Good morning and welcome to your Morning Briefing for Tuesday 28 January 2025. To get this in your inbox every morning click here.

Dynamic Planner launches Financial Personality Insights to improve client understanding

Dynamic Planner, the UK’s leading digital financial advice platform, has launched a new feature, Financial Personality Insights, designed to provide advisers with a deeper understanding of clients’ behaviours, emotions and thoughts around financial risk.

This enhancement builds on the platform’s established Attitude to Risk (ATR) questionnaire, offering more personalised advice capabilities.

UK companies paid out £92.1bn in dividends in 2024

UK companies paid out £92.1bn in dividends in 2024, 2.3% higher on a headline basis than in 2023.

However, these dividends were boosted by higher special dividends, but the underlying total, which excludes these one-off payments, fell 0.4% on a constant-currency basis to £86.5bn.

This is according to the latest Dividend Monitor report from global financial services company Computershare.

Chief risk officers emerge as strategic boardroom partners, says report

Chief risk officers (CROs) in UK financial-services firms are increasingly shifting from compliance enforcers to strategic boardroom partners, a report published yesterday (January 27) reveals.

The study, Optimising Growth: The Evolving Role of the Chief Risk Officer, explores how CROs now play a dual role: protecting organisations from threats while enabling growth through calculated risk-taking.

Quote Of The Day

They say the best time to start saving is yesterday, but the second-best time is today. This is especially true when it comes to saving for retirement

– Eleanor Levy, CCO of now:pensions, marks the start of Financial Planning Week.

Stat Attack

A freedom of information request from AJ Bell has lifted the lid on HMRC customer service ahead of the self-assessment deadline (31 January).

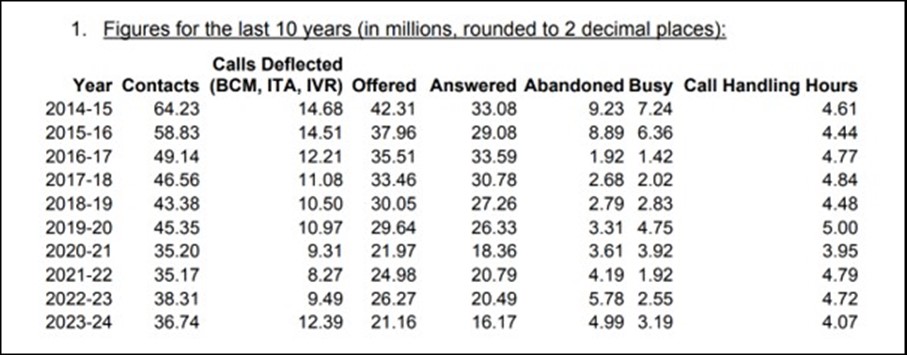

Figures from the request show that the number of calls answered by HMRC has fallen from 33.1 million in the 2014-15 tax year to just 16.2 million in 2023-24 (see table below). Other significant findings:

4 million hours

The amount of time HMRC spent handling telephone calls in the 2023-24 tax year, a figure that has stayed roughly steady over the same period, suggesting the average call is taking around twice as long to resolve.

15 minutes

The average time it takes to deal with a call that does get through, which could be a result of more complex queries and more people getting dragged into the UK tax system.

44%

Percentage of calls that were answered in the 2023-24 financial year, compared to 60% back in 2021-22.

34%

The percentage of calls that are deflected, a jump from 24% over the same three years.

HMRC deflects queries it considers can be resolved through its digital services, sometimes by playing an automated message before immediately ending the call itself.

Source: HMRC

In Other News

Reassured, the UK’s largest life insurance broker, has announced that over 10,000 customers have used its universal Trust form to simplify policy applications.

Launched in September 2023, the digital Trust form allows customers taking out life or critical/serious illness policies to bypass traditional insurer-specific forms, which often required physical signatures and paper documentation.

By eliminating the need to download, print, or sign documents, the form has significantly improved efficiency and convenience for customers.

Since its introduction, the digital Trust form has led to a 200% increase in completed and returned Trusts. The initiative has been recognised as a model for efficiency within the insurance sector.

Mark Townsend, CEO of Reassured, highlighted the positive impact of the digital solution, stating: “The Trust process has long been outdated and inefficient. Our universal Trust form provides a modern, insurer-agnostic solution that benefits both consumers and the wider industry.”

The digital Trust form has received legal and compliance approval from leading insurers, including Aviva, Legal & General, LV=, Scottish Widows and Vitality.

Ali Crossley, managing director of distribution at Legal & General Retail, praised the initiative for ensuring that policy proceeds reach the right beneficiaries promptly and efficiently.

Brooks Macdonald Group PLC has announced the launch of a share buyback programme valued at up to £10m.

The programme, approved by the Board of Directors, begins immediately and will conclude by the release of the Company’s full-year results for the year ending 30 June 2025, expected in September 2025.

Under the programme, shares will be repurchased on the open market and subsequently cancelled, reducing the Company’s share capital.

The Board stated that acquiring shares at a discount to the Company’s longer-term valuation and reflecting its disciplined approach to capital allocation aligns with its strategy.

Brooks Macdonald emphasised it retains significant financial flexibility to support its growth ambitions.

The buyback initiative operates under the authority granted at the Company’s Annual General Meeting on 24 October 2024, which received 99.99% shareholder approval. Daily purchases will be capped at 15,000 shares.

Singer Capital Markets has been engaged to execute the programme during the initial period, ending with the announcement of interim results for the six months to 31 December 2024 on 27 February 2025.

Trading decisions during this period will be made independently of the Company and adhere to pre-set parameters, enabling transactions during close periods.

From Elsewhere

Starmer to announce growth-boosting pension reform plans (Reuters)

DeepSeek a ‘wake-up call’ for US tech firms, Trump says (BBC News)

Rachel Reeves tells MPs of plans to go ‘further and faster’ in pursuit of growth (The Guardian)

Did You See?

The vast majority of Gen Z (86%) and Millennials (73%) said they would rather accept lower returns on their pension savings and work past the standard retirement age than fund what they perceive to be socially or environmentally damaging industries.

This is according to research from digital wealth manager Moneyfarm, which found that only 34% of the general population feel the same way.

The tobacco industry came top (44%) as the one people in the UK do not want their pension to be invested in.

This was followed by alcohol (31%), defence and ammunition (25%), fast fashion (22%) and oil and gas (21%).

However, just under a third (31%) of the nation said they have no issues or worries investing in any sector.

Out of those who are more financially worried, 60% said the priority is investment returns when selecting a pension plan.

Still, over half (52%) of people said they would not have a clue how to find out if their pension was ethically invested or not.

Additionally, 43% do not actually realise they have the power to select and choose where their pension invests.

To add to the issue, 56% have no idea how much their pensions could be worth when they retire and 43% admit they do not have a clear strategy on how they can get the most out of their pensions for retirement.

This has left 76% describing pensions as “too confusing”.

Read the full story here.

Comments