I wanted to do something a bit different for this column and focus on one particular investment trust: Neuberger Berman Private Equity Partners (NBPE).

I wanted to do something a bit different for this column and focus on one particular investment trust: Neuberger Berman Private Equity Partners (NBPE).

In the interest of transparency, I have some in my portfolio. Although I wish I’d bought in sooner. It’s done well.

Neuberger Berman is a private, independent and employee-owned asset manager. A rare structure in today’s markets but one that has a huge advantage in that it is able to take much longer-term initiatives without the constant worry of looking over its shoulder. It was something we valued in Hargreaves Lansdown’s earlier days.

For patient long-term investors, this doesn’t seem a bad time to look at buying

Much of private equity today is misunderstood, mainly because there are different models. The one that receives the most publicity tends to be made up of those that pounce on public companies, load them with debt and resell them back on public markets in a few years’ time.

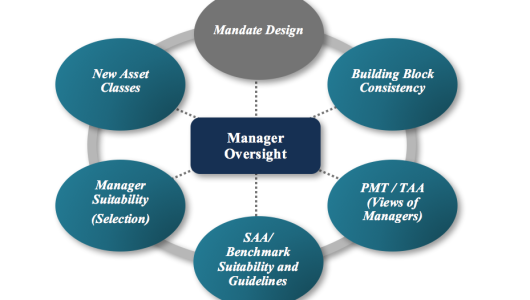

NBPE is a private equity investment trust, which focuses on investing alongside private equity managers into private companies that are profitable and growing. So, nothing like much of the negative media portrayal.

NBPE allows retail investors access to companies they could not buy themselves and with a sufficient spread to reduce the risk.

Those that receive the most publicity pounce on public companies, load them with debt and resell them back in a few years’ time

What’s more, like much in the private equity investment trust world, it sits on a discount – in this case, around 25%.

Some of this is due to worries over valuations that occurred in public markets in 2022 and the knock-on effect expected to be seen in net asset values (NAVs). That said, the actual hit doesn’t seem to have been so bad.

As big a hit has been new cost disclosure requirements. The Association of Investment Companies, alongside many others, believe these to be highly misleading, with the new declarations simply meaning portfolio managers deserting and selling down trusts.

As you might expect, much lobbying is going on. A change that might well lead to some upward repricing.

This is not a sector that can be represented in a passive style

NBPE compares well on fees in the sector, helped by its focus on direct co-investments and a single layer of fees.

Its NAV did lag the markets in 2023, as might have been expected, held back by lower valuation multiplies. It was up only 2.3% last year, compared to 24.4% for the MSCI. But, then, a year is way too short to judge most investments, let alone private equity.

Over 10 years, NAV is up 207% against the MSCI of 140.7%.

The company has 85 investments, of which 53 are alongside other private equity managers. Its largest holding, Action, is a good example of investing alongside others – in this case, 3i. I mention it as you might recognise the name: a hugely successful European discount retailer.

Just under a quarter (23%) of the portfolio is in Europe, with 75% in North America. The latter is hardly unexpected given the breadth of private equity in the States.

Much of private equity today is misunderstood, mainly because there are different models

Realisations tend to be strong in years when public markets are rising powerfully, as in 2021. Later years saw lower activity but signs for 2024 are good so far, with realisations of 10% of the opening portfolio value based on Q1 alone.

As importantly, new investment and follow-up opportunities are presenting themselves already, using $38m on two companies in the healthcare sector.

NBPE also pays a dividend, currently a little over 4%, based on the current share price (3% of NAV). This seems to be the way forward for many investment trusts in today’s more growth-orientated markets.

This is not a sector that can be represented in a passive style. The fund and sector are on large discounts, which have improved, but there seems a long way to go. For patient long-term investors, this doesn’t seem a bad time to look at buying.

Mark Dampier is an independent consultant and can be found tweeting at @MarkDampier

Comments