Markets have flown out of the traps 2023 to date. This is in stark contrast to last year where pretty much anything investors held ended up in negative territory.

Markets have flown out of the traps 2023 to date. This is in stark contrast to last year where pretty much anything investors held ended up in negative territory.

Pessimism ramped up, yet the calendar year performance of 2022 masks some areas that started to turn in the fourth quarter.

While this might have all the hallmarks of a bear market rally, it is worth exploring these sharp moves, albeit coming from a low base.

The tech darlings that have come to dominate the US market retrenched last year, after nearly 10 years of strong performance.

What didn’t work in 2022 has bounced back, albeit from a low base

In Europe, there’s no sign of large-cap retrenchment. Instead, the regular Stoxx Europe 600 index outperformed its equal-weighted sister version by the largest margin since 2001. That’s usually a headwind for active managers.

Meanwhile, in the UK, the market finished just in positive territory, helped by the large weights of banks, materials and oil and gas in the FTSE 100 index.

In fact, if the top 10 index constituents were removed, performance would have been around 8 percentage points lower. Shell returned 48% in pound sterling terms, Astra Zeneca 32% and HSBC 20%. Other key constituents BP and Glencore surged 50% and 57%, respectively. Just two firms in the top 10 were in negative territory: Diageo and GSK, both to the tune of 7%.

Style turnaround

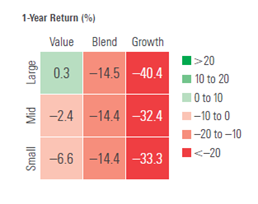

For growth stocks, 2022 became a year of horrors. The extent of these losses led to a marked shift between style returns for US equities (in dollars).

The image to the right shows US equity returns in 2022 by style (Source: Morningstar Direct. Data as of 31 December 2022).

These drastic losses have made such a dent in long-term returns that, even over the trailing five-year period, large growth stocks lagged large value stocks through the end of December 2022.

Eastern promise

Turning to markets year-to-date, what didn’t work in 2022 has bounced back, albeit from a low base. This is linked to relief at China re-opening and on expectations there will be a softer economic landing than previously feared in the developed world.

IT, communication services and consumer discretionary stocks have rallied hard after a more than sobering 2022. In the more speculative area of loss-making growth companies, several names that saw their stock prices drop like a stone last year have returned more than 60%, including Peloton and Roku. However, they’re all still way off their 2021 peaks reached after profiting from the pandemic.

The regulatory tightening cycle, which has unnerved investors over the past two years, appears to be reaching the end

As is Meta Platforms (previously Facebook), despite seeing its share price nearly double since early November. Some market participants have speculated that retail investors have been wading in on these names based on the fear of missing out, reminiscent of the meme stock frenzy in 2021.

Meanwhile, Europe’s bias towards cyclical sectors helped its stock market rise 6.7% in January (in euros), just ahead of the S&P 500 (in dollar terms), and UK markets have been reaching all-time highs. Emerging markets, where China is around a third of the index, have also been buoyed by its re-opening.

In contrast with other major markets, monetary policy remains accommodative in China and there is scope for further easing to support the economy, thanks to mild inflation.

The regulatory tightening cycle, which has unnerved investors over the past two years, also appears to be reaching the end, and China’s leadership has been increasingly vocal in expressing the commitment to support the private sector.

Since its recent lows, the China stock market rebounded by 40% in the three months to end of January, although it’s still down over five years.

Fixed income

Turning to fixed income, it was a torrid time in 2022. But, as with equities, most bond markets did see an upturn in the fourth quarter.

In addition, global government bond yields fell in January on encouraging news on inflation, particularly out of the US. Credit markets did well and outperformed government bonds both in the US and Europe and across both high-yield and investment-grade markets.

It will likely be a bumpy ride from here

However, inflation not being tamed as much as might be expected at this stage in the cycle, bonds fell back in February, with the yield on the US 10-year treasury rising to a three-month high mid-month.

European government bond yields headed toward recent multi-year highs after comments from the European Central Bank that higher interest rates are needed to control inflation. Since the start of the fourth quarter 2022 to date, emerging market debt and high yield have led the way, with government bond returns more subdued.

Markets and macro expectations are finely balanced. It will likely be a bumpy ride from here with markets oscillating on latest data linked to the prospect of higher-for-longer interest rates and how economies are holding up.

Many fund managers we are speaking to are doubling down on balance sheet strength and focusing on companies with strong positions in their markets that can grow, while being conscious of valuation.

The broad view being these companies might not necessarily stand out during cyclical rallies but should be able to gain market share as weaker competitors are flushed out, leaving them better off over time. This also means some of the growth darlings from recent years being less in vogue.

Jonathan Miller is director of manager research and ratings at Morningstar UK

Comments