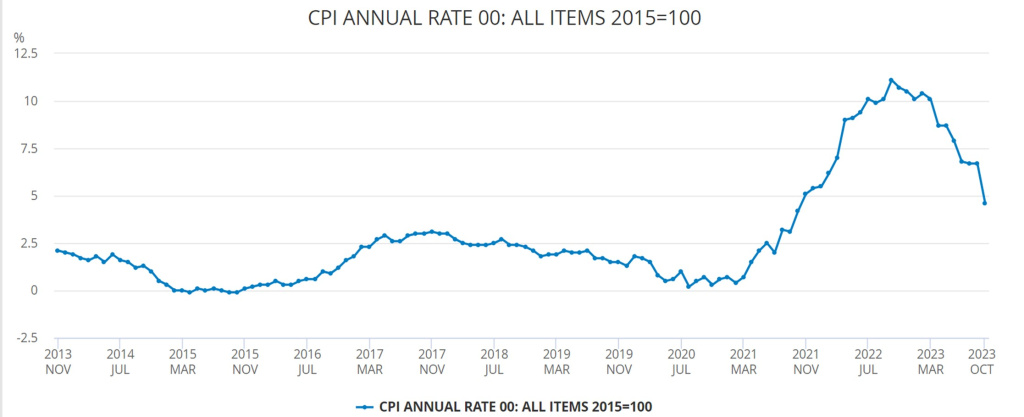

The Consumer Prices Index (CPI) rose by 4.6% in the 12 months to October 2023, an even steeper drop than expected from September’s 6.7%.

The latest Office for National Statistics figures showed that, on a monthly basis, CPI did not change in October 2023, compared with a rise of 2% in October 2022.

Meanwhile, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 4.7% in the 12 months to October 2023, down from 6.3% in September.

Charles Stanley Direct chief investment analyst Rob Morgan said the decrease was driven mostly by falls in household energy costs owing to a reduction in the energy price cap, and flattening food prices.

He said it is a “leap in the right direction” for the Bank of England (BoE), which is tasked with getting inflation back down towards its 2% target.

“Encouragingly, the month-on-month CPI was flat with a variety of areas showing a deceleration in price rises,” he added.

“This set of inflation data shows things are moving in the right direction, but just as squeezing the last bits of toothpaste out of the tube is more difficult, squeezing the last unwanted inflation out of the system can be tricky, so the BoE needs to maintain restrictive interest rates for some time,” he said.

“There is one more interest rate announcement to come this year on 14 December. Given the firmly downward trajectory in the inflation numbers and the mixed signals now coming from the economy it looks certain the BoE will continue to pause rates and allow the tightening so far to take further effect.

“Inflation is forecast to further subside towards 4% by the year end, with a lacklustre economy and cracks in the jobs market weighing on activity. The BoE would be happy with this path, although it will be vigilant of the various factors that could cause prices to veer off course. A continuation in the strength of wages, a weaker sterling, and a resurgence in the oil price are all potential concerns to monitor.

“It looks very likely that the current base rate of 5.25% represents the high-water mark for interest rates and market attention is focused on when the BoE will start to cut. The 2% target for inflation is not likely to come into view until the end of 2024 at the earliest, and it will take a period of higher rates to achieve this.”

Comments