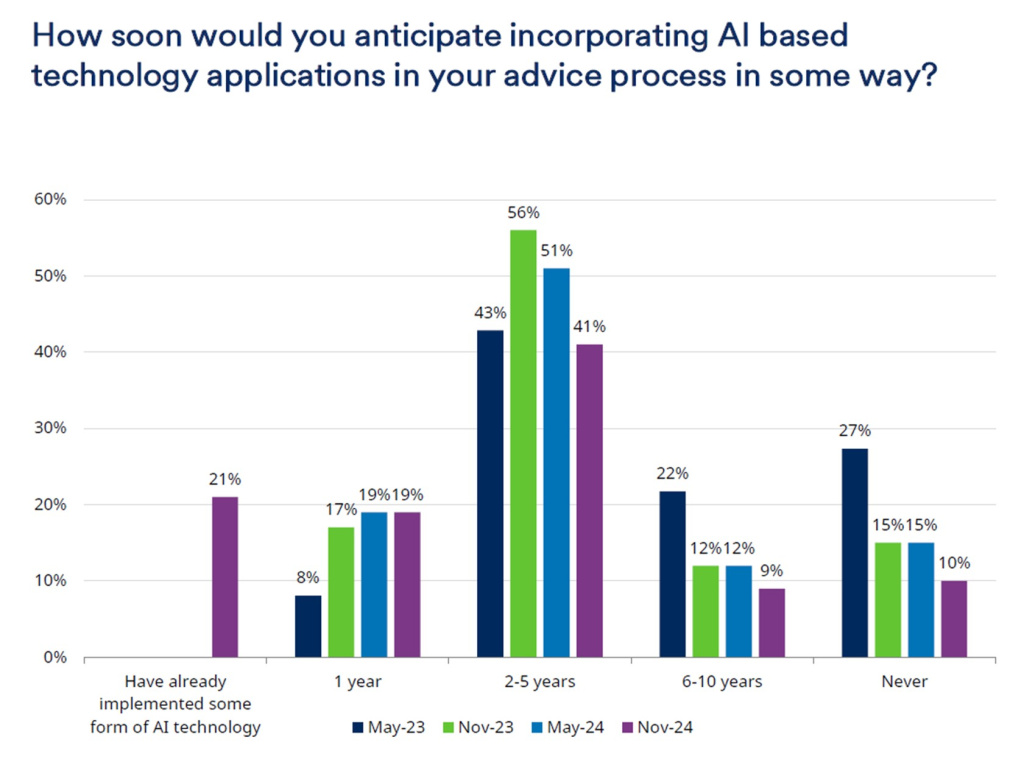

Financial advisers are starting to implement artificial intelligence (AI) technology into their businesses, with around a fifth (21%) saying they have already done so, Schroders research has revealed.

In its latest UK financial adviser survey, Schroders found 19% of advisers expect to incorporate AI into their advice process in some way within a year.

A further 41% said they intend to in the next two to five years.

Only 10% expect to never use AI, dramatically down from the 27% who said they would never use AI in May 2023.

Speaking at a report-launch dinner last night (4 December), Gillian Hepburn – commercial director at Schroders-owned Benchmark Capital – said the firm did not specifically ask what forms of AI advisers had implemented.

“It could be as simple as using ChatGPT for meeting notes or improving client communication,” she said. “But while that might seem basic, it’s a great starting point.”

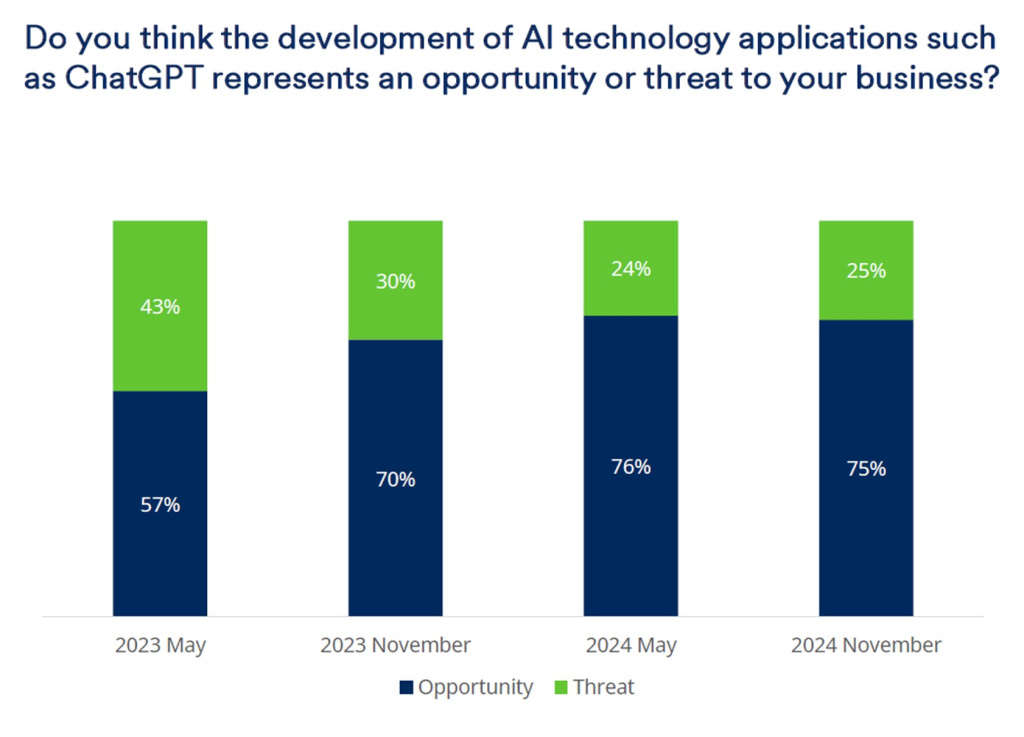

The report also suggested that 75% of advisers view the development of AI technologies as an opportunity for their businesses rather than a threat. This is up from 70% in November last year.

Hepburn suggested that the advice market may eventually reach a point where advisers do not even realise AI is behind much of the technology they use.

“Across the [Benchmark] network, we’re already seeing some interesting use cases in the advice sector. However, we are still in the early stages.

“In our business, we’re seeing a significant number of new entrants. That said, I’ve often noted that I’m not entirely sure we fully understand the problems we’re trying to solve [with AI].

“I’ve seen lots of demonstrations and innovations but sometimes wonder if we’re still in the VHS vs Betamax phase, trying to determine who the ultimate winner will be. Many of these companies are in their early stages.”

She said advisers should ensure they carry out the proper due diligence when choosing providers, and ask questions such as: Where does the data go? How secure is it?

“We [Schroders] stress the importance of being cautious about the data shared online. While we see AI as a tremendous opportunity rather than a threat, it’s essential to approach it with care,” she added.

“There are huge opportunities in the advice market, which is crying out for innovation like this.

“One concern I have is that while providers are working on re-engineering parts of the advice process, they’re not always considering the end-to-end picture.

“But I remain a big supporter of AI.”

The Schroders report also revealed that advisers are increasingly concerned about losing assets as a result of the great wealth transfer, but many are not doing enough to attract the next generation of clients, Schroders has warned.

It found 62% of respondents are concerned about the impact that wealth transferring between generations could have on their business.

However, 53% of survey respondents said the average age profile of their clients has increased over the past five years, compared with just 14% reporting a decrease.

Comments