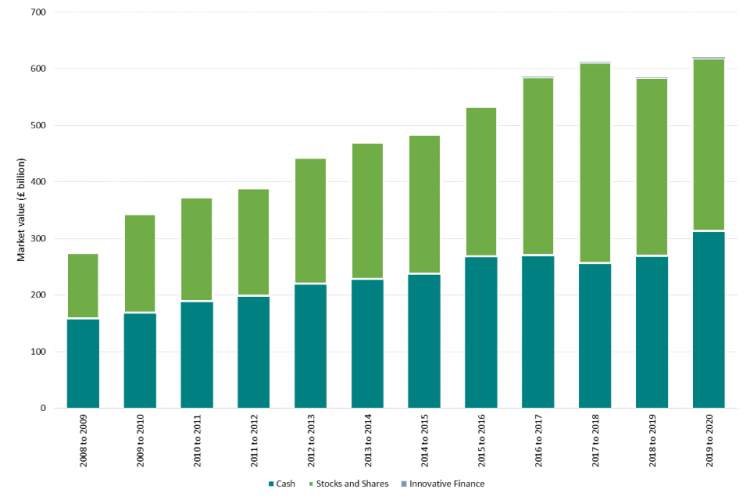

The market value of adult ISA holdings hit a record £620bn at the end of the 2019/20, a 6% rise on the previous year, new government figures show.

The uptick was driven by a 16% increase in the market value of funds held in cash.

This translates to cash ISAs now accounting for 51% of the market value.

Stocks and shares ISA holdings, meanwhile, accounted for 49% of the market value of ISA funds, down 9% on the year.

The total amount paid into ISAs increased by £7.1bn to £7bn, with £4.8bn extra invested in cash ISAs versus £1.6bn in stocks and shares ISAs.

Chart: Adult ISA fund market values

Analysts are enthused by the continuing popularity of ISAs.

But some have warned the reliance on cash ISAs means people risk having the real value of their fund “eaten away by inflation”.

AJ Bell senior analyst Tom Selby said those who held a significant proportion of their ISA in cash might have felt like they had “dodged a bullet” in March and April last year as markets tanked.

“However,” he added, “values have since recovered substantially, with the FTSE All share delivering whopping returns of 37% since April 2020 – a boon those invested in cash will have missed out on.”

Chris Cummings, chief executive of the Investment Association, said: “Comparing the strong ISA flows this April to the year before shows investors have been moving money into funds to make the most of tax incentivised savings and to deliver better returns amidst low interest rates on cash savings.

“The overall inflow to UK equities for a second consecutive month follows a sustained period of outflows and points to investor confidence continuing to grow as the UK looks to leave the pandemic economic consequences behind.

“In particular, the rising inflows to more domestically-focused UK Smaller Companies funds shows investors are increasingly positive that the post-Brexit UK economy will grow strongly as it opens up.

“In another strong month for responsible investment funds, savers invested £1.6bn, taking the total inflows to £13.5 billion over the last year – representing 30% of flows into funds.”

Chart: Number of Adult ISA accounts subscribed to during the financial year

The government data also showed the number of people subscribing to lifetime ISAs (LISAs) more than doubled year-on-year, from 223,000 to 545,000.

Selby said many of those who had invested prior to the pandemic will have used their LISA to buy a first home in 2020/21, driven to the market by the chancellor’s decision to slash stamp duty.

“The availability of LISA funds tax-free where they are used for a first home purchase will have helped thousands of people get a foot on the property ladder – and may also have combined with the stamp duty cut to drive the house price boom we have seen over the last 12 months,” he added.

In addition, around one million junior ISA (JISA) accounts were subscribed to in 2019/20 – the ninth full financial year since the scheme was launched – up from 954,000 the previous year.

Quilter financial expert Heather Owen hailed this as an “historic milestone” which shows “more and more parents value the generous subscription limits on offer and the ability to save for their children’s financial future”.

But she added, with a potential 18-year time horizon, it is “concerning that cash is king” when it comes to JISAs and cash accounts remain “vastly more popular” than their stocks and shares peers.

“While cash JISAs do generally provide returns above the rate of inflation, meaning account holders will not be losing money in real terms,” she said, “they will not benefit from potentially 18-years of investment returns.”

Earlier this week, NatWest announced it had launched a new junior Stocks and Share ISA (JISA) to help “offset the impact of inflation and low interest rates” on cash savings.

It said around 83% of UK parents currently saving for their children are doing so in cash, according to research by the bank.

Nearly half of these (46%) have simply opened a cash account. Meanwhile, only a quarter (23%) of UK parents are saving for a child via stocks and shares.

Comments