Financial advisers are increasingly concerned about losing assets as a result of the great wealth transfer, but many are not doing enough to attract the next generation of clients, Schroders has warned.

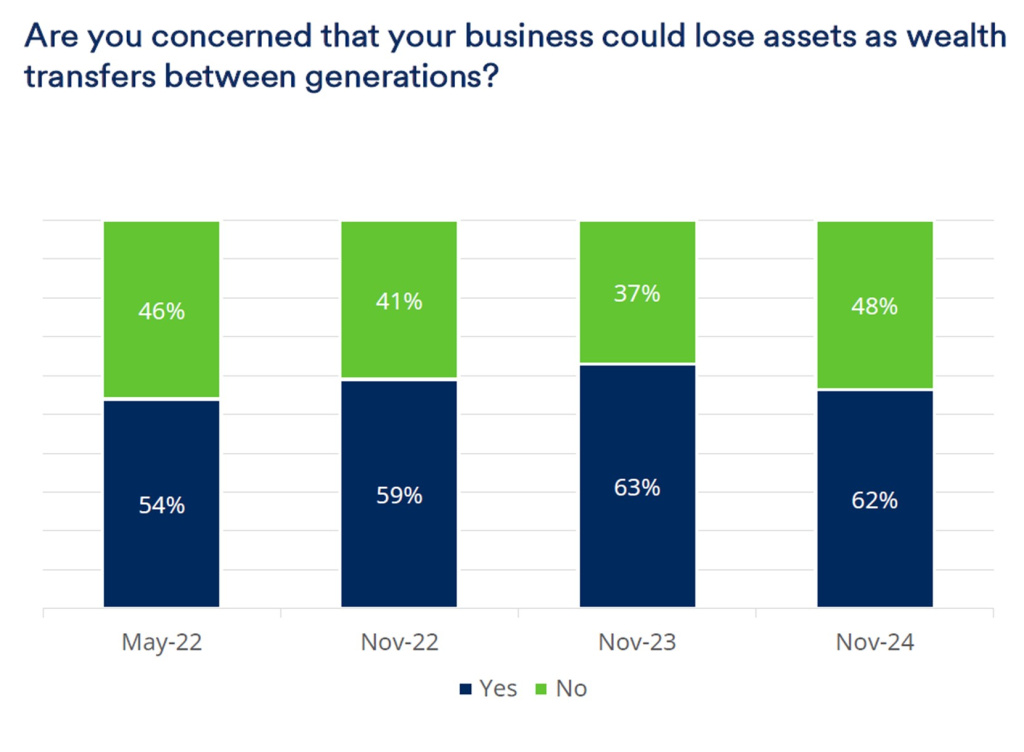

In its latest UK financial adviser survey, the firm found 62% of respondents are concerned about the impact that wealth transferring between generations could have on their business.

While this is marginally down from the 63% seen in November 2023, there is still “significant concern” about what is happening in this space.

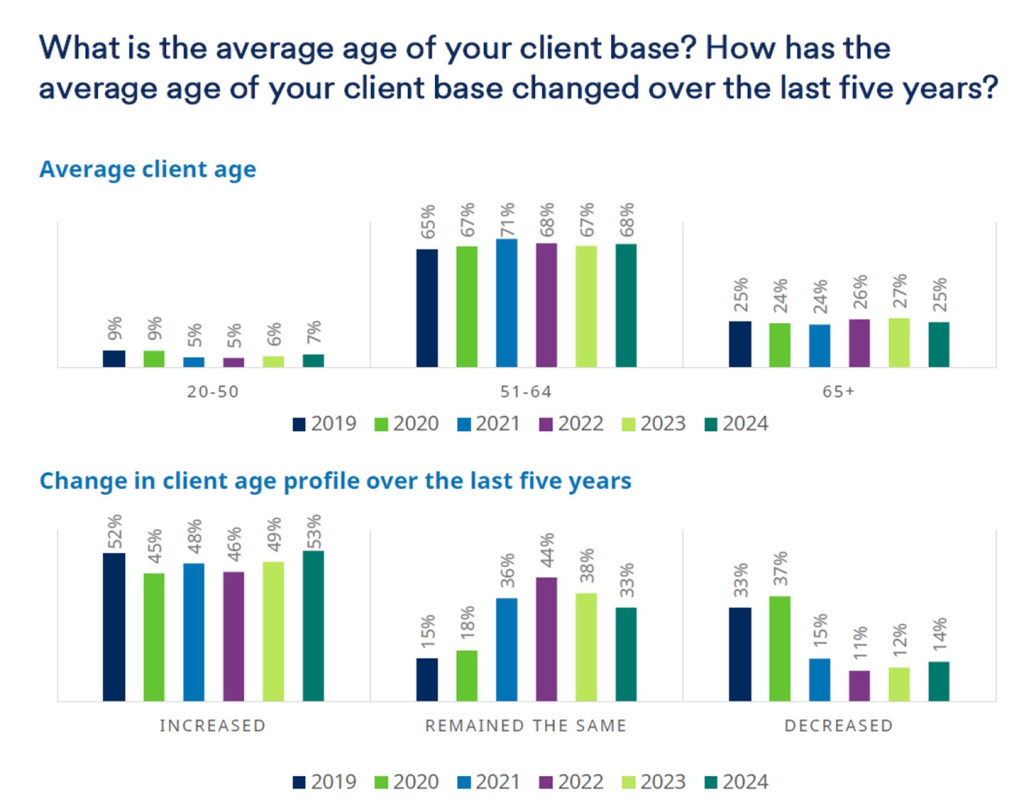

However, 53% of survey respondents said the average age profile of their clients has increased over the past five years, compared with just 14% reporting a decrease.

Schroders also found 68% of advisers questioned serve clients with an average age of age of 51-64.

When added to those aged 65 and above (25%), this makes up the vast majority of advice clients.

Speaking at a dinner to launch the report last night (4 December), Gillian Hepburn, commercial director of Schroders-owned Benchmark Capital, said: “Unfortunately, the numbers don’t quite add up. Yes, there’s concern, but are we actually addressing it? I’m not entirely convinced.”

She said the results of the survey suggest that advisers may not be focusing on or addressing the issue of wealth transfer, particularly to the next generation.

“I’ve been advocating for this for years and doing my best to raise awareness, but I think there’s still a long way to go on this front,” she said.

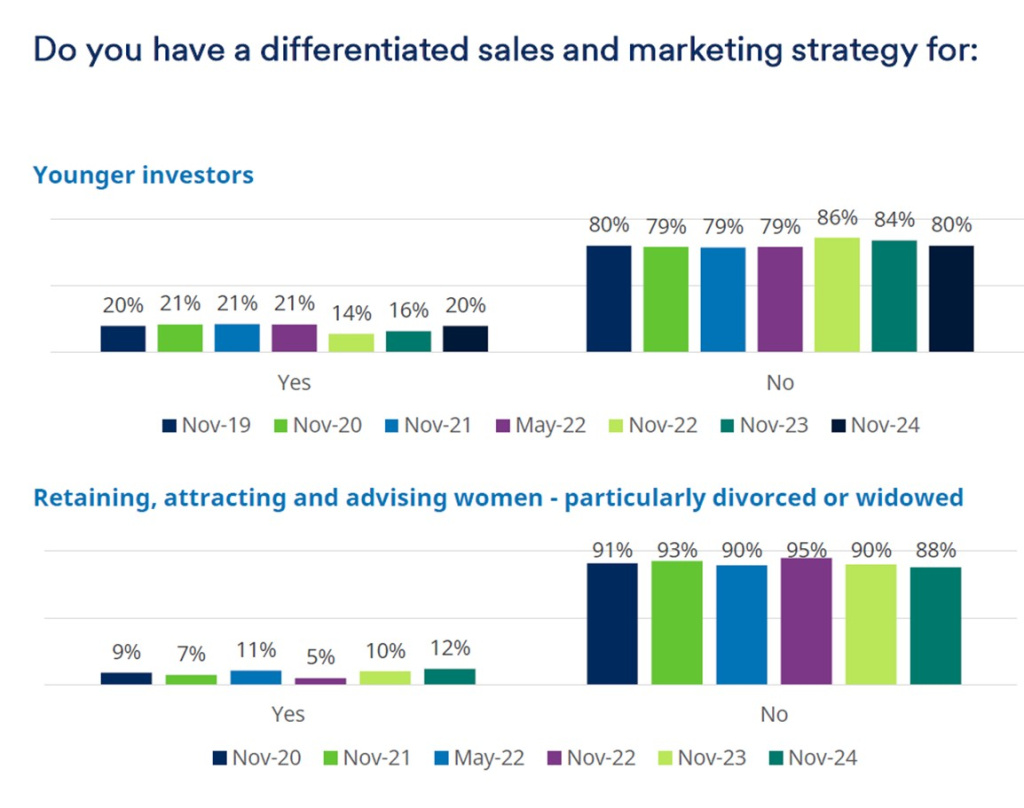

The Schroders report also found that advisers are not differentiating their sales and marketing strategies for younger investors. The figure, said Hepburn, remains “stubbornly” at 20%.

She added: “I believe that number should be significantly higher.”

She said another “critical area” to consider is attracting and advising women.

“Why is this important? The quick answer lies within the baby boomer generation,” she added.

“At present, two-thirds of wealth is typically held in joint households, and the first point of wealth transfer is usually from husband to wife. That is predominantly what we’re seeing in this generation.

“Women tend to live longer, and they’re the ones inheriting the wealth.”

She said the key challenge is that only 34% of widows who inherit wealth stay with the same adviser.

“This is why we spend so much time talking to advisers about this specific wealth transfer – it’s happening now.

“It also explains why we’re seeing the projection that, by next year, 60% of wealth in the UK will be held by women.”

Despite the importance of this focus on women, just 12% of advisers surveyed said they have a differentiated sales and marketing strategy for retaining, attracting and advising women, particularly those divorced or widowed.

The Schroders report also suggested that advisers are starting to implement artificial intelligence (AI) technology into their businesses.

It said 21% have already done so. Meanwhile, 19% of advisers expect to do so within a year. A further 41% said they intend to in the next two to five years.

I think that advisers are busy enough in the here and now; but to know and understand that dynamic you’d have to be one.

Seriously, don’t worry about us and our future workloads, we are just fine, but if it bothers Ms Hepburn that much then maybe she should roll up her sleeves and get stuck in rather than pontificating about it!