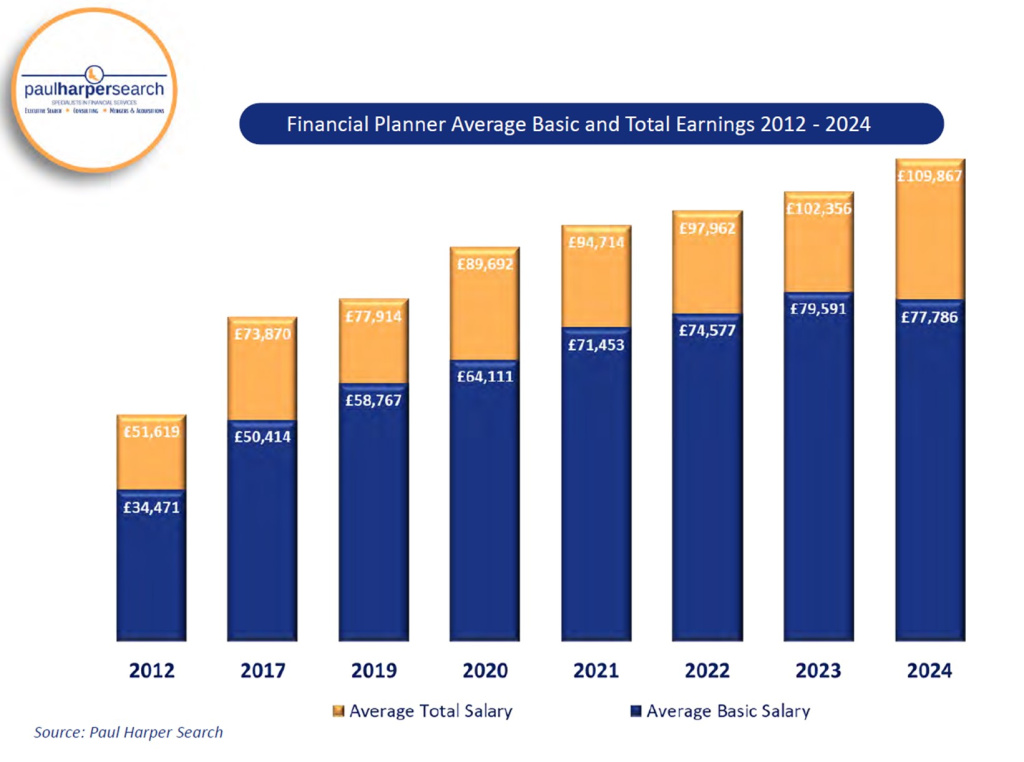

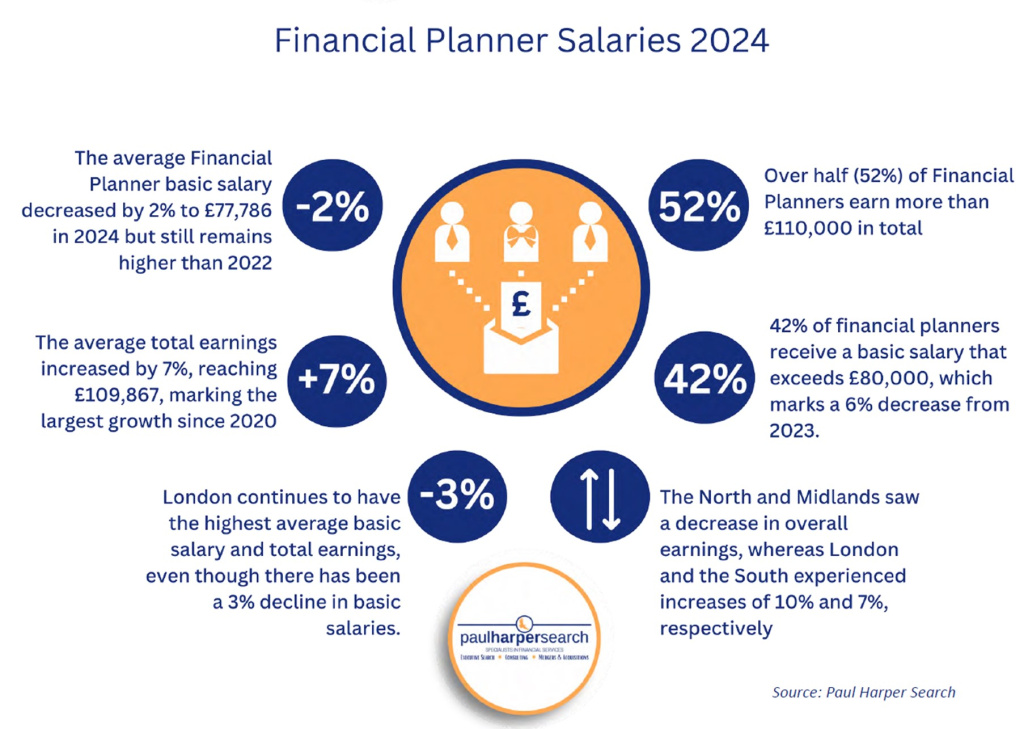

Adviser productivity has dropped in the past year, despite an average rise of 7% in employed advisers’ total earnings, research by consultancy Paul Harper Search has revealed.

The report found that, in 2024, fees generated per adviser dropped by 3.5% from £207,302 to £200,012.

The consultancy said a typical benchmark threshold it sees for advisers’ bonus schemes is based on experienced employed financial planners generating three times their salary, although it can vary from 2.5 to four times.

It said industry data shows “we are not there yet”.

In simple terms, an employed financial planner earning a basic salary of £80,000 should be overseeing a client book generating £240,000 of ongoing revenue from 100-150 clients.

Total revenue generated by this adviser, including all fees and commissions, should be £330,000 to earn the industry average salary of just under £110,000 per annum.

However, Paul Harper Search found that, in 2024, the average retail investment revenue per adviser is £200,012.

This is dramatically down from 2019, when three times the average adviser salary of £73,750 was £221,610, but average retail investment revenue per adviser was £177,539.

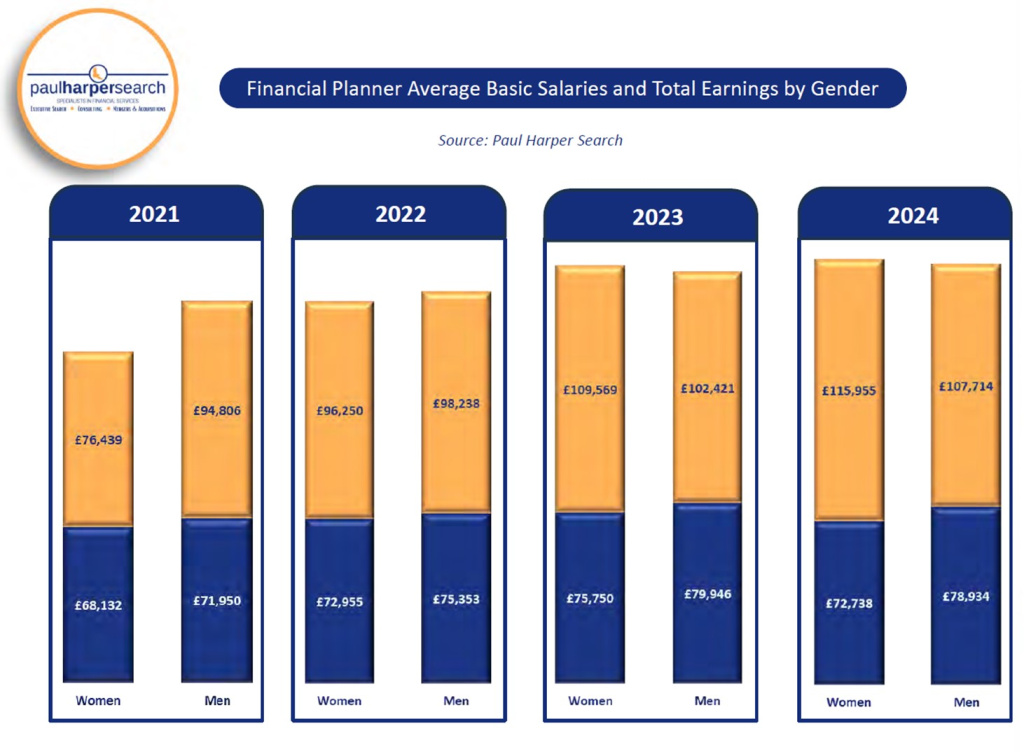

The report also found that advisers who are women now earn an average total of £115,955, while advisers who are men earn an average of £107,714.

Since 2021 the average total earnings for women have seen a remarkable increase of 52%, rising from £76,439 to £115,955.

In contrast, men’s total earnings have grown by 14%, increasing from £94,806 to £107,714.

Women’s basic salaries still lag behind men’s, with women earning an average basic salary of £72,738 compared to £78,738 for men.

After narrowing the gap between men’s and women’s average basic salaries to 6% from 2022 to 2023, the gap widened again in 2024, reaching 9%.

FCA data suggests there are 27,941 financial advisers working in 4,654 advice firms (as of 31 December 2023).

This represents a decrease of 1% in the number of financial advisers advising on retail investments, and 8% fewer firms from December 2022.

There is a general trend of people moving from smaller businesses to bigger businesses, said the Paul Harper Research report.

Adviser numbers continue to grow in the larger firms (six or more advisers) and are shrinking in the smaller firms of five or fewer advisers.

The 1% of advice firms with 50 advisers or more employed account for 50% of the advisers in the market, up by 1% from 49% in 2022.

Mark Twain is supposed to have said “There are three kinds of lies: lies, damned lies, and statistics.”

IF this is true, it points to getting more by doing less. Wither the wonderous AI? Yet again if this is an accurate report it points to the poor UK productivity.

So female advisers are earning significantly more than men – and they have benefitted from a 52% average increase since 2021, whilst men have only received 14%? So will Helena Morrisey, Money Marketing, the FCA et al now stop boring us all with the notion that women are getting a bad deal compared to men in retail financial services? Woman benefit from the same equal opportunities as men and the constant carping by those finding hobby mares to ride is just so boring.

They certainly needed to bang the drum for women & good on them. As often the case, the pendulum has to swing too far the other way before most people realise it’s gone too far.