of the best ways to communicate that a product meets a certain standard is to have a labelling mechanism that is underpinned by specific criteria and is approved by an authoritative body.”

Fund managers are required to highlight areas that may not be expected by the investor. This is like Mission Impossible, because the world is in transition

There have been many attempts at categorising investment approaches. For example, bodies such as the Investment Association and other groups have identified several distinct strategies.

And there are a number of voluntary sustainability labelling programmes around the world, mostly at the country level, sometimes the regional level; for example, Green Fin in France and Towards Sustainability in Belgium.

“Those are good programmes,” says Fidler. “But this FCA programme is a little bit different.

“For one thing, it’s backed by a regulatory authority, so there’s inherently more trust in the body that’s producing the label. It certainly has more resources to enforce the label, and more resources to explain to consumers what it is and why it’s important.”

‘Solid foundations’

Square Mile Investment Consulting and Research commercial director Steve Kenny believes the FCA’s proposed regulations are a positive development in the round.

He says there is “strong guidance” in terms of what works and what does not, which provides “solid foundations” for financial services firms to work on.

We don’t want to strip it back so far that there is artistic licence being jeopardised

“The other thing that’s really interesting is that this is an iterative process. So the regs as drafted aren’t the finished article,” he adds. “This is positive because it recognises that the market is dynamic and things are going to evolve.”

But Kenny says there are still unanswered questions about how things will work in practice.

“One of the things I find most difficult to understand in this piece of regulation is it suggests that fund managers are required to highlight areas within that portfolio that may not be expected by the investor,” he adds. “To my mind this is like Mission Impossible, because the world is in transition.

“You look at businesses like BP and Shell, which most people would see as fossil fuel companies, which are part of the problem rather than the solution. But, if you look at what those two businesses are doing in terms of greening their energy production, they are businesses in transition. In three years’ time, they may be the greenest on the planet.”

I look at the evolution of how regulators have been tackling the issue of greenwashing

Sadan says the FCA is not here to make “value judgements” about what people invest in. And, he adds, it is “critical” its labelling rules accommodate investment in assets that are transitioning to becoming more sustainable.

“We know that some consumers are happy to invest in companies that are on a journey to being more sustainable, while others only want to invest in companies that have already got there,” says Sadan.

“Our rules will make it clear to consumers and advisers what they’re investing in, so they can make an informed decision.”

One thing that is different about the FCA’s new scheme compared with previous attempts at categorisation is its flexibility, says Fidler. Voluntary labels often have technical specifications about, for example, whether fossil fuels are allowed to be held in the portfolio or whether they are capped at a certain level.

Our rules will make it clear to consumers and advisers what they’re investing in, so they can make an informed decision

“The FCA’s proposal is good in that it doesn’t get to that level of detail, so it still provides a good deal of flexibility for managers to design different sorts of products,” says Fidler.

“Consumers do want different sorts of products, and they care about different sorts of issues.”

‘Artistic licence’

Allowing asset managers some level of flexibility when picking investments for funds is key.

Tyndall Investment Management head of partnerships James Sullivan argues that greenwashing, by its nature, is subjective. Trying to make it too objective could cause issues for fund managers.

“I think the FCA’s intentions are to be applauded,” he says. “But we don’t want to strip it back so far that there is artistic licence being jeopardised.

The FCA has more resources to enforce the label, and to explain to consumers what it is and why it’s important

“As a fund buyer, I like the choice and I like interpreting different asset managers’ perceptions of ESG, sustainable or impact investing. I would rather still have the ability to make my own interpretation than follow a strict guidebook.

“Maybe a balance is to be found from the extreme we’re at today, without going all the way down to the other end of the spectrum where it’s purely black and white.

“We’re finding a lot of our [adviser] clients have moved away from requesting specific ESG or sustainable mandates, to just requesting consideration be given to the inclusion of ESG or sustainable funds within traditional or core mandates.

“In essence, they’ve got a foot in both camps. That, to me, feels like a sensible way of approaching this subject.”

The FCA’s measures will be key for financial advisers, and they will need to make sure they are clued up on the nuances of the new rules.

The FCA’s intentions are to be applauded, but maybe a balance is to be found

This is especially pertinent because a key focus of the Consumer Duty — due to be introduced in the summer of next year — is that advisers make sure clients have understood the questions they were asked during a factfind, and the advice they were given.

Sadan says the FCA is considering how it may introduce rules for financial advisers that say they should take into account sustainability matters in their investment advice and understand investors’ preferences on sustainability.

The regulator will follow up with a consultation on this further down the line.

Education

Platform One chief executive Alex Cowan-Sanluis says: “I think the IFA market as a whole is not suitably educated in ESG to accurately assess the validity of the products.

“That’s not its fault as it’s new and vastly complex, and it’s not been easy for the likes of expert ratings agencies and analysts to dissect all the information available and agree on measurements and appropriate yardsticks.

We are aiming to stamp out greenwashing in investment products

“But it is their responsibility to get a better understanding of how these products are rated in terms of ESG credentials.”

It is clear there is still much to be done to cut out greenwashing in the financial services sector.

The FCA’s consultation paper and subsequent regulations are a good start. But they are by no means the end.

This article featured in the January 2023 edition of MM. If you would like to subscribe to the monthly magazine, please click here.

The fact that there are no comments (other than this one) rather does demonstrate that this is not a topic of overriding importance to your readers.