The fall in inflation in July has offered some respite from the cost-of-living crisis, but experts have warned we are not out of the woods yet.

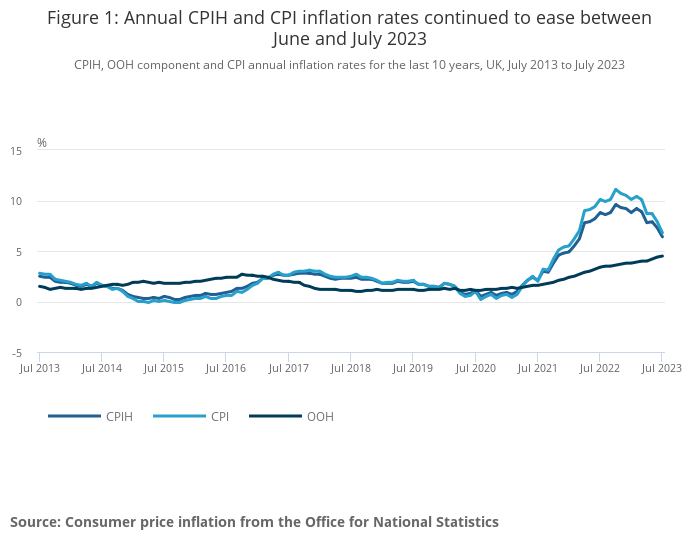

The Consumer Prices Index (CPI) rose by 6.8% in the 12 months to July 2023, down from 7.9% in June, the latest Office for National Statistics figures have revealed.

Statistics show CPI fell by 0.4% in July 2023, compared with a rise of 0.6% in July 2022.

Meanwhile, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 6.4% in the 12 months to July 2023, down from 7.3% in June.

Commenting on the figures, Interactive Investor senior personal finance analyst Myron Jobson said: “Inflation continues to moderate and head in the right direction which is a welcome sign for those who have struggled to maintain financial buoyancy because of high costs. But it remains far too high for comfort.

“However, the latest slowdown in inflation represents the kind of progress needed to get inflation down to the more sustainable 2% target.

“The easing of inflation was led by a fall in energy costs which fed through to households at the start of July when the new lower energy price cap came into effect.

“Businesses have also benefited from a reduced cost burden from lower gas and electricity prices which should continue feed into lower core inflation – which remained stuck in the mud in July, unchanged from June.”

IG Group chief market analyst Chris Beauchamp warned the Bank of England can allow itself “only a moderate period of rejoicing”.

“Headline CPI might be down, but the core figure shows that price growth remains sticky. Good news on goods deflation contrasts with the persistence of services inflation, yet another sign that higher prices are here to stay,” he said.

Derrick Dunne – chief executive of YOU Asset Management – added: “CPI inflation plummeted to 6.8% in the 12 months to July, thanks in no small part to the energy price cap cut.

“While this particular deflationary factor might be a one-off, the second consecutive fall in inflation indeed offers hope to those who have been hardest hit by cost-of-living pressures.

“The big problem now is that wage growth is rising faster than inflation for the first time in over a year, making the possibility of a wage-price spiral look increasingly real.

“Interestingly, hotels and air travel have been the largest upward drivers in July, showing that even a cost-of-living crisis isn’t getting into the way of a summer holiday season.

“So far in 2023, the Bank of England has been trying to engineer positive outcomes as the economic support introduced to soften the effects of the pandemic took inflation and wage growth ever higher.

“As we head into the second half of 2023, markets will be heavily focused on whether the rate hiking cycle is bringing the Bank anywhere close to hitting its 2% target, as well as the potential longer-term impact on the economy.”

I’m afraid the light at the end of the tunnel is a train bearing down. We have heard that wage rises are now over 7% – a record and that will force the BoE to put uprates again. UK inflation is the outlier – the highest in G7. So don’t cheer yet!

I agree with HK… except for the recent pay rises…

The Govt. (especially US Govt.) bond markets still show recessionary winds – both 3m & 2n taken from 10n give inverted yields – usually a reliable indicator.

Here in UK, inflation should have fallen, but fallen anyway –

1. Summertime energy spot and one month delivery futures are generally lower than Winter;

2. Energy stockpiling is now at maximum capacity, so the competition for supply has fallen – good news for Winter though;

3. Summer is generally a time for cheaper food due to seasonal factors – weather – though, I admit this year has seen extreme differences in weather behaviour. (We must hope for continued sunshine, little rain, and no hail in SW France)!

UK business may be seeing lower inflation, but will enjoy 25% CT very soon, (still) higher interest rates, and a year of uncertainty as the General Election approaches. No wonder profit extraction models are popular; and, due to the stupid contribution and fund limit rules, pensions are not going to see much share of this huge market.

As for wage growth.. hopefully, economically inactives – the scourge of the economy according to A. Bailey esq – will, at last bother to return to work!

Core inflation is the main, apparently, rate studied by the BoE to gauge inflation and, thereby, the setting of interest rates. This remains stubbornly high with little reduction. I have considered retraining as an industrial chemist, why? Well, the BoE has a secret laboratory to R&D the slipperiest Teflon yet – even beyond blaming everyone but… now let me think…