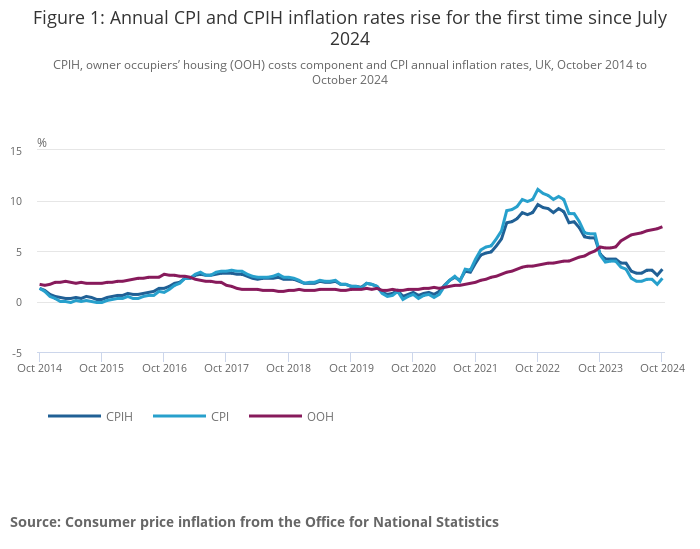

The Consumer Prices Index (CPI) rose by 2.3% in the 12 months to October 2024, up from 1.7% in September, the latest Office for National Statistics (ONS) data has revealed.

Meanwhile, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.2% in the 12 months to October 2024, up from 2.6% in September.

ONS said the largest upward contribution to the monthly change in both CPI and CPIH annual rates came from housing and household services, mainly because of electricity and gas prices.

The largest offsetting downward contribution came from recreation and culture.

The rise has sparked fears of reacceleration in inflation.

Rob Morgan, chief investment analyst at Charles Stanley Direct, said the rise was “slightly higher than expected” and “overwhelmingly the result of an unwelcome 10% rise in energy prices”.

“Core inflation, which strips out volatile elements such as fuel and food, remained at 3.3%, higher than the Bank of England would like,” he said.

“This reveals underlying stubbornness in services inflation, which the Bank is closely monitoring.

“That remains high at 5%, with extra volatility thrown in from hotel and airfare prices, and wage rises are running at a similar clip.”

He warned that the figures reaffirm doubts around a more aggressive path of interest-rate cuts.

This is especially pertinent, as the fiscal policies unveiled in the Budget stand to add to the upward pressure on prices and mean services inflation may be harder to flush out of the system owing to its higher labour intensity.

Hargreaves Lansdown head of personal finance Sarah Coles said the “unwelcome” return above the inflation target is “unlikely to be a one-off”.

“Inflationary pressures look set to keep prices rising more quickly,” she said.

“The good news is that public-sector pay rises and the rise in the minimum wage should help ease the immediate pain of higher prices for some people.

“The bad news is that this could end up feeding into higher prices further down the line, spurring another round of inflation

“Retailers are also warning that higher National Insurance could spark power price rises, and with inflationary pressure building, rate cuts might be off the agenda for a while yet.”

She said the energy price hike at the start of October bears much of the responsibility for this rise in inflation.

“It’s not a surprise. The energy price cap soared 9.5% at the start of October, to £1,717 for an average user. That’s up £149.

“Things have been far worse in the very recent past: gas prices are still 36% below their peak and electricity is down 22%.

“However, prices are still horrible compared to their levels before the invasion of Ukraine.

“Gas prices are up 88% from March 2021 and electricity is up 56%.”

Comments